Welcome to Edition 33 (The Larry Bird Edition) of Low Carbon Pulse – sharing significant current and recent news on progress towards net-zero greenhouse gas (GHG) emissions (NZE) for the period from Friday December 17, 2021 to Sunday January 23, 2022 (inclusive of each day). This Edition is a little later than advertised to allow it to report on the ScotWind Leasing Scheme outcomes and the end of EU Green Taxonomy consultation phase.

Edition 34 will be published on Tuesday February 8, 2022, covering the period from Monday January 24, 2022 to Sunday February 6, 2022, and will include the Report on Reports for November and December 2021.

Please click here for the landing page of Low Carbon Pulse, which contains links for Editions 29 to 32. Please click here for the First Low Carbon Pulse Compendium (covering the 12 month period from October 6, 2020 to October 5, 2021, including the First Anniversary Edition of Low Carbon Pulse).

Click here and here for the sibling publications of Low Carbon Pulse, the Shift to Hydrogen (S2H2): Elemental Change series and here for the first feature in the Hydrogen for Industry (H24I) features. This is the first edition of Low Carbon Pulse for calendar year 2022.

Reminder of why Editions 32 and 33 are named for 1980s basketball players? From August 13, 2021 to December 13, 2021, the author of Low Carbon Pulse was located in Papua New Guinea (PNG). While located in PNG, the author rediscovered a passion for basketball (long dormant). With the rediscovery of passion, and, more importantly, muscle memory, the satisfying sound of the swish returned (as the basketball touched "nothing but nylon"), and so the capacity to "switch -off" was rediscovered.

With rediscovery, the author (re)discovered, on "you-tube", the achievements of Earvin "Magic" Johnson and Larry Joe Bird (after whom the Twitter logo is named). No doubt reflective of the decade in which the author played basketball, Magic Johnson and Larry Joe are the author's favourite basketball players. Always have been, always will be!

Both played for one franchise during their careers; Magic played No 32 for the Los Angeles Lakers and Larry Joe played No 33 for the Boston Celtics. Each franchise retired their numbers on their retirements. On the court, they were the fiercest of competitors. Off the court, they were, and remain, the best of friends.

To the author, Messrs Johnson and Bird remain the embodiment of authenticity, manifest in their genuineness, and hard fought success, wrought by application and hard work, two folk who cut no corners, and shared 8 championships during the 1980's. Different times, different values, well-before COP-1.

The year ahead:

This section of Low Carbon Pulse considers events that appear to the author likely to influence progress to NZE during 2022.

In each edition of Low Carbon Pulse during 2022, the news items that appear likely to be key over the coming two weeks will be identified: this approach was taken during the middle-months of 2021 until the focus turned to the 26th session of the Conference of Parties (COP-26) of the United Nations Framework Convention on Climate Change.

Background:

Among other things, Edition 32 of Low Carbon Pulse outlined Themes and trends that emerged during 2021 and provided a Look forward to the coming 12 months. In this context, the adoption of decisions relating to Article 6 of the Paris Agreement were touched upon in passing (under Carbon Credits, Article 6 and the Paris Rulebook).

Edition 32 noted that a stand-alone article is to be published during the early part of 2022 to provide an outline about Carbon Credits, Article 6 and the Paris Rulebook, and the near, medium and long term role of Carbon Credits, including as deforestation is curtailed and ceases, and afforestation and reforestation continues, and land-use generally comes to the fore. This stand-alone article is in the works.

Ahead of the publication of this article, and in any event, the author thought that it would be helpful (see Timeline for 2022 - February to September) to provide a summary of the work that still needs to be done by the Intergovernmental Panel on Climate Change (IPCC) to produce the first comprehensive assessment report since the report that informed the development and adoption of the Paris Agreement in 2015 (IPCC's Sixth Assessment Report). Among other things, the IPCC's Sixth Assessment Report will include the synthesised findings from among other things the Sixth Assessment Report – Climate Change 2021, The Physical Science Basis (2021 Report).

As noted below, the IPCC's Sixth Assessment Report will be the key publication of 2022, to be published in advance of the 27th session of the Conference of the Parties (COP-27). The finalisation of the IPCC's Sixth Assessment Report, in particular the Synthesis Report, will run in parallel with work arising from CMA 12a, 12b and 12c adopted at the Conference of Parties serving as the meeting of the Parties to the Paris Agreement at its third session (CMA 3) in the context of Article 6.

In addition, the Timeline for 2022 identifies events that appear to the author likely to influence progress to NZE during 2022.

Content of this Edition 33:

As the length of each edition of Low Carbon Pulse has increased (likely to continue at around 20 pages each edition), it has become apparent that a contents page might assist the reader.

Pages 2 to 4: Timeline for 2022; Page 4: Key Theme for 2022; Page 4 and 5: Legal and Regulatory Highlights; Pages 6 and 7: A Big Week For Wind; Page 8 and 9: Climate change reported and explained; Pages 9 and 11: GCC Countries; Page 11: Africa; Page 11 and 12: India and Indonesia; Page 12 and 13: PRC and Russia; Page 13: EUrope and UK, France and Germany, Germany and South Africa; Page 14: Americas; Page 14 and 15: Australia; Page 15 and 16: Blue and Green Carbon Initiatives and Biodiversity; Page 16 and 17 Bioenergy and Heat Recovery; Page 17 and 18: BESS and HESS (and other energy storage); Page 20 to 22: Carbon Accounting, Carbon Capture, Carbon Capture and Use and CDR; Page 22: Carbon Credit and Hydrogen Markets and Trading; Page 20 to 23: E-fuels and Future Fuels; Pages 27 to 30: Wind round-up, on-shore and off-shore; Pages 30: Solar and Sustainability; Page 28: NZE Waste; Pages 30 and 31: Land Mobility and Transport; Pages 31 and 32: Ports Progress and Shipping Forecast; and Page 32: Airports and Aviation.

Timeline for 2022:

The events identified are not all of the events that may influence or impact progress to NZE, but they are events on the radar of the author as likely to do so. Each event will be covered in Low Carbon Pulse.

- TBA: Fifth United Nations Conference on Least Developed Countries (LDC5) is to be held: see Edition 31 of Low Carbon Pulse for background on the 46 countries (Afghanistan, Angola, Bangladesh, Benin, Bhutan, Burkina Faso, Burundi, Cambodia, Central African Republic, Chad, Comoros, Democratic Republic of the Congo, Djibouti, Eritrea, Ethiopia, Gambia, Guinea, Guinea-Bissau, Haiti, Kiribati, Lao People’s Democratic Republic, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Myanmar, Nepal, Niger, Rwanda, Sao Tome and Principe, Senegal, Sierra Leone, Solomon Islands, Somalia, South Sudan, Sudan, Timor-Leste, Togo, Tuvalu, Uganda, United Republic of Tanzania, Yemen, Zambia) that are considered the least developed (LDCs).

LDCs are home to around 13% of the global population and 40% of the poorest people globally. It is understood that LDC5 will include a high-level thematic round-table to discuss the issues faced by LDCs and the need of LDCs for support.

- February 28 to March 3: Inaugural Middle East and North Africa Week, organised under the auspices of the United Nations Framework Convention on Climate Change (UNFCCC) will be held. The Middle East and North Africa Week is to be hosted by the United Arab Emirates (UAE).

The role of the UAE is becoming ever more prominent and important – as marked by the successful World Future Energy Sumit held from January 17 to 19, 2022. Likewise the Kingdom of Saudi Arabia (KSA) and the Sultanate of Oman are taking lead roles.

- February to September: The IPCC will progress finalisation of its first comprehensive assessment report (IPCC's Sixth Assessment Report) since the IPCC's Fifth Assessment Report. The Fifth Assessment Report, among other things, informed the development and adoption of the Paris Agreement in 2015.

The IPCC's Sixth Assessment Report will comprise contributions from three Working Groups, I, II and III detailed as follows:

- the findings of Working Group I (Physical Science Basis) as to the physical impact of climate change in the 2021 Report (published in August 2021, and reported on in Edition 24 of Low Carbon Pulse);

- the assessment of Working Group II (Impacts, Adaption and Vulnerability) on the impact of climate change; and

- the assessment of Working Group III (Mitigation of Climate Change) on mitigation of the effects of, and progress to limit emissions causing, climate change.

By mid-February, it is expected that the Summary for Policymakers contained in the 2021 Report will be pretty much finalised: the 2021 Report comprised a Summary of Policymakers in draft (feedback was sought on it): see Edition 24 of Low Carbon Pulse that summarises the key findings. The report of Working Group II will be published at the end of February 2022, and the report of Working Group III will be published in early April 2022.

