Japans renewable FIP scheme and recent changes to the regime for battery storage

12 August 2022

12 August 2022

Japan is aiming to source 36-38% of its electricity generation from renewable sources by FY20301 and achieve carbon neutrality by 2050, while at the same time maintaining a stable and affordable supply. The amendment of the Act on Special Measures Concerning Procurement of Electricity from Renewable Energy Sources by Electricity Utilities (Act No.108 of 2011) is a significant step towards this goal.

One of the key changes implemented through the amendment is the introduction of a Feed-in Premium (the "FIP") scheme and a gradual transition away from a Feed-in Tariff (the "FIT") scheme as explained in more detail below.

Battery energy storage systems ("BESS") are playing an increasingly important role in the transition towards net zero. However, the regulations for BESS in Japan were generally perceived as requiring further clarification and development to promote this industry. In response to the increasing need to stimulate renewable energy sources, some reforms and discussions have been undertaken to address this issue.

This briefing note focuses on (a) key differences between the FIT and the FIP schemes; (b) the current status of the FIT/FIP schemes with respect to BESS; and (c) subsidies for BESS.

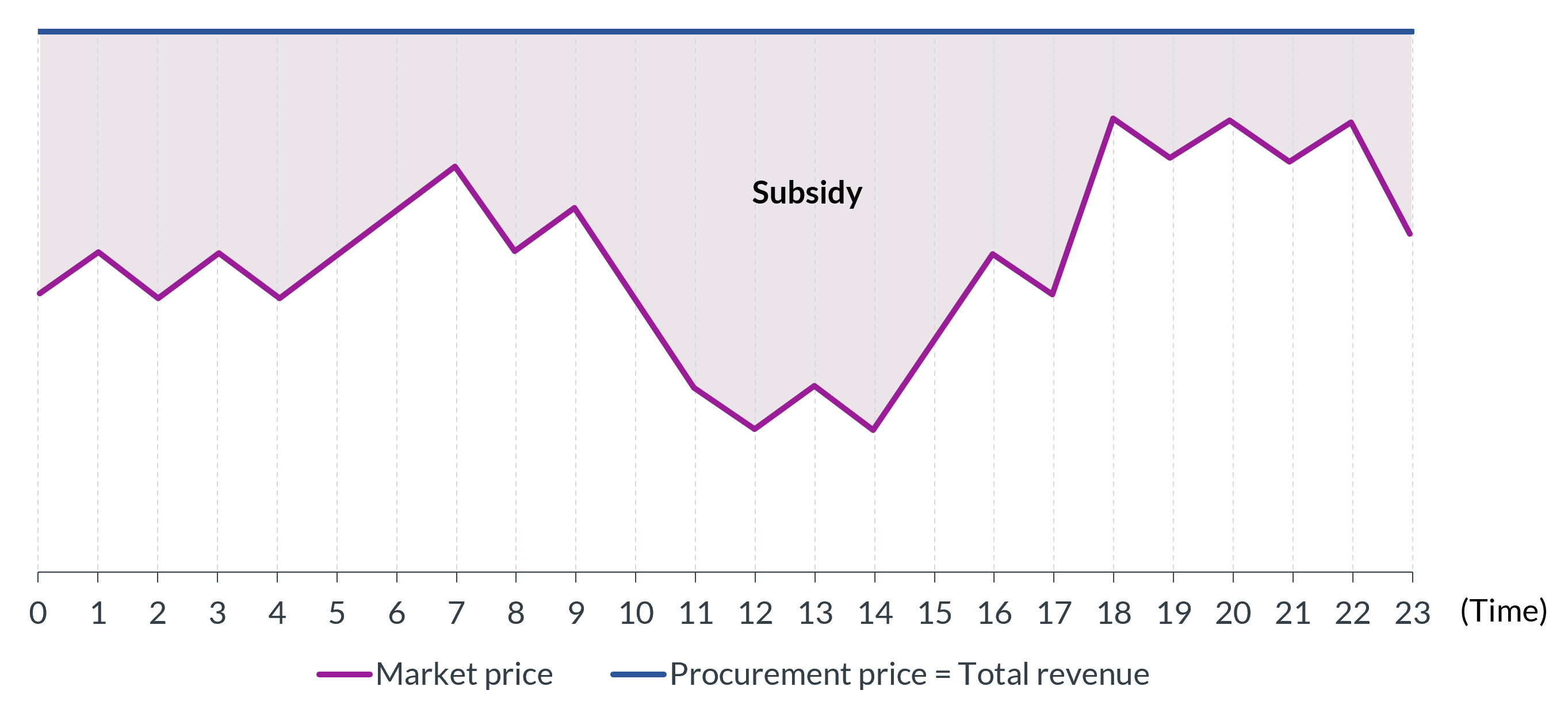

Under the FIT scheme2 , utility companies are required to purchase all electricity generated by renewable energy generators at a fixed price irrespective of the prevailing market price. The generators are also protected from imbalance risk, i.e. the assumption of cost by the generators for the difference between the amount of energy actually generated and the estimated amount of energy generation submitted in advance to the Organization for Cross-regional Coordination of Transmission Operators (the "OCCTO") (the "Imbalance Cost") (see Point No. 5 in Section "Revenue structure under the FIP scheme" below for details). The FIT scheme has contributed to the rapid growth of the renewable energy generation sector in Japan, particularly solar and onshore wind. However, due to the fact that the FIT scheme offers a fixed price for all electricity generated, generators are decoupled from the market and have no incentive to increase electricity generation during peak hours or reduce at times of over-supply or manage imbalance risk.

