PLNs New Greener RUPTL Key Highlights

12 October 2021

The long-awaited 2021-2030 Electricity Supply Business Plan (Rencana Usaha Penyediaan Tenaga Listrik or RUPTL) from PLN (the Indonesian state utility) was finally issued and presented to the public on 5 October 2021. The delay in the issuance of a new RUPTL (with PLN having skipped this exercise altogether in 2020) has been attributed to the drop in electricity demand because of the COVID-19 pandemic, as well as a shift in the Government of Indonesia's focus towards renewable energy as a result of Indonesia's commitments under the Paris Climate Agreement and its recently declared carbon neutrality objectives. The new 2021-2030 RUPTL has been declared by PLN and the Ministry of Energy and Mineral Resource as the "Green RUPTL". In this short update, we set out some of the key highlights of the RUPTL which is (915 pages long and) an essential document for all stakeholders, including private investors, to gain understanding of the opportunities and projects pipeline for the years ahead.

Lowered demand growth projections: Electricity demand in 2020 experienced negative growth of -0.79% due to the effects of the Covid-19 pandemic. In light of the sector's current condition, it is further projected that electricity demand growth for the next 10 years will average 4.9% per year, lower than the growth projections under the previous RUPTL (2019-2028) which averaged 6.4% per year.

Increased share of renewables in future projects pipeline: The new RUPTL is intended to lay the foundation for Indonesia's energy transition to achieve carbon neutrality by 2060. For this purpose, PLN plans to add on 40.6 GW of new power generation capacity by 2030, with generation from renewable energy plants taking up 20.9 GW or 51.6% of the new capacity. However, the RUPTL also notes that the development of renewable power plants will be subject to a number of factors including the supply-demand balance, readiness of the system and that the "economy must also be considered".

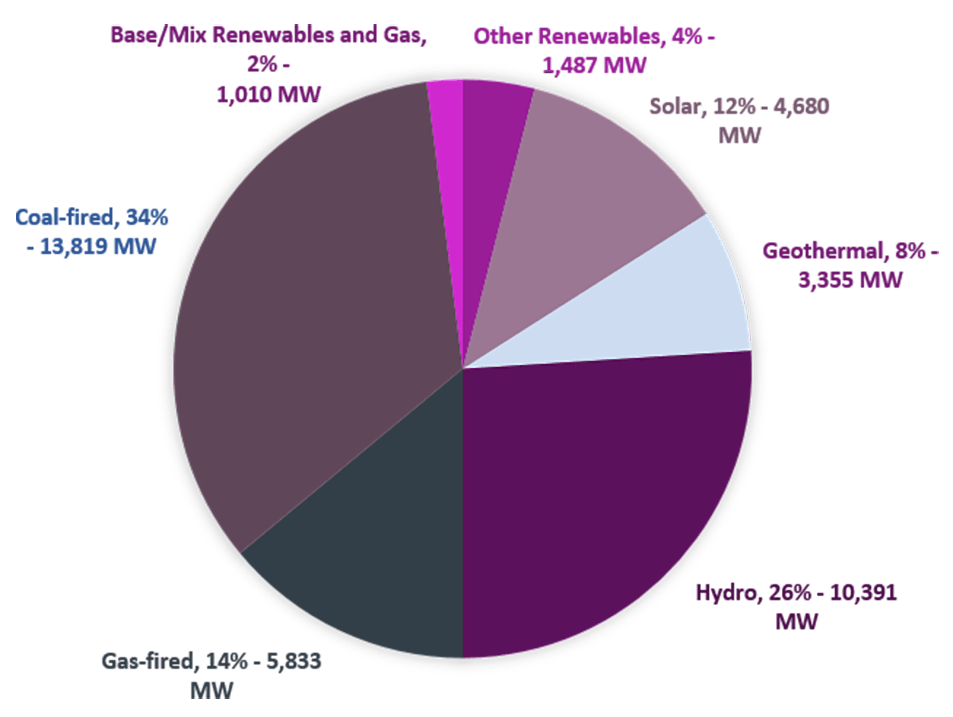

The chart below provides an overview of the projected new generation capacity over the next decade by technology:

Reduction in carbon emissions: The RUPTL reiterates the Paris Agreement commitments of the Government of Indonesia (GoI) to reduce 29% of greenhouse gas emissions by 2030. As the electricity sector is part of such commitment, PLN commits to the following policies:

1. Prioritization of the development of new and renewable energy, where PLN projects an increase in renewable energy power plants to 10.6 GW by 2025 and 18.8 GW by 2029.