In September, the IPCC will publish the Synthesis Report. The Synthesis Report is the last of the major reports from the IPCC's sixth assessment cycle (with the core writing team meeting January 25 to 29, 2022 to continue the development of the Synthesis Report). The Synthesis Report will synthesise and integrate materials contained in the Assessment Reports from each Working Group, and in three Special Reports (Global Warming of 1.5OC, Climate Change and Land and The Ocean and Cryosphere in a Changing Climate). The Synthesis Report will be in two parts, the Summary of Policymakers (SPM) and the Longer Report. Neither part of the Synthesis Report will be anywhere near the length of each Working Group Report and each Special Report.

The Synthesis Report will be published well-ahead of the 27th session of the Conference of the Parties (COP-27) which will take place in Sharm El-Sheikh, South Sinai, Egypt (see below under November 7 to 18: COP-27).

By way of reminder, Edition 32 of Low Carbon Pulse covered the UNFCCC NDC Synthesis Report, reporting on the impact on climate of the implementation of NDCs to which Parties had committed as at the end of July 2021, and the United Nations Environmental Program (UNEP) Production Gap Report reported that in setting NDCs countries had not taken account of planned increases in fossil fuel production and use.

The NDC Synthesis Report informed the UN Secretary General, Mr Antonio Guterres' use of the phrase "the Catastrophic Pathway" of a 2.7°C increase in average global temperature.

The Production Gap Report informed a considerable amount of news coverage and debate, a good deal of it well-informed and constructive, no doubt as a result of the excellence of the Report.

The NDC Synthesis and Production Gap Reports contributed considerably to the understanding of the need for increased NDCs well-ahead of COP-27. The progress to increased NDCs will be covered by Low Carbon Pulse.

- March 7 to 12: The IUCN Africa Protected Areas Congress (APAC) will be held, being the first continent-wide meeting of African leaders, interest groups and citizens, convened to focus on the need to progress action to establish and to preserve protected areas. The APAC will take place in Kigali, Rwanda.

At APAC the role for, and the importance of, protected areas will be discussed, in particular the role in conserving nature, delivering services to vital life-supporting ecosystems, safeguarding Africa's wildlife, and promoting sustainable development while conserving the cultural heritage and traditions of each country.

The role of protected areas in the promotion sustainable development illustrates the balance that needs to be struck to allow the 54 countries in Africa (including 33 of the 46 LDCs in Africa) to develop economically, allowing for projected population growth and increased urbanisation, while at the same time conserving and restoring the environment.

In addition to Africa having 33 of the 46 LDCs, Africa has countries highly vulnerable to the impact of climate change. See this graphic map.

As will be apparent, a number of African countries (Angola, Burkina Faso, Burundi, Central African Republic, Chad, Democratic Republic of the Congo, Niger, Eritrea, Ethiopia, Republic of Congo, Somalia and South Sudan, each an LDC) are identified as most likely to be vulnerable to climate change by reference to their ability to adapt to climate change.

- April 25 to May 8: The UN Biodiversity Conference (or COP 15) will be continue in Kunming, Peoples Republic of China (PRC).

The first part of the UN Biodiversity Conference was held in October 2021, setting the scene for the second part through the adoption of the Kunming Declaration and the establishment of the Kunming Biodiversity Fund.

The second part of the UN Biodiversity Conference is expected to progress thinking around policy settings with the adoption of a framework to achieve 21 points / targets and 10 milestones by 2030, together with net-improved outcomes by 2050, and as such reset thinking, and in some cases, provide a framework for thinking on policy settings.

While it is possible that the second part of COP 15 may be delayed, there is a clear expectation that an agreement will be reached, emphasised by the members of the Convention on Biological Diversity working group which has carriage of the drafting and finalisation of the agreement.

- May 2 to 6: The XV World Forestry Congress will be held in Seoul, Republic of Korea (ROK) under the theme of Building a Green Healthy and Resilient Future with Forests. The XV World Forestry Congress will consider six sub-themes.

For the author of Low Carbon Pulse, the progress made at the Congress will be key, both for forestry and land use. Already in the first month of 2022, there has been a clear uptick in interest in the role that land-management and optimal land-use can have on increased absorption of CO2, i.e., its negative GHG emission impact.

- May 9 to 21: The 15th United Nations Conference on Diversification will be held in the Côte d'Ivoire.

Consistent with LDC5, the UN Biodiversity Conference and the XV World Forestry Congress, the overarching theme that may be expected to emerge will be how to address deforestation, reforestation, afforestation, and land restoration, and land-management and land-use generally.

- June 2 and 3: The Stockholm+50 conference will be held in Sweden. The conference will mark the 50th anniversary of the world's first conference on the environment - United Nations Conference on the Human Environment held in Stockholm, Sweden, June 5 to 16, 1972, which gave rise to the establishment of the UN Environment Programme (UNEP) and the concept of sustainable development, as captured in the Stockholm Declaration.

- June 26 to 28: The G7 Summit will take place at Schloss Elmau, Bavaria, Germany, reflecting the Presidency of Germany. It is to be expected that climate change will dominate the agenda.

- June 26 to 30: The World Urban Forum 11 will take place in Katowice, Poland under the theme Transforming our Cities for a Better Urban Future.

- June 27 to July 1: The UN Ocean Conference will take place in Lisbon, Portugal. The UN Ocean Conference will be the second time that the United Nations has convened a conference on the impact of climate change (and loss of natural habit and pollution) on the oceans.

The oceans (blue carbon) and flora (green carbon) are increasingly being regarded as the lungs of the planet, both essential to mitigating the impact of climate change on the climate system, and both susceptible to the impact of climate change.

- August 22 to 24: The World Conference on Climate Change & Sustainability will take place in Frankfurt, Germany. The World Conference on Climate Change & Sustainability is regarded as the foremost global forum for multilateral discussion about climate change.

- September 13 to 27, 2022: The 77th session of the UN General Assembly will take place in New York City, New York State, the United States. As has become the tradition, Climate Week NYC will take place at the same time, and will be a pre-COP-27 meeting.

- October 30 and 31: The 17th G20 Summit will take place in Bali, Indonesia, reflecting the Presidency of the Republic of Indonesia. As with the G7 Summit in June 2022 it is expected that climate change will be a key agenda item ahead of COP-27.

- November 7 to 18: COP-27 will take place in Sharm El-Sheikh, South Sinai, Egypt, and represents an opportunity to assess and develop thinking to address the impacts of climate change in Africa.

- For the purposes of framing thinking about the impacts of climate change in Africa, the World Meteorological Organization (WMO) and its partners, have developed the State of the Climate in Africa 2020, which is a helpful starting point for framing and understanding the impacts of climate change.

Key Theme For 2022:

If there was one key theme before, during and after COP 26, it was the need to Increase NDCs during 2022 ahead of COP-27: At COP-26 the High Ambition Coalition COP-26 Leaders' Statement announced that they were committed to increasing the NDCs to align with holding the increase in average global temperatures to 1.5°C (Stretch Goal) for the purposes of commitments to be made before or at COP-27.

In addition, at COP-26, all countries agreed to update their NDCs ahead of COP-27. It is to be expected that countries will update their NDCs, and, in the case of many, it is hoped that they will stretch their NDCs, including to a level that is aligned to keep the increase in average temperatures at a level that is lower than the Stretch Goal and that gets to NZE as soon as possible before 2050, not by 2050.

Legal and Regulatory highlights:

This section considers news items that have arisen within the news cycle of this Edition 33 of Low Carbon Pulse in respect of laws and regulation, and broader policy settings, in each case describing substance, progress and impact.

- EU policy settings to achieve 55 by 30: Edition 32 of Low Carbon Pulse reported that on December 15, 2021, a package of legislation and policy settings was released by the European Commission (EC) providing a framework to decarbonise gas markets, to promote hydrogen production and use, and to reduce CH4 emissions.

This framework is provided in a regulation and a directive - see links to each: Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on the internal markets for renewable and natural gases and for hydrogen and Proposal for a DIRECTIVE OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on commons rules the internal markets in renewable and natural gases and in hydrogen.

The reaction to the framework has been mixed, primarily arising from the continued balancing of natural gas as a transition fuel by Governments and achieving energy transition so as to progress to NZE, and the perspective of many in the renewable electrical energy sector who use of natural gas as a transition fuel as amounting to the preservation of the natural gas industry.

To the author of Low Carbon Pulse, the position is more nuanced, but the conclusion is that natural gas is needed, and certainty is required to ensure energy security and sustainable energy prices, at the same time as the use of natural gas is phased out. The best way, and quickest way, to phase out natural gas is through the acceleration of the development and deployment of renewable electrical energy capacity and e-fuel production capacity, and the use of bioenergy.

- EU Green Taxonomy: Edition 32 of Low Carbon Pulse reported on the adoption of the EU Green Taxonomy and that its adoption and application may mean. The text is repeated again to provide context.