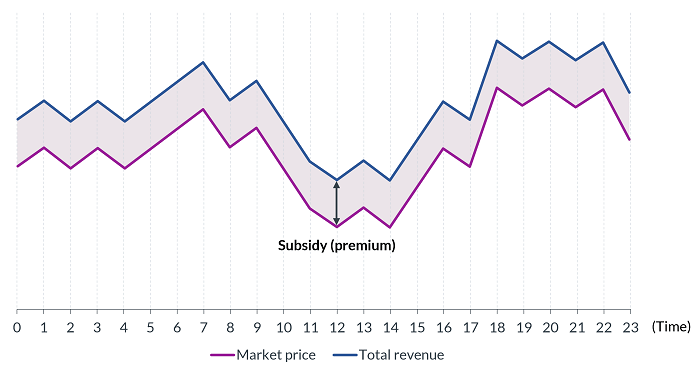

Under the FIP scheme, the premium paid to generators is calculated as a margin which is added to the wholesale market price (or in the case of a bilateral trade, the agreed purchase price). Therefore, under the FIP scheme revenue fluctuates along with the market price as the revenue the generator receives and the market price are now expressly linked. Unlike under the FIT scheme, it is expected that the generators will have more incentive to increase their supply of electricity (through the use of BESS, for example) during peak hours as this will have a direct impact on their revenue. They either sell the electricity in a wholesale market or in bilateral trades with electricity retailers. The utility companies are no longer required to purchase the output of renewable energy generators as they were under the FIT scheme. Nor are renewable energy generators exempted from the Imbalance Cost. However, during the initial stages of the FIP scheme and with respect to solar and wind power projects, a certain amount of money will be provided to the generators on account of Imbalance Cost as part of the premium. This is a transitional measure to address the generators' assumption of the Imbalance Cost and to provide an incentive to opt for the FIP scheme instead of the FIT scheme (where available). For FY2022, that amount of money to be provided is JPY 1.0/kWh, which is expected to be gradually reduced3.

FIT:

FIP:

(source: https://blog.eco-megane.jp/fip/; translated by Ashurst)

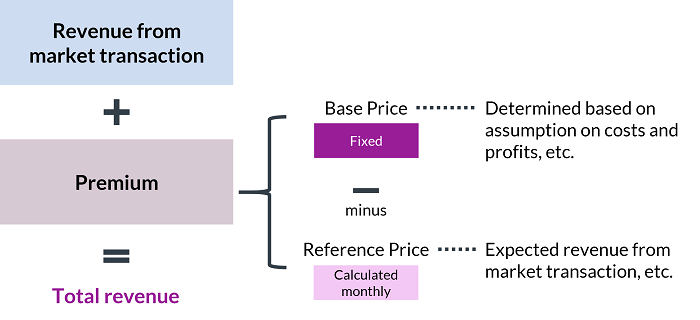

Revenues under the FIP scheme are structured as follows:

(source: https://blog.eco-megane.jp/fip/; translated by Ashurst)

The base price is determined using a similar method to that used for determining FIT tariffs. The base price is determined for (other than exceptional cases) each fiscal year as the fixed amount that would apply for the entire term of the FIP, i.e., twenty years. The base price can either be set administratively for a given year by the Minister of METI considering the opinions of the Procurement Price Calculation Committee, or it can be determined by a bidding process.

