UK sustainability disclosure and anti-greenwashing rules finalised: PS23/16 published by the FCA

30 November 2023

30 November 2023

On 29 November 2023, the FCA published the final rules and guidance on its proposed framework for a UK sustainability disclosure requirements and labelling regime. The policy statement is much anticipated, having been delayed significantly in its release from H1 2023.

The number of responses to the consultation paper was considerable (460) and reflected the degree of interest and scrutiny these measures attracted. The final rules, however, are not a vast rewrite of the original proposals although there are some key clarifications and changes.

This briefing sets out the main aspects of the rules, signposts some of the more useful parts of the papers and highlights the key changes from what we saw previously.

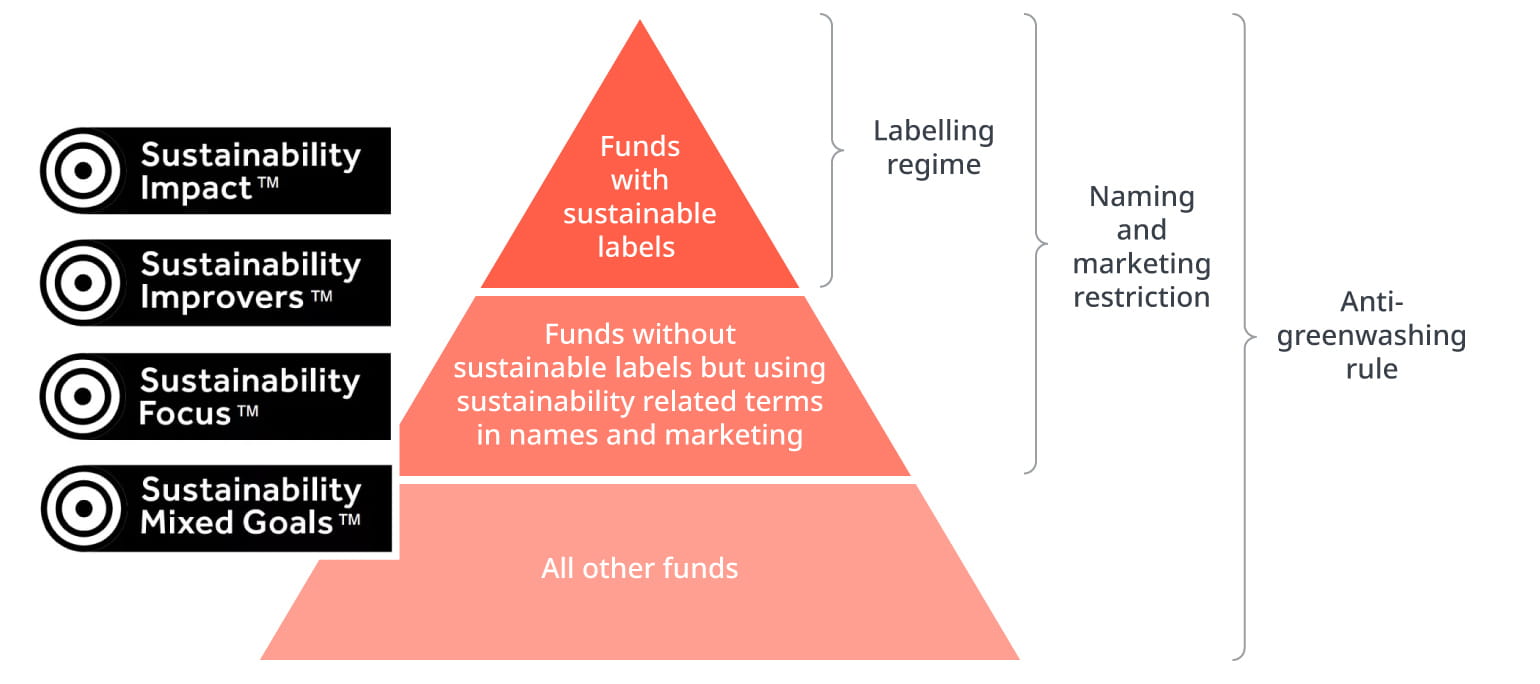

The FCA has released a policy statement on the SDRs and labelling regime, as well as a guidance consultation on the proposed anti-greenwashing rule that will apply to all regulated firms.

As a recap, we summarised the previous consultation in our briefing here. Much has stayed the same, or been tweaked at the most. Some parts have more substantial changes. These include:

1.a. The anti-greenwashing rule will enter into force in May 2024, compared to on publication of the policy statement (as previously suggested). This will be welcome relief to firms who ought to be performing a gap analysis between the rule and its guidance and their current marketing and/or product governance framework.