-

"EU Green Taxonomy adopted:

On December 9, 2021, the first climate delegated act (the EU Taxonomy Climate Delegated Act) was approved by the EC, and will become law on January 1, 2022, confirming the adoption of the Technical Screening Criteria.

Among other things, the EU Green Taxonomy provides:

1. a basis by reference to which corporations may report; and

2. CO2-e intensity benchmarks for the energy sector (that are neutral as to technology) of 100 g CO2-e/kWh as making a substantial contribution to climate mitigation, and 250 g CO2-e/ kWh giving rise to significant harm.

-

What this does not mean and what is its practical application?

The effect of the EU Taxonomy Climate Delegated Act is that the EC must use the EU Green Taxonomy to assess climate change adaptation and climate change mitigation activities, including to do no significant harm across environmental objectives.

Effectively, the EU Green Taxonomy does not define what technology must be used (hence it is neutral as to technology), but the technology used for the purposes of prescribed activities will be assessed against the Taxonomy, including the benchmarks.

The positions of participants and stakeholders has informed the "debate" around the CO2-e intensity benchmarks for some time, including around the use of natural gas and nuclear energy sources (including as sources for the production of hydrogen and hydrogen-based fuels) in the context of the EU Green Taxonomy.

The EC has not acknowledged formally that the EU Green Taxonomy might include natural gas or nuclear energy sources. The role of natural gas and nuclear is clear, but in the words of Mr Frans Timmermans: " … nuclear and transition gas play a role in energy transition … [but] that does not make them green". "

(A link is attached to the ec.europa.eu website that contains relevant materials under EU taxonomy for sustainable activities.)"

- Badging natural gas and nuclear energy: Edition 32 of Low Carbon Pulse noted that: "The EC will determine how to badge natural gas and nuclear energy by the end of 2021".

At the time of publication of Edition 32 of Low Carbon Pulse, the suggestion that the EU Green Taxonomy may include natural gas or nuclear energy, or both, had been the cause of considerable activity, comment and speculation, including around divisions between key EU countries, France and German.

On January 1, 2022, the EC began consulting with the Member States Expert Group on Sustainable Finance and the Platform on Sustainable Finance in respect of the draft text of a Taxonomy Complementary Delegated Act covering natural gas and nuclear activities (see EC press release entitled EU Taxonomy: Commission begins expert consultations on Complementary Delegated Act covering certain nuclear and gas activities).

The EC stated on January 1, 2022, that:

"The EU Taxonomy guides and mobilises private investment in activities that are needed to achieve climate neutrality in the next 30 years … The Taxonomy provides for energy activities that enable Member States to move towards climate neutrality … Taking account of scientific advice and current technological progress, as well as varying transition across Member States, the Commission considers that there is a role for natural gas and nuclear [power] as a means to facilitate the transition towards a predominantly renewable-based future [the EC Position]. Within the Taxonomy framework, this would mean classifying these energy sources under clear and tight conditions (for example, gas must come from renewable sources or have low emissions by 2035), in particular as they contribute to climate neutrality".

The Member States Expert Group on Sustainable Finance and the Platform on Sustainable Finance are required to be consulted on all Delegated Acts under the Taxonomy Regulation, reflecting the expert role of each under the Taxonomy Regulation.

In the original press release of January 1, 2022, the EC contemplated that Member States Expert Group on Sustainable Finance and the Platform on Sustainable Finance Platform on Sustainable Finance would have until January 12, 2022 to provide contributions. January 12, 2022 became Friday January 21, 2022. The EC will analyse the contributions received on or before January 21, 2022, ahead of the adoption formally of the Complementary Delegated Act.

- How a technical rulebook unleashed a political storm over EU green energy (updated to January 14, 2022 – 17.24) is the title of an article from Euronews.com. The article provides a very helpful summary of the road travelled (covered in various editions of Low Carbon Pulse) to the current form of the EU Green Taxonomy.

The storm of comment directed against the EC Position was seeded by a leaked draft (ahead of being shared by the EC to the Member States) that contemplates a road for gas installation to December 31, 2030, and nuclear sites to December 31, 2045, subject to complying with "clear and tight conditions" including 270 grams of CO2 per kilowatt hour for natural gas installations.

The EU Green Taxonomy is important in the EU context, and is likely to be important globally, because it is likely to be followed by countries around the world. Unless there is a change in position from the EC, as a practical matter, the Taxonomy Complementary Delegated Act will progress, and is likely to be in place by the end of January 2022.

- Denmark making mark:

- Danish Hydrogen Strategy: On December 17, 2021 the Danish Government published a paper titled Power-To-X and Hydrogen Opportunities in Denmark.

- Denmark and Virginia collaborate: On January 11, 2022, State of Green (a Danish Government website) reported that Denmark had signed an energy cooperation agreement with the US State of Virginia under which Denmark is to share insights and know-how for the purposes of assisting the State of Virginia implementing its off-shore renewable energy plans, including the development of a world scale 2.6 GW off-shore wind field (the Coastal Virginia Offshore Wind Project).

Under the Virginia Clean Economy Act, Virginia plans to derive 100% of its energy from clean sources by 2045.

- Polish Hydrogen strategy: On January 7, 2021, hydrogen-central.com reported that the Council of Ministers approved the Polish Hydrogen Strategy to the year 2030, with an outlook to 2040. The Polish Hydrogen Strategy will be considered in detail in the January and February Report on Reports contained in the Appendix to Edition 36 of Low Carbon Pulse.

A Big Week For Wind:

- ScotWind Leasing Scheme

- Final Stage of ScotWind Leasing Scheme: On January 17, 2022, the Crown Estate Scotland announced the successful tenderers ScotWind Seabed Leasing auction process (ScotWind Leasing Scheme).

The ScotWind Leasing Scheme process commenced on January 15, 2021 (see Edition 8 of Low Carbon Pulse), with the deadline date for the submission of applications being July 16, 2021 (see Editions 20, 21 and 22 of Low Carbon Pulse), having been extended from March 31, 2021. The ScotWind Leasing Scheme was the first auction process since the management of off-shore wind rights was devolved to Scotland.

- Fifteen lease areas: As noted in Edition 22 of Low Carbon Pulse, the Crown Estate Scotland ran the auction process for 15 off-shore areas: Aberdeenshire (three areas - E1, 2 and 3), Argyll (W1), Moray Firth (five areas – NE 2, NE 3, NE 6, NE 5 and NE 7), Islay (N4), Lewis (N4), Orkney (three sites off the west of Orkney, into the outer Hebrides, N1, N2, and N3), and Shetland (NE1).

The 15 off-shore areas the subject of the ScotWind Leading Scheme are detailed in the map below (to the left). The off-shore areas the subject of successful tenderers (see the table on the next page) are detailed in the map below (to the right).

- Size and shape of the areas:

Edition 8 of Low Carbon Pulse reported on the ScotWind Leasing Scheme process and reported that the total area of the 15 sites is 8,600 km2 or 3,320 miles2.

Edition 22 of Low Carbon Pulse reported that 74 applications had been made by the July 16, 2021 deadline.

- ScotWind Leasing Scheme successful applicants tabled:

On January 17, 2022, the Crown Estate website published a table detailing the successful applicants for off-shore wind leases.

Out of the 74 applications made, seventeen projects have been successful, and those successful projects cover a little over 7,000 km2 of the 8,600 km2 available for award.

The aggregate amount bid by the successful projects being a little under GBP 700 million. Each of the successful proponents / bidding consortia was covered in Edition 22 of Low Carbon Pulse (under Applicants for off-shore wind leases). See this graphic for the locations and successful applicants of the off-shore wind leases.

The development of the seventeen projects will have direct and immediate benefits for the Scottish economy, and the broader UK economy. Proponents of each successful project procure goods and services to commence: (1) to undertake and to complete on-shore infrastructure (including at ports) and factories to allow the manufacture and fabrication of the footings, towers and turbines to allow the development of the projects; (2) to develop on-shore infrastructure to allow the connection to the transmission network in Scotland; and (3) to develop on-shore infrastructure to use the renewable electrical energy generated off-shore, including the development of Green Hydrogen production facilities as Scotland develops into a major producer of Green Hydrogen, including for the purposes of the export of Green Hydrogen to continental Europe (see Editions 31 and 32 of Low Carbon Pulse).