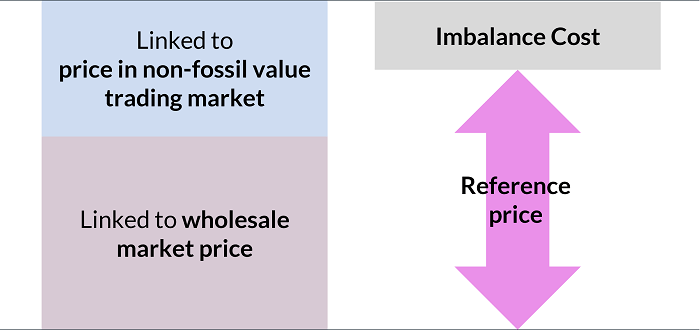

The reference price is essentially the anticipated amount that a generator would earn from the sale of renewable energy on the market. It is calculated monthly based on an average market price. The reference price comprises the sum of the relevant market electricity price and the price of an environmental value in a non-fossil value trading market minus, during the initial stages of the FIP scheme, a certain amount of money to be provided on account of Imbalance Cost (see Points No. 3 and No. 4 below in this Section for details of calculation).

(source: https://blog.eco-megane.jp/fip/; translated by Ashurst)

We set out below further details in response to various practical queries with respect to the FIP scheme based on our dialogues with some potential new entrants interested in this market:

| 1. Is there any indexation of the base price? |

|---|

| No indexation applies to the base price. However, if the METI Minister finds particularly necessary due to significant changes in economic circumstances, the base price could be revised. |

| 2. What are the base prices for FY2022? |

Some of the base prices under the FIP scheme for FY2022 for projects that are not subject to auction and with an output capacity above or equal to 50kW are as follows:

For base prices applicable to other categories of energy sources and output capacity, including those for FY2023 and FY2024, please refer to the FIT/FIP Guidebook FY2022. |

| 3. How is the "wholesale market price", which is used as part of the calculation of the reference price, calculated? |

The "wholesale market price" for a given month will be calculated as follows (unit: JPY/kWh): wholesale market price for Month X of Year Y = yearly average of wholesale market prices for Year Y-1 + (monthly average of wholesale market prices for Month X of Year Y - monthly average of wholesale market prices for Month X of Year Y-1) |

| 4. What is the "non-fossil value trading market"? |

| This is a market established by METI and operated by JEPX (Japan Electric Power eXchange; the only wholesale electricity exchange in Japan) since May 2018. The value of electricity generated from non-fossil fuel, one sort of the "environmental value" (e.g. zero-emission value), is represented by "non-fossil certificates" so that the non-fossil value become tradable. The non-fossil value trading market was created for the electricity generators to sell their non-fossil certificates. The trading is conducted online, in auctions and four times a year. The average of the (non-FIT, renewable-designated) prices of the most recent four auctions is referred to for the purposes of the calculation of the reference price set out above in this Section. These certificates are typically purchased by electricity retailers each of whom is required to achieve by FY2030 the target ratio of 44% or more of non-fossil fuel-based electricity generation to the entire electricity that it supplies7. Non-fossil fuel-based electricity generated under the FIT scheme and outside that scheme are both subject to the trading. The price unit is JPY/kWh. |

| 5. How is the Imbalance Cost assessed? |

| The Imbalance Cost is assessed for each of nine geographic areas of Japan in which the electricity transmission and distribution service is provided (the "Areas"). The details of the assessment methodology are provided by the report "Imbalance Cost Regime from FY2022 (Interim Report) dated 17 December 2019 and revised on 21 December 2021 by Electricity and Gas Market Surveillance Commission under METI (the "Imbalance Cost Report")8 and 9. The unit price of the Imbalance Cost is assessed for each measurement period of 30 minutes and published at the website of Imbalance prices Calculation Service10. |

| 6. Could there be any mismatch between the reference price and the amount of revenue that each generator actually earns from the sale of renewable energy on the market? |