2. Fuel conversion and utilization of exhaust gas, where PLN plans to switch from fuel to gas for gas power plants, combined cycle gas turbine plants and gas engine power plants as well as to utilize biofuel mix for diesel power plants. Fuel switching/conversion will also be implemented for coal-fired power plants (CFPPs) by replacing a part of the feedstock to biomass.

3. Utilization of biomass-based fuels as primary energy source.

4. Implementation of low carbon and efficient technologies.

Energy mix targets: The RUPTL also reiterates the optimal energy mix target of the National Energy Policy as well as the energy mix targets for the electricity sector to support the general energy mix target, as follows:

| Energy | GENERAL ENERGY MIX TARGET | ENERGY MIX TARGET IN POWER GENERATION |

||

|---|---|---|---|---|

| BY 2025 | BY 2050 | BY 2025 | BY 2038 | |

| New and renewable energy | At least 23%, as long as the economy is fulfilled |

At least 31% as long as the economy is fulfilled | More than 23% | Around 28% |

| Oil | Less than 25% | Less than 20% | A maximum of 0.4% | A maximum of 0.1% |

| Coal | At least 30% | At least 25% | Around 55% | Around 47% |

| Natural gas | At least 22% | At least 24% | Around 22% | Around 25% |

Key renewable technologies for future developments: Over the next decade, PLN intends to develop new and renewable energy with, according to the RUPTL, a focus on (i) large geothermal developments, (ii) large-, medium- and small-scale hydro, (iii) large and small-scale wind farms, and (iv) small-scale solar, biomass, biofuel, biogas and coal gasification power plants. The RUPTL also provides a roadmap for the development of new and renewable energy from 2021 to 2030 which includes projections of new installed capacity per technology and per year as reflected below:

| new and renewable energy | New capacity (in mw) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | Total | |

| Geothermal | 136 | 108 | 190 | 141 | 870 | 290 | 123 | 450 | 240 | 808 | 3,355 |

| Hyrdo | 400 | 53 | 132 | 87 | 2,478 | 327 | 456 | 1,611 | 1,778 | 1,950 | 9,272 |

| Mini-hydro | 144 | 154 | 277 | 289 | 189 | 43 | 2 | 13 | 6 | 1,118 | |

| Solar | 60 | 287 | 1,038 | 624 | 1,631 | 127 | 148 | 165 | 172 | 157 | 4,680 |

| Wind | 2 | 33 | 337 | 155 | 70 | 597 | |||||

| Biomass/waste | 12 | 43 | 88 | 191 | 221 | 20 | 15 | 590 | |||

| Base load power | 100 | 265 | 215 | 280 | 150 | 1,010 | |||||

| Peaker plants | 300 | 300 | |||||||||

| Total | 752 | 648 | 2,028 | 1,670 | 5,544 | 978 | 991 | 2,458 | 2,484 | 3,370 | 20,923 |

Market participants will note and query the rationale for the sudden dips in anticipated new solar, wind and biomass/waste capacity after 2025 which does not align with the trends anticipated in most other countries in the region and beyond.

Opportunities for IPPs and the private sector: The RUPTL also affirms the need for the private sector's participation in the build-up of new capacity. Specifically, the RUPTL anticipates that IPPs will develop 64.8% of Indonesia's new power capacity, including 56.3% of the new renewable power plants, over the next decade. For solar, that figure lies at 63.7%.

Energy transition "trilemma": According to PLN, the energy transition is to be carried out by striking a balance between the three often conflicting challenges known as the "energy trilemma": (a) security of supply (which generally means that there should be no heavy reliance on one single energy supply source and the need for reliable energy infrastructure); (b) sustainability (which involves the development of energy supply from renewable and other low-carbon sources while still achieving the supply and demand balance); and (c) affordability (i.e. the energy supply is to be tailored to the natural resources and needs across the population to select the most suitable energy mix).

Energy independence: In line with the National Energy Policy, in order to reduce the use of imported fuel for power generation, PLN aims to drastically reduce the utilization of diesel power plants. In 2019, diesel power plants represented 4.15% of the total electricity production and PLN now aims to reduce this to 0.4% by 2025 with more eco-friendly and competitive energy sources.