- Successful tenderers:

| MAP reference |

LEAD APPlicants |

option fees |

technology |

total capacity (MW) |

| 1 |

BP Alternative Energy Investments |

£85,900,000

|

Fixed |

2,907 |

| 2 |

SSE Renewables |

£85,900,000 |

Floating |

2,610 |

| 3 |

Falck Renewables |

£28,000,000

|

Floating |

1,200 |

| 4 |

Shell New Energies |

£86,000,000 |

Floating |

2,000 |

| 5 |

Vattenfall |

£20,000,000 |

Floating |

7986 |

| 6 |

DEME |

£18,700,000 |

Fixed |

1,008 |

| 7 |

DEME |

£20,000,000 |

Floating |

1,008 |

| 8 |

Falck Renewables |

£25,600,000 |

Floating |

1,000 |

| 9 |

Ocean Winds |

£42,900,000 |

Fixed |

1,000 |

| 10 |

Falck Renewables |

£13,400,000 |

Floating |

500 |

| 11 |

Scottish Power Renewables |

£68,400,000 |

Floating |

3,000 |

| 12 |

BayWa |

£33,000,000 |

Floating |

960 |

| 13 |

Offshore Wind Power |

£65,700,000 |

Fixed |

2,000 |

| 14 |

Northland Power |

£3,900,000 |

Floating |

1,500 |

| 15 |

Magnora |

£10,300,000 |

Mixed |

495 |

| 16 |

Northland Power |

£16,100,000 |

Fixed |

840 |

| 17 |

Scottish Power Renewables |

£75,400,000 |

Fixed |

2,000 |

| Totals |

|

£699,200,000 |

|

24,826 |

- By the end of February 2022:

- Carbon Credits, Article 6 and the Paris Rulebook:

In contrast to the slower growth in demand for hydrogen and hydrogen-based fuels (in particular Green Hydrogen), the demand for carbon credits appears to be increasing at pace, in particular in the Voluntary Carbon Market / Voluntary Carbon Credit Market.

In the Voluntary Carbon Market / Voluntary Carbon Credit Market, carbon credits have value to corporations that have committed to achieving GHG emission reductions (and, in the longer term, NZE on the basis of carbon neutrality). Previous editions of Low Carbon Pulse have covered the uses of words and phrases in this context, but ultimately, decarbonisation takes time, and needs to be achieved across Scope 1, 2 and 3 emissions. To buy time, while still reducing GHG emissions on a net-basis, corporations buy carbon credits.

In the stand-alone article, the author of Low Carbon Pulse will outline Carbon Credits, Article 6 and the Paris Rulebook, and the near, medium and long term role of Carbon Credits, including as deforestation is curtailed and ceases, and afforestation and reforestation continues, and as there appear to be increasingly calls for the regulation of the Voluntary Carbon Market / Voluntary Carbon Credit Market.

By way of reminder, Edition 32 of Low Carbon Pulse noted that a publication entitled, Why was it so significant that COP-26 completed the Paris Rulebook? Contained a high-level summary of the significance of the Paris Rulebook.

Climate change reported and explained:

This section considers news items within the news cycle of this Edition 33 of Low Carbon Pulse relating to climate change and its impact. The intention is to monitor significant and material data points and information, and to explain them.

- 2021 in numbers:

- On December 27, 2021, The Economist provided a reflection of 2021 in numbers. The first number is 49.6OC, being the temperature recorded in Lytton, British Columbia, Canada, resulting in a wildfire that burned Lytton to the ground. Similar conditions impacted the Pacific Northwest. These conditions are extreme weather events. As noted in Edition 26 Low Carbon Pulse, an extreme weather event is "an event that is rare at a particular place and time of year, normally rare means rarer than the 10th or 90th percentile of a probability density".

The Economist reflected that on December 8, 2021, the price of carbon in the EU was €88.88 per tonne of CO2, approaching the USD 100 per tonne, with this higher price of carbon in part related to the increased use of fossil-fuels across the EU (which increased use resulted in an increase of over 600% in natural gas prices during 2021).

The balance of the new items informing The Economist 2021 in numbers were covered in the Reflections on calendar year 2021 contained in Edition 32 of Low Carbon Pulse (published in December 17, 2021), i.e., there was alignment between The Economist and Low Carbon Pulse!

- On January 7, 2022, The Guardian provided a reflection on 2021 in numbers (under More than 400 weather stations beat heat records in 2021).

The Guardian article, based on excellent source material from Maximiliano Herrera, is well-worth a read for those interested in getting a sense of the range and spread of the impact of climate change across the globe.

- The January 2022 edition of National Geographic provides detailed coverage climate change, and a cogent summary:

"[2021] was the year of Texas' deep freeze in February, Canada's highest temperatures in recorded history in June, and Germany and Belgium's lethal flash flooding in July".

- On January 10, 2022 Copernicus Climate Change Services (C3S) released its annual findings for 2021.

The key findings that grabbed the headlines were that the last seven years have been the warmest on record, and that 2021 was the fifth-warmest on record. At a more granular level, 2021 was a year of extreme temperatures in Europe, heatwaves in the Mediterranean, and unprecedented high temperatures in North America.

In addition, Copernicus Climate Change Service (#C3S) report for December 2021 is well-worth a read and a view. With December 2021 being the sixth-warmest December on record.

- On January 13, 2022 the National Oceanic and Atmospheric Administration (NOAA) published its analysis (under 2021 was the world's 6th-warmest year on record). See graphic map.

The NOAA notes that C3S annual findings rank 2021 as the fifth-warmest year on record, compared to its finding of 2021 as being the sixth-warmest on record.

What both C3S and the NOAA find is that the last seven years have been the warmest on record. For those wishing to take a deeper dive, there is broad alignment across the findings of C3S and the NOAA.

- 2022 in numbers: On December 29, 2021, the UK Met Office released its forecast for average global temperatures during 2022:

"The average global temperature for 2022 is forecast to be between 0.97OC and 1.21OC (with a central estimate of 1.09OC) above the average for the pre-industrial period (1850-1990) … : the eighth year in succession when temperatures have exceeded 1.0OC above pre-industrial levels". See the forecast graph.

- 1750 to 2021 in graphic: Mr Karim Elgendy posted a graph on LinkedIn showing that:

"we have caused more damage to the climate since we recognised what we were doing, than we did … before."

GCC Countries:

This section of Low Carbon Pulse considers news items within the news cycle of this Edition 33 of Low Carbon Pulse relating to the Gulf Cooperation Council (GCC) Countries, being countries that are leading the way in the development of Blue Hydrogen and Green Hydrogen capacity for own use and for export.

- KSA spree: On December 17, 2021, solarquarter.com, reported that by 2030 the KSA plans to spend USD 293 billion on renewable energy projects and related transmission and distribution infrastructure.

- Hyport Duqm: On December 26, 2021, the Oman Daily Observer provided an update on the Hyport Duqm Project (see Editions 18, 22, 25, and 26 of Low Carbon Pulse), in particular the size and shape of the Project shared by Mr Anwar al Battashi (OQ Project Lead) and Mr Jean-Baptiste De Cuyper (DEME Concessions Project Lead).

The Hyport Duqm Project is to be developed in phases, with the aim for Phase 1 to have 300,000 metric tonnes of Green Ammonia production capacity a year, and on completion to have production capacity of 1 million metric tonnes of Green Ammonia a year.

Hyport Duqm Project is a partnership between OQ (the global integrated energy group of the Sultanate of Oman) and DEME Concessions (renewable energy and off-shore marine infrastructure business of DEME Group of Belgium).

- ACWA powers ahead: On December 27, 2021, energy-utilities.com reported that a consortium, led by ACWA Power (leading developer, investor and owner operator of power and water assets), had achieved financial close for the USD 1.33 billion Red Sea Utilities project, a public-private partnership (PPP) project, under which the Red Sea Tourism Development Company (TRSDC) is procuring the development of utilities and related infrastructure.

It is understood that the PPP project includes the provision of power generation and potable water production, sewage treatment and solid waste management and treatment. The TRSDC is owned by the Public Investment Fund (PIF), with PIF providing a guarantee in respect of the offtake of utilities entered into between the TRSDC and the consortium.

The consortium comprises ACWA Power, Saudi Tabreed District Cooling Company and SPIC Huanghe Hydropower Development Company. It is understood that the project-financing was secured from Al-Rahji Banking and Investment Corporation, Banque Saudi Fransi, Saudi British Bank, Arab Petroleum Investment Corporation, Standard Chartered Bank and Riyad Bank.

- Aramco to produce hydrogen vehicles: On January 7, 2022 (or thereabouts), it was reported that Aramco is considering whether, and, if so, how best, to produce vehicles using hydrogen fuel cell technology. While Aramco has the resources to produce vehicles, it may be that this initiative will result in the development of vehicle production capacity within the KSA undertaken by established vehicle manufacturers.

See: Aramco website.

On January 22, 2022, The Siasat Daily (siasat-com.cdm) reported (under Saudi Arabia to develop hydrogen fuel cell-based transport) that Saudi Arabia had signed eight memoranda of understanding on January 20, 2022, with a number of corporations to implement pilot projects for hydrogen fuel-cell buses, cars and trains, and transportation applications generally, and sustainable / synthetic aviation fuel (SAF) in selected areas of the Kingdom.