| Yes. The reference price is not the actual market price but the price calculated as set out above in this Section. Notably, the settlement period in the wholesale market is 30 minutes while the reference price is calculated monthly based on an average market price as shown in Point No. 3 above, which could potentially cause a mismatch. |

| 7. What happens when the premium results in a negative amount by calculation above, i.e., the reference price exceeds the base price? |

| In these circumstances, no premium is provided, but generators are not required to pay the difference between the base price and the reference price. This structure is based on the idea that the FIP scheme is intended to encourage generators to introduce renewable energy sources. |

| 8. What happens when the "wholesale market price", which is used as part of the calculation of the reference price of a given month, results in a negative amount by calculation in the answer to question 3 above? |

| This could happen when the wholesale market prices of the previous year for the corresponding month steeply rose. In these circumstances, the "wholesale market price" used as part of the calculation of the reference price is deemed to be zero/kWh except where the reference price (but without taking the Imbalance Cost into account) results in a positive amount after adding the price of an environmental value in a non-fossil value trading market. |

| 9. How and when the payment of the premium will be processed? |

Under the FIP scheme, OCCTO is in charge of the payment of the premium and pays directly to each of the relevant generators. OCCTO processes the payment for the electricity supplied in Month X as follows: (a) early Month X + 2: determine the amount of the electricity supplied; (b) middle – late Month X + 2: calculate the amount of premium, i.e., unit price of the premium (JPY/kWh) multiplied by the amount of electricity supplied, and notify the relevant generator of the amount of their premium to be provided and the basis of the calculation; and (c) early Month X + 3: pays the premium to the relevant generator. |

| 10. Can the projects that have already been granted the FIT get transferred to the FIP scheme? |

Yes. With respect to the facilities with an output capacity above or equal to 50kW of all the categories of renewable energy sources, the projects that have been granted the FIT can get transferred to the FIP scheme by completing the required procedures upon applications including the approval of a business plan11. |

| 11. Is a completion of construction of generation facilities prerequisite to be eligible for the FIP scheme? |

No. The process and procedures of the FIP scheme from the application up to the end of projects are the same as those of the FIT scheme, where construction is expected to be commenced after a business plan is approved by METI. |

FIP schemes have been used in several European countries, but such schemes are not without their critics. While FIT schemes insulate renewable generators from price risk, FIP schemes expose renewable generators to pricing volatility, albeit with the benefit of the premium. However, the same criticisms that are levelled at FIT schemes surrounding overpaying can also be levelled at FIP schemes, where the level of the premium might be too high or too low depending on the prevailing market price.

Moreover the idea of the FIP and its linkage to market prices is that it encourages renewable energy generators to respond better to market signals and match output and demand accordingly. However, in practice, this is difficult for generators of intermittent technology such as wind or solar, absent on-site BESS.

In Japan's first-ever FIP auction where the total capacity available for the FIP auction was 175,000 kW, the government awarded 5 projects with a cumulative capacity of 128,940 kW among 12 projects confirmed eligible for auction with a cumulative capacity of 179,021 kW. The highest awarded price was JPY 9.90/kWh and the weighted average of the awarded prices was JPY 9.87/kWh12.

Japan's target energy mix for FY2030 set out in the 6th Strategic Energy Plan is to source 19-21% of its electricity generation from solar and wind. When the proportion of intermittent generation such as solar and wind in a country's energy mix increases, then this has an impact on grid stability and large-scale energy storage facilities begin to play an important role.

BESS is already in operation in Japan as part of solar or wind power generation facilities where the BESS is installed within these facilities and owned by those relevant energy generators ("Co-located BESS"). However, there is increasing focus on BESS installed separately from energy generation facilities by operators other than these relevant energy generators and connected to the power grid ( "Stand-alone BESS"). We set out in the rest of this briefing note below the current status including recent reforms and the possible future direction of travel as regards both Co-located BESS and Stand-alone BESS.

Both the FIT scheme and the FIP scheme apply to electricity generated by a renewable generation facility that has been granted the FIT or FIP and stored in a Co-located BESS for that facility. Moreover, in the case where a Co-located BESS is subsequently installed within the relevant solar power generation facility, the FIP scheme (unlike under the FIT scheme) offers a following flexibility. With respect to solar power projects that have been granted (a) the FIP in and after FY2022 and (b) the FIT in and after FY2022 and then transferred to the FIP scheme by the relevant approval (see Q&A 10 in Section "Revenue structure under the FIP scheme" above), a change of a business plan is permitted without this triggering a change of the original base price. This positive change reflects the expected role of BESS under the FIP scheme in terms of helping generators export at times of peak demand and minimise Imbalance Costs.