1.b. The anti-greenwashing rule applies to sustainability claims in the wider sense, i.e. those that include environmental and/or social characteristics, not just green claims. This aligns with the European approach to the concept of sustainability.

2. The labels are largely the same as previously suggested with the addition of a new ‘mixed goals’ category. Previously, the three proposed categories were mutually exclusive. This fourth category will be welcomed as it is more reflective of how many funds are structured (although we query whether this won’t end up the ‘default’ and of limited value to end customers as a result).

3. Use of the labels will be tightly controlled, with a notification required to the FCA if you intend to use the labels in order to ‘access’ (i.e. download) the labels for use on the product literature.

4. The requirements have been slightly simplified with general requirements and label specific requirements.

5. There is an indication of expansion to financial advisers and pensions. The FCA aim to expand the regime over time and look to include:

This briefing is split into two sections: the first on the new anti-greenwashing proposals and the second on the SDRs and labelling.

In its consultation, the FCA proposed a new general anti-greenwashing rule reiterating requirements for all regulated firms that sustainability related claims must be clear, fair and not misleading.

The new rule at ESG4.3.1R requires all firms to ensure that any reference to the sustainability characteristics of a product or service is:

This rule will apply to all regulated financial services firms, including those firms who are responsible for approving financial promotions of unauthorised firms.

Rather than coming into effect immediately on publication of the FCA's Policy Statement, it is proposed that the rule apply from 31 May 2024 to give firms the opportunity to gap analyse their current processes and procedures with the new rule and guidance.

To support the new anti-greenwashing rule, the FCA has published a guidance consultation (GC23/3). Firms are well advised to focus on this publication in their review of regulatory expectations on the new rule. You can feedback on the proposed guidance consultation until 26 January 2024 and the guidance will be finalised so that it comes in to force at the same time as the anti-greenwashing rule on 31 May 2024.

The guidance notes that the effect of the anti-greenwashing rule is that firms should ensure that their sustainability related claims are:

The guidance consultation goes on to set out seven examples which are illustrative of practices that would breach the anti greenwashing rule.

|

Example |

|

|

1 |

A firm makes promotional statement that a fund is 'fossil fuel free' but the portfolio actually includes investments in companies involved in the production, sale, and distribution of fossil fuels where the company's revenue earned from those activities is below a certain threshold. |

|

2 |

An investment manager claims in the fund marketing material that all investments are reviewed for their sustainability characteristics however that is not actually a significant factor in the investment manager's decisions. |

|

3 |

A firm places a large image of a rainforest at the top of its webpage about savings accounts, with an overlay of text that reads 'sustainable savings'. The savings products includes green savings accounts (which use deposits to lend to companies to fund sustainable projects) but the image may give the audience the impression that all savings accounts help create positive change. |

|

4 |

A bank promotes 'green bonds – greening the planet' which are used to finance a range of sustainability projects, including renewable energy and improving the energy efficiency of companies. However proceeds can also be used to improve the energy efficiency of fossil fuel production and distribution – information which is not included in the promotional material. |

|

5 |

A commonly tracked benchmark claims to be 'sustainable' by excluding companies with ESG ratings 'lower than 3,' but the benchmark administrator does not specify what the rating aims to assess. Users and end investors may therefore be misled. |

|

6 |

An insurer offers the UK's greenest car insurance, but there is no information to demonstrate how the insurance has made a positive environmental impact compared with all UK car insurance products. |

|

7 |

A firm claims that by purchasing their investment bond, investors will reduce emissions more than through the purchase of any other investment bond. However, the firm does not make it clear that this comparison only refers to Scope 1 emissions (as opposed to all emissions, Scope 1, 2 and 3). |

These illustrative examples are useful indicators of what the FCA see as egregious marketing practices in relation to sustainability.

Four labels have been confirmed, one more than previously suggested in the consultation. The categories are largely the same, with a minor tweak from 'sustainable' to 'sustainability' in their titles.

The labels remain voluntary – firms can choose to use them and are not required to (although note the naming and labelling requirements which place restrictions on what you can say in relation to a sustainable product if you are not using a label).

The four labels are:

For each label, there are five general requirements and some label specific requirements.

The general criteria fall under 5 key themes:

All products using a label must have a sustainability objective to improve or pursue positive environmental and/or social outcomes as part of their investment objectives.

Firms must also identify and disclose whether pursuing the positive sustainability outcomes may result in material negative outcomes.

Firms must obtain or undertake an independent assessment of the robust, evidence-based standard for sustainability to confirm that it is appropriate for selecting the product’s assets. The assessment can be obtained from a third party or undertaken by the firm, provided that it is independent from the investment process.