The Minister of Energy, Prince Abdulaziz bin Salman said that:

-

"This step is taken simultaneously with drafting the hydrogen strategy, which arises from the integrated energy strategy that lays out the objectives, road map, and implementation timeline".

- Aramco sponsors hydrogen vehicle: Before and during the Paris – Dakar rally, YouTube was replete with videos of the Aramco sponsored Gaussin Group engineered hydrogen racing truck – Sherazade (Queen of the Desert). To the uninitiated the videos may appear to be sight only, not sound. This is not an error: Sherazade is zero GHG emission and zero noise emission vehicle. Sherazade completed the rally.

- Aramco, Ministry of Energy and SABIC CO2 capture and use: On January 11, 2022, Saudi Green Initiative posted news that Aramco, the Ministry of Energy for the KSA and SABIC (leading chemical corporation) are combining efforts to scale-up carbon capture technology and to use CO2 captured to produce chemicals and sustainable / synthetic fuels, with the initial focus being the production of methanol.

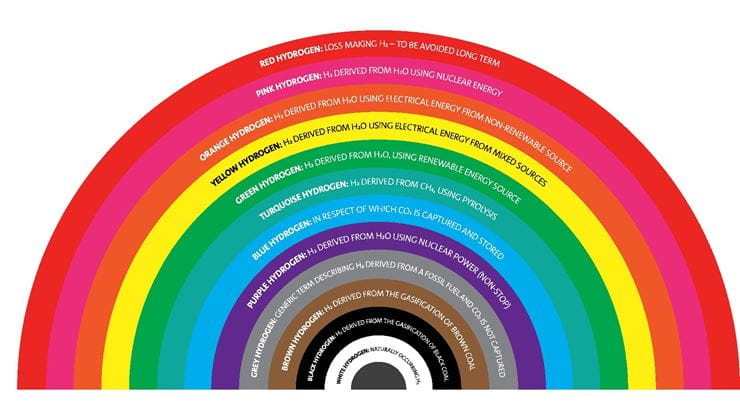

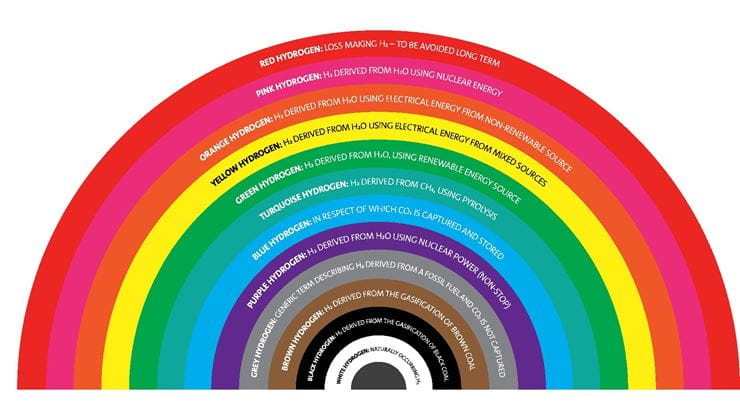

- Emirates Nuclear Energy Corporation (ENEC) targets hydrogen production: On January 12, 2022, english.alarabiya.net reported that ENEC's Barakah nuclear power plant is considering the extent of its potential to create one million metric tonnes of hydrogen per year. See Ashurst Hydrogen Rainbow below for explanation of the colours of hydrogen.

Ashurst Hydrogen Rainbow ©Ashurst 2021

[Note: Some authors / commentators use Purple Hydrogen to refer to the production of hydrogen using coal or petcoke gasification using CCS to capture the CO2 arising]

- UAE and ROK extend energy partnership: On January 17, 2022, The Korea Herald reported that ROK President, Mr Moon Jae, in a three day visit to GCC Countries, had said that: "Korea and the UAE will expand energy corporation into the hydrogen sector, a core energy source in the age of carbon neutrality".

The importance of the energy partnership is emphasised by the fact the President Moon was accompanied by the Minister of Trade, Industry and Energy, Mr Moon Sung-wook, and the CEOs of each of KNOC, the Korea International Trade Association, Hyundai Motor Group, GS Energy, SK Gas and Doosan Fuel Cell.

- Oman and BP committed to multiple GWs: On January 17, 2022, pv-magazine reported (under Oman partners with bp on multi-gigawatt renewables, green hydrogen development) that the Oman Ministry of Energy and Minerals had signed an agreement with BP (leading international energy corporation) to progress with the development of a combined renewable electrical energy and Green Hydrogen production project by 2030. In the near term, BP will assess the solar and wind resources in a 8,000 km2 area of land that would be used to locate photovoltaic solar and wind generation capacity to provide renewable electrical energy for the production of Green Hydrogen.

- Masdar continues to lead the way: On January 18, 2022, energy-utilities.com reported (under Masdar targets 200GW of clean energy capacity) that Masdar (Abu Dhabi Future Energy Company) is targeting the development and deployment of 200 GW of clean energy capacity.

While there is no stated timeline for reaching this target, in the medium term Masdar intends to have 50 GW of installed capacity by 2030. The renewable energy business of Masdar will certainly have the right shareholder base to achieve the longer term target, with Taqa holding 43%, Mubadala 33% and ADNOC 24% of the equity in Masdar.

- Masdar, Siemens and TotalEnergies to develop a SAF plant: On January 19, 2022, h2-view.com reported that Masdar, Siemens and TotalEnergies intend to develop a demonstration sustainable / synthetic aviation fuel (SAF) production plant in Masdar City, Abu Dhabi, with front-end engineering and design to commence during 2022.

The SAF production plant would provide an off-taker for Green Hydrogen as a feedstock for the production of SAF.

- Masdar and Engie and Fertiglobe align to develop Green Hydrogen production facility: On January 19, 2022 (or thereabouts), Masdar and Engie announced that they had signed a collaboration agreement with Fertiglobe (a joint venture between ADNOC and OCI NV, the world's largest seaborne exporter of urea and merchant ammonia) to assess together whether and if so how to develop together a Green Hydrogen production facility in the UAE developing an electrolyser with capacity of up to 200 MW.

See: Masdar and Engie announcements

Mangrove restoration progressing in UAE: On January 20, 2022, an engie press release (under Mangrove Rehabilitation Project – Environment Agency Abu Dhabi and Engie complete Phase II of the Mangrove Rehabilitation Project) announced the success of the second phase of the Blue Carbon Environmental and Social Responsibility project (Mangrove Seeding Project).

The Mangrove Seeding Project involved the use of drone planting technology to plant more than 35,000 mangrove seeds in the Mirfa lagoon, Abu Dhabi. Edition 31 of Low Carbon Pulse outlined the CO2 absorption capacity of mangroves.

Africa:

This section considers news items within the news cycle of this Edition 33 of Low Carbon Pulse relating to Africa. Africa remains the continent with most developing countries, the most LDCs and the most countries vulnerable to climate change, and the continent with some of the lowest levels of electrification.

- Electrification globally: On December 27, 2021, Mr Alessandro Blasi, Special Advisor to the IEA Executive Director (Dr Fitoh Birol) posted an Our World in Data graphic, providing a summary of the percentage of electrification globally by country. The graphic is telling, the retelling of a journey into the heart of darkness (after Joseph Conrad).

India and Indonesia:

This section considers news items within the news cycle of Edition 33 of Low Carbon Pulse relating to India and Indonesia, two countries with increasing populations and urbanisation, attendant increased levels of electrification, and being the countries with the third and seventh most GHG emissions.

- Long arms, with giant handshake: On December 18, 2021, thismoney.co.uk, reported that Octopus Energy (leading UK energy supplier) had contracted with Sterlite Power (leading Indian infrastructure giant) under which Octopus Energy will supply green power to millions of homes in India.

- Bloom Energy and NTPC Limited make progress: On December 20, 2021, businesswire.com, reported that Bloom Energy (leading electrolysis technology corporation) had been selected by NTPC Limited (the largest energy corporation in India) to provide solid-oxide electrolysers and hydrogen fuel cells for the first hydrogen energy storage system (HESS) project.

- Deep pockets needed: On December 21, 2021, energyvoice.com, reported that the Government of Indonesia estimates that a total of USD 1,043 billion (or USD 1.043 trillion) is needed to develop 707.7 GW of renewable electrical energy to achieve NZE by 2060.

The Secretary of the Directorate General of New, Renewable Energy and Energy Conservation, Mr Sahid Junaidi stated in November 2021 that Indonesia has clean energy potential of 3,685 GW, with 3,285 GW of solar, 95 GW of hydropower, 57 GW of bioenergy, 155 GW of wind, 24 of geothermal, and 60 MW of marine.

As such, the issue for Indonesia is not sufficient renewable resources, it is sufficient funding.

- India Hydrogen Alliance – December 2021: Attached is the link to the December edition of India H2 Monitor – December 2021. As noted in previous editions of Low Carbon Pulse, we intend to include the link rather than repeat the context of the India H2 Monitor.