BESS will play an ever more important role as grids become increasingly reliant on the generation of electricity by intermittent zero carbon sources such as solar and wind. With the cost of BESS falling, Japan foresees a significant expansion in BESS with more and more new entrants. Given this impact, the Electricity Business Act (Act No. 170 of 1964; the "EBA") was recently amended through the Act to Partially Amend Laws Concerning Rationalisation of Energy Use to Establish a Stable Energy Supply and Demand Structure (Act No. 46 of 2022), which was enacted on 20 May 2022 (such amended EBA, the "Amended EBA").

The main changes to Stand-alone BESS made by the Amended EBA include (a) categorising a Stand-alone BESS business that satisfies certain conditions13 set out in the METI ordinance as an "Electricity Generation Business" under the BEA and (b) enabling Stand-alone BESS businesses to apply for a connection to the power grid. Stand-alone BESS businesses are required, in accordance with the METI ordinance, to notify the METI Minister of certain information on (i) the site where the relevant Stand-alone BESS is to be installed, (ii) frequency, (iii) output capacity and (iv) storage capacity. According to a report published in February 2022 and prepared by a METI expert committee (Electricity and Gas Basic Policy Subcommittee) on new issues relating to a future power system (the "METI Committee Report"), the amendment to the EBA envisages METI having the power to require the provision of relevant information and to give necessary instructions to the operators of a Stand-alone BESS such as dispatch instructions at the times when supply margins are tight. The relevant provisions of the Amended EBA will take effect on 1 April 2023.

With respect to the practical timing for business operators of Stand-alone BESS businesses to be able to connect their BESS to the power grid, based on our consultation with METI14, we understand that it may in general take perhaps one or two years after the entry into force of relevant legislation for a market environment to be ready in practice for the implementation and operation of such new businesses. As we noted above, the details of the necessary criteria to be categorised as an "Electricity Generation Business" and the notification to the METI Minister are to be determined by the METI ordinance and this is an evolving area.

To facilitate Japan's achievement of planned energy-mix and carbon-neutrality goals, and given the current market environment set out in Section "Background" above, the Japanese Government earmarked JPY 13 billion to promote Stand-alone BESS with subsidies as part of its FY2021 supplementary budget. The initial subsidy programme to cover the construction costs of Stand-alone BESS was open to applicants from 16 February 2022 to 11 March 2022.

To be eligible, a BESS must be a Stand-alone BESS with a minimum output capacity of 1,000 kW. Except for some special categories of storage batteries15, a Stand-alone BESS with an output capacity of 1,000 kW or more but less than 10,000 kW was entitled to receive a subsidy of up to 1/3 of the total construction cost and a Stand-alone BESS with an output capacity of 10,000 kW or more was entitled to receive a subsidy up to 1/2 of the total construction cost. In both cases, the total amount of the subsidy per application was capped at JPY 2.5 billion.

When this programme was launched, the initial application guidelines suggested potential subsequent rounds of applications. However, as of the date of this briefing note, it has been announced that the application for this subsidy programme has been closed, as the total amount of subsidies granted has already reached the amount of the budget allocated to this programme as a whole. Market participants have been surprised by the short-lived nature of this scheme, particularly given the recent launch of the FIP scheme in April 2022 and the Amended EBA enacted on 20 May 2022: the market will need to wait and see whether further subsidy rounds will be provided to promote further investment in Stand-alone BESS in the near future.

While Japan's FIT scheme has been hugely successful in stimulating investment in renewable generation technology, it has come at a significant cost to the electricity consumer. The introduction of the FIP scheme ties the cost of renewable energy more to the market price, but it remains to be seen how renewable generators will adapt to the exposure to market price volatility and imbalance risk that is inherent in the premium structure.

On the battery front, the clarification of the treatment of Co-located BESS and its interaction with the FIP scheme is helpful, although many investors are likely to be frustrated at the short-lived nature of the initial funding round for Stand-alone BESS and will be waiting to see what the Government does next. Moreover it appears there remains a significant amount of implementation work to do to fully develop the applicable framework for Stand-alone BESS.