Electric vehicles expansion: PLN foresees a substantial increase in the development of the Electric Vehicle (EV) market in Indonesia. The role of PLN in the EV sector is to provide the charging system infrastructure in accordance with the assignment from the GoI to kick-start the sector and supply chain in Indonesia. The number of EVs will reach approximately 12,000 units by 2022 and based on a roadmap provided in the RUPTL, the number of EVs should reach 38,000 units by 2024. In this context, PLN acknowledges that the business model, tariff scheme and payment mechanism for EVs will soon need to be established.

Smart Grids: PLN also intends to implement smart grid technology starting with the launching of a number of pilot projects, including:

Transmission network development outlook: The RUPTL provides that within the 2021-2030 period, the development of the distribution system will focus on developing further transmission systems with a voltage of 500 kV and 150 kV in the Java-Bali system and 500 kV, 275 kV, 150 kV and 70 kV lines in the East Indonesia and Sumatra systems. PLN also plans further developments of the substations infrastructure (76,662 MVA up to 2030) and 47,723 kms of new transmission lines. PLN is also working towards new transmission interconnections in Sumatra and Sulawesi as well as a plan for the interconnection between Indonesia's large islands, and also with Malaysia and Singapore.

Opportunities for the private sector in transmission: Typically, transmission projects are essentially all carried out by PLN, while the interconnection related to IPP-owned power plants can be carried out by the relevant IPPs depending on the projects and PLN's appointment requirements. The new RUPTL now states that there may be options for transmission projects to be carried out by the private sector under certain business schemes, such as build-operate-transfer, build-lease-transfer, or power wheeling.

Current installed capacity: The RUPTL states that, as of December 2020, the total installed power generation capacity in Indonesia was 62,449.20 MW consisting of (i) 43,688.48 MW from plants owned by PLN, (ii) 17,319.60 MW from IPPs, and (iii) 1,441.12 MW from leased power plants. The majority of the installed capacity (51%) consists of CFPPs, followed by gas-fired power plants (29%), diesel power plants (7%), hydro (8%), geothermal (5%), with the rest being made up of power generation from other renewable energy technologies (such as solar and wind).

Current generation mix: The energy mix for power generation as of December 2020 was still strongly dominated by CFPPs at 67%. Meanwhile, generation from new and renewable energy only experienced a very slight increase from 12.2% in 2011 to 13% by December 2020.

Electrification ratio: According to the RUPTL, end 2020 the electrification ratio in Indonesia reached 99.20%. However, there still remains isolated areas where electrification ratio and access to electricity is lagging behind. This includes mainly the eastern provinces of Nusa Tenggara Tengah, Maluku and Papua. For these areas, PLN plans to develop power generation units utilizing local renewable energy and employ hybrid or microgrid systems, with either battery storage or back-up diesel power plants, to provide 24-hour electricity to the communities. These plans include, among others, the development of small-scale renewable power plants such as communal solar power systems, as well as hybrid solar and hybrid wind power systems. The RUPTL also reaffirms PLN's plans to achieve a 100% electrification ratio in Indonesia by 2022.

Almost 20 months went by since the last RUPTL (2019-2028) was issued in February 2019. The new RUPTL (2021-2030) comes at a critical juncture for Indonesia's power and energy sectors. With the increased international and domestic pressure against power generation from fossil fuels and the commitments made by Indonesia under the Paris Climate Agreement, PLN has been tasked to shift the focus of its future development plan from coal-fired base-load generation towards a substantially more diverse energy mix focusing (increasingly) on generation from renewable energy sources.

The new RUPTL attempts to deliver this renewed vision and is a step in the right direction, but more efforts will be required for this vision not to remain a plan, but become reality. This starts with the support which PLN will need from the GoI to be able to deliver on these objectives given the "energy transition trilemma" it refers to in the RUPTL, and which includes the budgetary support and policy incentives required to unlock Indonesia's renewables potential. Further reforms and improvements of the regulatory framework are also urgently required and may hopefully now be in the cards with the Bill on New and Renewable Energy being discussed and progressed in Parliament, and the new Presidential Regulation on tariff and procurement of renewable energy projects by PLN being in the works for the past couple of years. Considerable private and institutional funding and expertise (both domestic and international) are at the doorstep to help implement this vision of a Greener Indonesia. However, further clarity and stability of the investment framework (including in terms of pricing/tariffs and the applicable procurement processes) will also be necessary for these resources to be mobilized in the near future.

Authors: Frédéric Draps, Partner, Elizabeth Sidabutar, Associate, Khairunissa Yuliandhini, Junior Associate and Rachelia Jumanti, Legal Intern.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.