- BPCL outlines USD 3.36 billion plan: On January 7, 2022, it was reported widely that Bharat Petroleum Corporation Ltd (BPCL) plans to invest in a diversified renewable energy and green portfolio, including photovoltaic solar, wind, biomass and hydroelectric.

The plan is to develop 1 GW or renewable and green electrical energy capacity by 2025, and 10 GW by 2040, at the latest. As reported, it is expected that the 1 GW of renewable electrical and green energy capacity by 2025 will comprise 800 MW of photovoltaic solar and 100 MW of wind, with the balance being provided by smaller scale biomass and hydroelectric projects.

- India On track for NZE by 2070: On January 9, 2022, Dr Fatih Birol (Executive Director of the IEA) continued his positive outlook for the decarbonisation of the Indian economy (see Edition 23 of Low Carbon Pulse for earlier positive outlook). Dr Birol wrote: "As a developing economy with over 1.3 billion people, India's energy and climate goals are not just transformational for India but for the whole planet".

Dr Birol directs us to an "op-ed" in The Times of India authored by the CEO of NITI Aayog (Government of India Agency, that serves as the apex public policy think tank) Mr Amitabh Kant and Dr Birol outlining the policy goals and settings for India.

- India aligned with IEA and IRENA: On January 18, 2022, h2-view.com reported (under India Boosts commitment with IRENA agreement) that the Indian Ministry of New and Renewable Energy is combining with the International Renewable Energy Agency (IRENA) to accelerate progress in scaling up the renewable energy and clean energy development and deployment to allow the development of Green Hydrogen production capacity.

It is reported that the agreement was signed on January 16, 2022, and it is considered that the progress hoped for will contribute to the achievement of the National Green Hydrogen Mission.

Japan and Republic of Korea (ROK):

This section considers news items within the news cycle of this Edition 33 Low Carbon Pulse relating to Japan and ROK, being the countries with the fifth and tenth most GHG emissions, and the greatest dependence on imported energy carriers.

- ROK allocates 2.2 GW in PV tender: On January 5, 2022, pv-magazine.com, reported that the ROK Energy Agency announced the results of the second photovoltaic tender of 2021. The Energy Agency announced that it had allocated the entire 2.203 GW of photovoltaic solar capacity the subject of the tender, with the average price of the allocated capacity being a little below USD 0.12 per kWh, with all allocated capacity awarded a 20 year contract to supply renewable electrical energy. It is understood that capacity was allocated in respect of 5,393 projects in total.

The average price is a little higher than for the previous tender to allocate 2.050 GW of photovoltaic capacity. ROK will tender for a further 4.2 GW of photovoltaic solar capacity during 2022.

- Japan and Australia partner for export: On January 7, 2022, it was reported widely that Japan and Australia had signed a partnership under which AUS $150 million will be made available to support trade in clean hydrogen, with funding support to develop clean hydrogen and clean hydrogen derived fuels, including ammonia.

- ROK and LH2 shipbuilding: As noted in previous editions of Low Carbon Pulse (see Editions 2, 6, 10, 17, 32 and this Edition 33) Kawasaki Heavy Industries is progressing the development of LH2 carriers. On January 12, 2022, Hyundai Heavy Industries subsidiary, Korea Shipbuilding & Offshore Engineering Co. Ltd (KSOE) announced that it expects to have developed technology to allow the scalable carriage of liquid hydrogen by 2025. To date, KSOE reports that is has developed containment tanks able to transport 20,000 m3 of liquid hydrogen per tank.

PRC and Russia:

This section considers news items that have arisen within the news cycle of this Edition 33 of Low Carbon Pulse relating to the PRC and Russia, being countries that give rise to the most and the fourth most GHG emissions.

- Wenzhou Taihan Floating Photovoltaic Solar connects to East China Grid: On December 20, 2021, offshore-energy.biz reported that the 550 MW Wenzhou Taihan Floating Photovoltaic Solar (WTFPS) project had connected to the East China Grid to provide renewable electrical energy to the Southern Zhejiang Industrial Cluster. The WTFPS project comprises nearly 1.5 million photovoltaic panels covering 4.7 km2.

- Dezhou Dingzhaung Floating Photovoltaic enters operation: On January 5, 2022, rechargenews.com reported that Huaneng had linked the 100 MW of reservoir-based floating photovoltaic solar to 8 MWh of BESS, and to the wind capacity in the Dezhou Dingzhuang Integrated Wind and Solar Energy Storage project in Shangdong province. It is reported that the installed capacity of the Dezhou Dingzhuang Integrated Wind and Solar Energy Storage project is 320 MW.

- World's largest pumped storage facility goes live: On January 4, 2022, cleantechnica-com reported (under Largest Pumped-Hydro Facility in World Turns on in China) that State Grid Corporation (the largest grid operator globally, and long-standing proponent of use of pumped storage for grid integrity and stability) had commissioned its 3.6 GW Fengning pumped storage facility in Hebei province.

At the moment, the PRC has 30 GW of installed pumped storage capacity, with that plan to have 65 GW installed by 2025 and 120 GW by 2030. One of the clear advantages for the PRC is that State Grid Corporation (as state-owned corporation) has committed (consistent with being a long-standing proponent) to develop pumped storage capacity in tandem with the development and deployment of intermittent renewable electrical energy capacity across the PRC. The use of pumped storage has been part of plans of State Grid for at least the last 15 years, with pumped storage long being viewed as the most effective means of storage of electrical energy.

- PRC to invest up to USD 75 trillion: On January 11, 2022, asiatimes.com published an article entitled Study forecasts China investment of $75 trillion in carbon neutrality. While Low Carbon Pulse does not tend to include new items that report on the level of investment required to achieve NZE, this article, and the study to which it relates (from the Research Group of the Green Finance Committee of China Society For Finance and Banking) is noteworthy. The 200 page study was prepared under the direction of Ma Jun, President of the Beijing Institute for Finance and Sustainability, coming under the auspices of the Beijing Municipal Bureau of Financial Work.

- PRC installed 53 GW of photovoltaic solar in 2021: On January 22, 2022, pv magazine (daily.newsletter@pv-magazine.com) reported that the National Energy Administration (NEA) reported that newly installed photovoltaic capacity in the PRC market reached 53 GW in 2021. Of this capacity, around 29 GW is from distributed generation projects.

- PRC to reach 500 GW of module capacity by the end of 2022: On January 20 and 21, 2022, it was reported widely that Asia Europe Clean Energy (Solar) Advisory (AECEA) estimates that by the end of 2022 the PRC will have developed 500 GW of module production capacity.

Europe and UK:

This section considers news items that have arisen within the news cycle of this Edition 33 of Low Carbon Pulse relating to countries within the European Union (EU) and the EU itself (as an economic bloc) and the UK given geographical proximity, and similar policy settings and progress towards NZE. In combination, countries comprising the EU give rise to the most GHG emissions after the Peoples Republic of China (PRC) and the US. The UK is a top-twenty GHG emitter, but has been a front-runner in progress towards NZE.

- UK CCS and CCUS business model update: On December 21, 2022, the UK Government, Department for Business, Energy & Industrial Strategy published updates on the proposed commercial frameworks for transport and storage, power and industrial carbon capture business models – Transport and storage business model: January 2022 update and Transport and Storage – heads of terms: January 2022 update.

- Rewilding land in the UK: On January 6, 2022, The Guardian, reported that farmers in the UK will be encouraged to rewild land. To effect rewilding, the UK Government is inviting bids for between 10 and 15 pilot projects covering at least 500 hectares and up to 5,000 hectares. The awards are expected in respect of pilot projects by summer 2022.

The Guardian reports that by 2028 it is expected that the UK Government will provide between GBP 700 and 800 million a year for re-wilding. In the long term, by 2040 the UK Government aims to rewild around 300,000 hectares – stated another way, an area the size of the author's home county of Lancashire, England.

- Expansion of European Hydrogen Backbone (EHB): Editions 14, 20 and Report on Reports of Low Carbon Pulse have covered the development of the EHB. On January 18, 2022, it was announced that the EHB had welcomed six new members from Bulgaria, Croatia, Latvia, Lithuania, Norway and Portugal. The EHB comprises gas infrastructure corporations working together to develop a pan-European dedicated hydrogen infrastructure system, now covering 27 European countries. See graphic map.

- UK Government backs Britishvolt Blyth build: On January 21, 2022, the UK Government announced (under Government backs Britishvolt plans for Blyth Gigafactory to build electric vehicle batteries) that it has given an "in principle offer" to Britishvolt to provide funding support through the Automotive Transformation Fund for the purposes of the development of a giga-factory in Blyth, Northumberland.