Authors: David Wadham, Partner; Kensuke Inoue, Partner and Akemi Kishimoto, Senior Associate.

1. Sixth Strategic Energy Plan of Japan approved by the cabinet on 22 October 2021 (the "6th Strategic Energy Plan").

2. The FIT scheme continues to co-exist with the FIP scheme for a couple of years depending on the category of renewable energy source and the output capacity of the relevant facility. The public notices of the Ministry of Economy, Trade and Industry ("METI") designate the categories of renewable energy source and the output capacity that are eligible for each of the FIT scheme and FIP scheme for each year. METI's public notices also designate the categories of renewable energy source and the output capacity that are subject to auction processes. For FY 2022 for example, for the facilities with the output capacity above or equal to 50kW and below certain threshold (respectively set for each category of renewable energy source) generators could choose either the FIP or FIT scheme, except for wind where there is no such threshold. The details are set out on pp.8-9 of the Renewable Energy FIT/FIP Scheme Guidebook (FY2022) (https://www.enecho.meti.go.jp/category/saving_and_new/saiene/data/kaitori/2022_fit_fip_guidebook.pdf) (the "FIT/FIP Guidebook FY2022").

3. The amount of money provided will be reduced by JPY 0.05/kWh each year until FY2024, then by JPY 0.1/kWh from FY2025.

4. If the FIT scheme with an output capacity above or equal to 250kW is chosen, then subject to auction capped at 10.00, 9.88, 9.75 and 9.63 for each round (all in JPY/kWh).

5. If the FIT scheme is chosen, then subject to auction capped at JPY 16/kWh.

6. This is for those projects to which the Act on Promotion of Use of Marine Areas for Development of Marine Renewable Energy Generation Facilities ("the Marine Renewables Energy Act") does not apply and thus no auction will be conducted.

7. This goal is set out by METI's public notices relating to the Act concerning Promotion of Use of Non-fossil Energy Sources and Effective Use of Fossil Energy Raw Materials (Act No. 72 of 2009).

8. https://www.emsc.meti.go.jp/info/public/pdf/20211223001a.pdf.

9. From FY2022, in brief, the Imbalance Cost is the highest of the following:

(a) Cost per kWh to ensure a stable power supply in response to the imbalance

The response to the imbalance is carried out mainly through a control system called Keystone Japanese Coordinating system ("KJC"). KJC is a common platform for the adjustment of supply and demand of electricity covering nine Areas. It collects data on the estimated imbalance from each Area, set off these imbalances across Areas and allocates the required amount of adjustment to each Area based on the merit-order list it receives from each Area. This cost is assessed at the KJC level and the same amount of cost per kWh would apply to the relevant Areas where the adjustment has been made through KJC as above.

(b) Cost per kW to secure a required supply at the time of tight electricity supply

This cost is calculated based on the formula set out in the Imbalance Cost Report and is capped at 600 yen/kWh except for FY2022 and FY2023 when this is capped at 200 yen/kWh as a temporary measure.

(c) Cost per kWh to secure a required supply at the time of tight electricity supply

This cost is intended to reflect the cost incurred due to the shortage of electricity supply when there is a concern about the fuel shortage. This cost is yet to be introduced in practice and is expected to be implemented once the refurbishment of the relevant system for calculation is completed.

10. https://www.imbalanceprices-cs.jp/.

11. A model case of the transfer procedure is presented in the website of Agency for Natural Resources and Energy

(https://www.enecho.meti.go.jp/category/saving_and_new/saiene/kaitori/FIP_index.html).

12. The details of the auction results announced by OCCTO on 17 June 2022 are available at https://www.occto.or.jp/fip/nyusatsu.html.

13. The METI Committee Report (defined below in this paragraph) refers to, as an analogy to a battery storage, a pumped storage power generation, which is currently regulated as "Electricity Generation Business" if it satisfies the relevant criteria including an output capacity of "over 10,000 kW".

14. A phone call with an officer of METI in charge of the amendment of the EBA made on 27 April 2022.

15. With respect to a Stand-alone BESS manufactured based on new technologies or by re-using a battery storage module already used for driving of electric vehicles, it was entitled to receive the subsidy up to 1/2 of the total construction cost regardless of the size of its output capacity. The same cap applied as applied to the general type of a Stand-alone BESS.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.

Sign-up to select your areas of interest

Sign-up