Ordinarily, at least 70% of the product’s assets must be invested in accordance with its sustainability objective, with reference to a robust, evidence-based standard that is an absolute measure of environmental and/or social sustainability.

Firms must also identify and disclose any other assets held in the product for other reasons (eg, cash, derivatives), including why they are held.

Firms must identify KPIs to measure progress against the sustainability objective (these can measure the progress of the whole product or individual assets).

Firms must ensure there are appropriate resources, governance and organisational arrangements to support delivery of the sustainability objective, including having the right people with the right skills in place to help deliver the objective.

Firms must identify and disclose the stewardship strategy needed to support the delivery of the sustainability objective, including activities they expect to take and outcomes they expect to achieve.

Firms must also set out an escalation plan to be able to take action when assets do not demonstrate sufficient progress towards the sustainability objective and/ assets subject to such action remain within the 70% threshold.

|

|

A manager may only use the relevant label where: |

|

|

1 |

Sustainability focus |

The fund's objective is consistent with the aim of investing in assets that are environmentally and/or socially sustainable, determined using a robust, evidence based standard. |

|

2 |

Sustainability Improvers |

The fund's objective is consistent with the aim of investing in assets that have the potential to improve environmental and/or social sustainability over time, determined by the potential of those assets to meet the robust, evidence based standard. For sustainability improvers, a manager must: a. identify the period of time by which the product and/or assets is expected to meet the standard set; b. identify short and medium term targets for improvements in the sustainability of the product and/or assets; and c. obtain robust evidence to satisfy itself that the assets in which the product invests have the potential to meet the standards. |

|

3 |

Sustainability impact |

The fund's objective is consistent with the aim of achieving a pre-defined positive, measurable impact in relation to an environmental and/or social outcome. For sustainability impact, a manager must: a. specify a theory of change in line with the fund's objective; and b. specify a robust method to measure and demonstrate that the fund is achieving a positive environmental and/or social impact. |

|

4 |

Mixed use |

The fund's objective is to invest in accordance with two or more of the sustainable objectives above. |

Yes, but it will be subject to the naming and marketing restriction.

Non-labelled products with sustainability related terms in their name and/or marketing:

Firms can continue to use the terms in marketing provided that the anti-greenwashing rule is met and the disclosures and statement (referred to below) are produced.

Non-labelled products using sustainability related terms must:

There are now two key disclosures required in relation to the product itself:

a. consumer facing disclosures, that must comprise of maximum 2 A4 pages of information presented clearly, concisely and easy to understand; and

b. detailed product level disclosures to be set out in pre-contractual disclosures and ongoing disclosures.

There may also be on demand disclosures required where public disclosures are not appropriate and which should be provided to eligible clients on demand. Eligible clients are those who have their own sustainability related disclosure requirements. (One request per 12 month period is required, within a reasonable time frame and not before 2 December 2025.)

A firm must also disclose how it is managing sustainability related risks and opportunities in relation to products managed by them. These are likely to build on existing TCFD reports.

|

Firms |

Product |

Element of SDR regime |

|

Asset Managers:

|

*except for non-UK AIFs, closed-ended AIFs that make no additional investments after 22 July 2013, Social Entrepreneurship Funds (SEFs) and Qualifying Venture Capital Funds (RVECAs) |

Labelling: general requirements for use of a label and qualifying criteria Product-level disclosures: produce and publish consumer-facing, precontractual and ongoing product level disclosures:

Naming and marketing: requirements for use of sustainability related terms in naming and marketing, associated disclosures and statement |

|

Managers of feeder funds |

Feeder funds |

Labelling: only permitted to use the label that the relevant master fund uses, and most of the general requirements for use of a label apply Product-level disclosures: provide retail clients with easy access to the product-level disclosures produced by the relevant master fund Naming and marketing: requirements to use the same sustainability-related terms in naming and marketing that the master fund uses, provide clients with access to associated disclosures produced by the relevant master fund, and, where sustainability-related terms are used without a label, produce a statement explaining why |

|

All in-scope managers with AUM above £5 billion |

All in-scope products above |

Entity level disclosures |

|

Distributors |

All in-scope products and recognised schemes marketed to retail clients |

Communicate labels and consumer facing disclosures Notice on overseas products |

Firms should plan now how they will implement these new rules in advance of:

a. the anti-greenwashing rule coming into force on 31 May 2024;

b. labels available to be used from 31 July 2024; and

c. naming and marketing rules in force from 2 December 2024.

This will take considerable effort to gap between existing practices and the new rules. From experience with SFDR, much work will be needed with respect to internal stakeholder management, process change and operationalisation of the new requirements.

If you would like to discuss how these will affect your business, please contact any of the authors below.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.

Sign-up to select your areas of interest

Sign-up