- UK Government receives applications for funding to develop Track 1 Clusters: On January 21, 2022, a number of corporations announced that they had made applications to the UK Government Department of Business, Energy and Industrial Strategy (BEIS). Edition 34 of Low Carbon Pulse will include details of applications made.

France and Germany:

This section considers news items within the news cycle of this Edition 33 of Low Carbon Pulse relating to France and Germany.

- Increased funding support: During December 2021, the cabinet of the Federal German Government, led by Chancellor Mr Olaf Scholz, decided to increase funding support by €60 billion for the existing Energy and Climate Fund (EKF).

- H2Global approved: On December 20, 2021 it was reported widely that the EC had approved a €900 million Federal German Government scheme providing funding support for the development of Green Hydrogen production capacity outside the EU (H2Global).

Under H2Global, funding support will be provided through competitive tenders, with successful tenderers required to provide, sell and buy side prices in a double auction model under which the lowest price for hydrogen supply and the highest price for hydrogen purchase will be successful, minimising the amount of funding support required.

Germany and South Africa:

Edition 32 of Low Carbon Pulse covered the GH2 Mex report [Green Hydrogen in Mexico: towards a decarbonization of the economy (Volumes I, II, III and IV)], continuing the ever increasing number of countries with which Germany is developing collaborative relationships to allow the development of Green Hydrogen production capacity (see Editions 2, 4, 12, and 13 of Low Carbon Pulse).

On January 18, 2022, h2-view.com reported that (under South Africa, Germany to collaborate on developing a hydrogen economy) that the German Government, through the German Development Agency (Deutsche Gesellschaft für Internationale Zusammenarbeit or GIZ), will provide financial support to support the development of a Green Hydrogen eco-system in South Africa.

Americas:

This section of considers news items that have arisen within the news cycle of this Edition 33 of Low Carbon Pulse relating to the US, Brazil, Canada, and Mexico, being countries that give rise to the second, sixth, ninth and eleventh most GHG emissions.

- Mandated photovoltaic solar and batteries: On December 17, 2021, it was reported widely that the US State of California updated its Build Energy Efficiency Standards (see the 2022 Build Energy Efficiency Standards) to require photovoltaic solar and battery electric storage systems to be incorporated into future commercial buildings and structures.

- 100% by 2050: On December 20, 2021, popsci.com (popular science) reported on a paper published in Renewable Energy (Zero air pollution and zero carbon from all energy at low cost and without blackouts in variable weather throughout the US with 100% wind-water-solar and storage) that supported the scenario that the US could run reliably on clean energy by 2050. The report and the paper are well-worth a read providing a clear line of sight to achieving 100% renewable electrical energy across the US on a number of bases.

- Office of Clean Energy Demonstrations announced: On December 22, 2021, the US Department of Energy (DOE) announced the establishment of the Office Of Clean Energy Demonstration to oversee funding support of around USD$ 21.5 billion for clean energy projects, with a fair proportion of this funding support earmarked for the development and deployment of clean hydrogen projects – see Edition 31 of Low Carbon Pulse.

The funding support is part of Infrastructure Investment and Jobs Act (IIAJA) covered in Edition 31 of Low Carbon Pulse, with around USD 9 billion of the USD$ 21.5 billion earmarked to support the development of Green Hydrogen (shading to renewable hydrogen) capacity.

- Canada 2022: Energy Policy Review: On January 13, 2022, the IEA published Canada 2022: Energy Policy Review. The Review will be considered in detail in the January and February Report on Reports to comprise the Appendix to Edition 36 of Low Carbon Pulse.

Australia:

This section of considers news items that have arisen within the news cycle of this Edition 33 Low Carbon Pulse relating to Australia, a top-twenty GHG emitting country, and a developed country with the highest GHG emissions per capita. And yet Australia is making progress to achieving NZE at a faster rate than many other developed countries, and, along with the GCC Countries, is one of four countries rich in solar resources (and wind resources) that appear likely to lead in the development of the hydrogen economy over the next five years (and beyond): Australia, Chile, the PRC and Spain.

- Five Release Areas for CCS: In December 2021 the Department of Industry, Science, Energy and Resources (DISER) announced the release of five areas for exploration for use for off-shore GHG storage.

The five areas are off-shore in the Northern Territory (two release areas in the Bonaparte Basin) and the State of Western Australia (one release area in the Browse Basin, and two release areas with the Northern Carnarvon Basin). Bids can be submitted between March 4, 2022 and March 10, 2022.

- CSIRO GenCost Consultation: On December 17, 2021, the Commonwealth Scientific and Industrial Research Organisation (CSIRO), published for consultation its annual assessment of GenCost.

The headline from the consultation draft is that photovoltaic solar and on-shore wind are the lowest cost sources of new electrical energy generation, well below the cost of fossil fuels and a fraction of the cost of the generation of electrical energy from nuclear sources. This is not new news, but it confirmatory of other studies in Australia and globally.

- South Australia ends 2021 in record territory: Throughout 2021 Low Carbon Pulse reported on various renewable electrical energy dispatch records set in South Australia (see Editions 6, 9, 12 and 28 of Low Carbon Pulse).

On January 12, 2022, reneweconomy.com.au, reported that for a period of 6.5 days ending on December 29, 2021, the renewable electrical energy dispatched within South Australia mismatched load for 156 consecutive hours.

- South Australia and New South Wales to develop interconnector: On January 14, 2022, pv-magazine-australia reported that the construction of the electricity interconnector between the States of South Australia and New South Wales (EnergyConnect) will commence early in 2022.

The development of the electricity interconnector will allow each State to progress more readily and speedily to the decarbonisation of electrical energy production. Further, EnergyConnect is considered likely to unlock / to accelerate more than AUS$ 20 billion of renewable electrical energy investment across the two States.

- Kawasaki Heavy to transport light: Edition 32 of Low Carbon Pulse reported that it was likely that the MV "Suiso Frontier" (see Editions 2, 8, 10 and 17 of Low Carbon Pulse) built by Kawasaki Heavy Industries Limited (KHI), and owned by HySTRA, would travel to Australia during December 2021 to load, to transport and to deliver to Kobe, the first cargo of liquid hydrogen (LH2) as the Hydrogen Energy Supply Chain (HESC) project progresses (see Editions 10 and 12 of Low Carbon Pulse).

The development of LH2 carriers is key to the development of the hydrogen export industry. As many commentators have noted, the unit cost of transportation of LH2 in LH2 carriers as currently configured and sized needs to fall, with the development of LH2 carriers with containment systems (tanks) able to transport a mass of LH2 that has a heating value comparable with that of a LNG carrier. As reported in Low Carbon Pulse previously, KHI is making progress in this regard, including developing a 40,000 m3 tank, and contemplating the development of LH2 carriers with four such tanks.

On December 24, 2021, the Suiso Frontier left Japan, docking at the Port of Hastings, Victoria, Australia, on January 20, 2022. The arrival of the Suiso Frontier was marked by an arrival ceremony. The arrival of the Suiso Frontier marks the final piece in the jigsaw puzzle called the HESC. The concept of the HESC was developed in 2015 (long before hydrogen plans, road maps and strategies became common), and involved forward thinking folk committing to the development of the HESC, including forward-thinking by the Federal Government of Australia, in particular the funding support that it provided.

- No time for complacency in the Lucky Country:On January 20, 2022, the author of Low Carbon Pulse came across a map showing CO2 emissions arising from electric energy consumption.

Blue and Green Carbon Initiative and Biodiversity

This section considers news items that have arisen within the news cycle of this Edition 33 Low Carbon Pulse relating to the Blue Carbon and Green Carbon initiatives and Biodiversity.

For the purpose of this Edition 33 of Low Carbon Pulse, the author decided to focus on the issue forestry and land management and land-use, in particular whether to allow re-growth to be natural or planned (including for commercial purposes). While there are many variables, it is clear that there is common ground that allowing natural re-growth will favour the maintenance or the re-generation of biodiversity.

For these purposes, areas of at least 50,000 hectares are to be favoured for reforestation. This may be regarded as the gold standard for forests, both existing and natural re-growth.

The capacity of forests to absorb CO2 and to manage the release of CH4 as biomass decomposes can be assisted greatly by effective husbandry. For the author whether natural re-growth or planned, or both, the only benchmarks that really matter are CO2 absorption and accompanying biodiversity.

-

More CO2, more photosynthesis: On December 21, 2021, cleantechnica.com reported on a new study on the impact of increased levels of CO2 in the climate system on the rate of photosynthesis. There has been debate for a while around whether or not increased levels of CO2 affect the rate of photosynthesis of CO2 by flora. Research undertaken by the Lawrence Berkeley National Laboratory and UC Berkeley found that flora is photosynthesising in 2020 (with 420 ppm of CO2) at a rate that is 12% greater than was the case in 1982 (with 360 ppm of CO2).

The lead author of the study, Mr Trevor Kennan noted that the study shows that there has been "a very large increase in photosynthesis, but it is nowhere close to removing the amount of carbon dioxide we're putting into the atmosphere. It's not stopping climate change by any means, but it its helping us slow it down".

The study does not allow us to conclude that there is or is not a point at which flora will cease to increase the rate of photosynthesis, but the study does underline the importance of ceasing deforestation, and accelerating reforestation and the increased use of afforestation.

-

Tropical Rainforests in view (not gone with the wind): On December 29, 2021, in mongabay.com Mr Rhett A Butler published a great article, The year in rainforests 2021. The article provides a helpful overview of 2021, focussing on the persistence of tropical rain forest deforestation. Also the article provides a look forward to the year ahead, and provides previous years-in-reviews 2020 to 2009. All up, the article and the links are helpful and informative resources.

-

Soil microorganisms and carbon capture: Edition 32 of Low Carbon Pulse included two diagrams providing a diagrammatic representation of the function of soil and the role of healthy soils in the context of Sustainable Development Goals.

These diagrams put the author in mind of the diagram outlining in simple terms the role of microorganisms on carbon capture in the soil ecosystem. The diagram is taken from the following study. In the context of the next piece, this diagram underlines the importance of understanding the role of ecosystems in the context of reforestation and afforestation, in the context of natural and planned re-growth.

This other diagram provides a diagrammatic representation of the role of forests as "moisture machines" (Moisture Machines: How Forests Fill the Atmosphere with Water). The message conveyed by this diagram ties even closer to the next piece: forests recycle 200 km3 of water a day (through the evaporation of water vapour transpired). In contrast, human activities globally use 10 km3 of water a day.

Green Carbon – the "wood-wide web":

A Trillion Trees to three trillion trees: During down time over the holiday season, the author read A Trillion Trees by Mr Fred Pearce. The book provides a helpful reminder of the importance of trees, and because of this the author has shared some of the most cogent facts and stats:

-

Among the many memorable passages in A Trillion Trees Mr Pearce writes: "Before the existence of forests, the atmosphere of the Earth was baking hot, bone dry, short of oxygen and thick with carbon dioxide. Today, three million trees keep us cool and watered, by soaking up the carbon dioxide and by sweating moisture to sustain "flying rivers" that deliver rain across the world. Their breath alters atmospheric chemistry too, making clouds and even generating the winds. Trees, in short, created and sustain the life-supporting climate of our plant."

-

"Trees don’t just dominate our living world, they made it": "Half the biomass in trees is made up of carbon … there are still around three trillion trees. They contain as much carbon as mankind has deposited into the atmosphere since the start of the Industrial Revolution … A tree's relationship to carbon changes through its life-cycle. Growing trees absorb carbon. Dying trees release it, as their biomass rots."

-

" … stomata – the microscopic pores on leaves that take in carbon dioxide from the air and release oxygen and water … a chemical process that uses energy from the sun to combine carbon dioxide from the air with water drawn up from the [roots of trees]. This creates glucose from which plant cells form … the stomata take in the carbon dioxide and then release the main waste products from photosynthesis: oxygen and excess water [in the form of water vapour]".

The release of excess water to the atmosphere (transpiration) moistens the atmosphere …

The planet's three trillion trees release an estimated 60,000 cubic kilometres of water a year [Note: This is at the lower end of estimates with others as high as 73,000 km3]. Forming clouds as moisture blows downwind, this moisture is responsible for at least half of all the rain and snow that falls on land. In continental interiors that figure raises to more than 90%. This recycling of moisture makes a world fit for more trees.

-

In addition to keeping the air moist, water recycling keeps the air cool.

-

Transpiration requires energy. A single tree in a tropical forest can transpire a hundred litres of water a day – equivalent to two-household air-conditioning units. "On the giant forested island of Sumatra in Indonesia, the air around the forests can be up to ten degrees cooler than in the neighbouring palm oil plantations".

-

Global greening is not clearly not enough to stop global warming. It may turn out to be temporary if, as many researchers believe, the end result of all the extra carbon dioxide is that trees "grow fast by dying young".

Optimising land-use can increase absorption capacity: On January 18, 2022, nature.com published a paper entitled The global carbon sink potential of terrestrial vegetation can be increased substantially by optimal land management.

The paper is powerful:

"Vegetation carbon sequestration varies under different land management practices … [the proposed] integrated method … of optimal land management .. finds that global land vegetation can sequester an extra 13.74 PgC per year [13.74 giga-tonnes of CO2-e] if location-specific optimal land management practices are taken …". See Figure 1.

-

More about mangroves: On January 4, 2022, the WWF at www.worldwildlife.org published a feature entitled Mangroves as a Solution to the Climate Crisis. For the regular reader of Low Carbon Pulse, there will be nothing new in the feature, but it is well-worth a read because it picks-up on all of the policy setting benefits of restoration of mangroves as a "nature based solution".

-

CO2 and mosses: On January 5, 2022, an article was published by physorg entitled Rising atmospheric CO2 concentrations globally affect photosynthesis of peat-forming mosses, reporting on research by scientists at Umea University and the Swedish University of Agricultural Sciences.

The most telling paragraph in the article is: " .. increasing CO2 during the last 100 years has reduced photorespiration, which has probably boosted carbon storage in peatlands to date and dampened climate change. However, increasing atmospheric CO2 only reduced photorespiration in peatlands when water levels were intermediate, not when conditions were too wet or to dry. Unlike higher plants, mosses cannot transport water, so the water table level controls their moisture content, which affects their photosynthetic performance. So, models based on higher-plants' physiological responses cannot be applied".

-

Vale EO Wilson: December 26, 2021 was marked with the passing of EO Wilson. As well as tireless commitment to the protection and restoration of biodiversity, EO Wilson was responsible for one of the more thought provoking quotes that stuck in the mind of the author:

"We have created a Star Wars civilisation, with Stone Age emotions, medieval institutions and god-like technology".

The Economist (January 8, 2022) provided a worthy obituary.

Bioenergy and heat-recovery:

This section of considers news items that have arisen within the news cycle of this Edition 33 of Low Carbon Pulse relating to bioenergy, being energy, whether in gaseous, liquid or solid form, derived or produced from biomass.

Bioenergy includes any energy derived or produced from biomass (organic matter arising from the life-cycle of any living thing, flora or fauna, including from organic waste streams), whether in gaseous, liquid or solid form.

BIO ENERGY IN GASEOUS FORM

|

Biogas: a mixture of CH4 and CO2, arising from the decomposition of organic matter, including derived or produced from anaerobic digestion.

|

Biomethane: CH4 in near pure form, derived or produced from upgrading Biogas or gasification of biomass. Biogas and Biomethane are Biogases.

|

Bio CNG: Biogas or Biomethane that is compressed.

|

Bio LNG: Biomethane that is liquified.

|

The landmark reports of calendar year 2021, the International Energy Agency (IEA) Net-zero by 2050: A Roadmap for the Global Energy Sector (IEA Roadmap), and the International Renewable Energy Agency (IRENA) World Energy Outlook (WETO) both identified Bioenergy and BECCS (and BECCUS) as key to achieving NZE by 2050.

IEA ROADMAP AND WETO – SIX AND SEVEN PILLARS

|

IEA Roadmap

|

The seven pillars of the IEA Roadmap are: 1. Energy efficiency; 2. Behavioural change; 3. Electrification; 4. Renewables; 5. Hydrogen and hydrogen-based fuels; 6. Bioenergy and land use change; and 7. Carbon capture, utilisation and storage.

|

WETO

|

The six pillars of the WETO are: 1. Energy conservation and efficiency; 2. Renewables (power and direct uses); 3. Electrification of end use (direct); 4. Hydrogen and its derivatives; 5. CCS and CCUS in industry; and 6. BECCS and other carbon removal measures.

|

In addition, recovered heat and waste heat (derive from any source, including waste water) has been added to this section. From recent activity and reporting, it appears likely that the avoidance of waste heat energy, and the recovery of waste heat energy will become a priority under the first pillar as a part of Energy Efficiency (IEA) and Energy conservation and efficiency (IRENA). By some estimates, up to 67% of energy arising is wasted.

The increased awareness of sourcing heat reflects increased awareness of the energy used to heat buildings, and its source: heating buildings results in around 25% of total final energy demand, with around 75% of the feedstock used to satisfy that energy demand derived from fossil fuels.

- Anaerobic digestion ecosystem: By way of background, one of the technologies used to derive and produce biogas is anaerobic digestion, and with further processing biogas is the feedstock for biomethane.

Among other things (as explained in Edition 32 of Low Carbon Pulse, under Bio-LNG in Tassie), biomethane can be used as the feedstock to produce bio-LNG.

Anaerobic digestion is explained in detail Ashurst article Waste to Wealth compendium.