The top tips for portfolio hotel deals...when more really is more

28 February 2024

28 February 2024

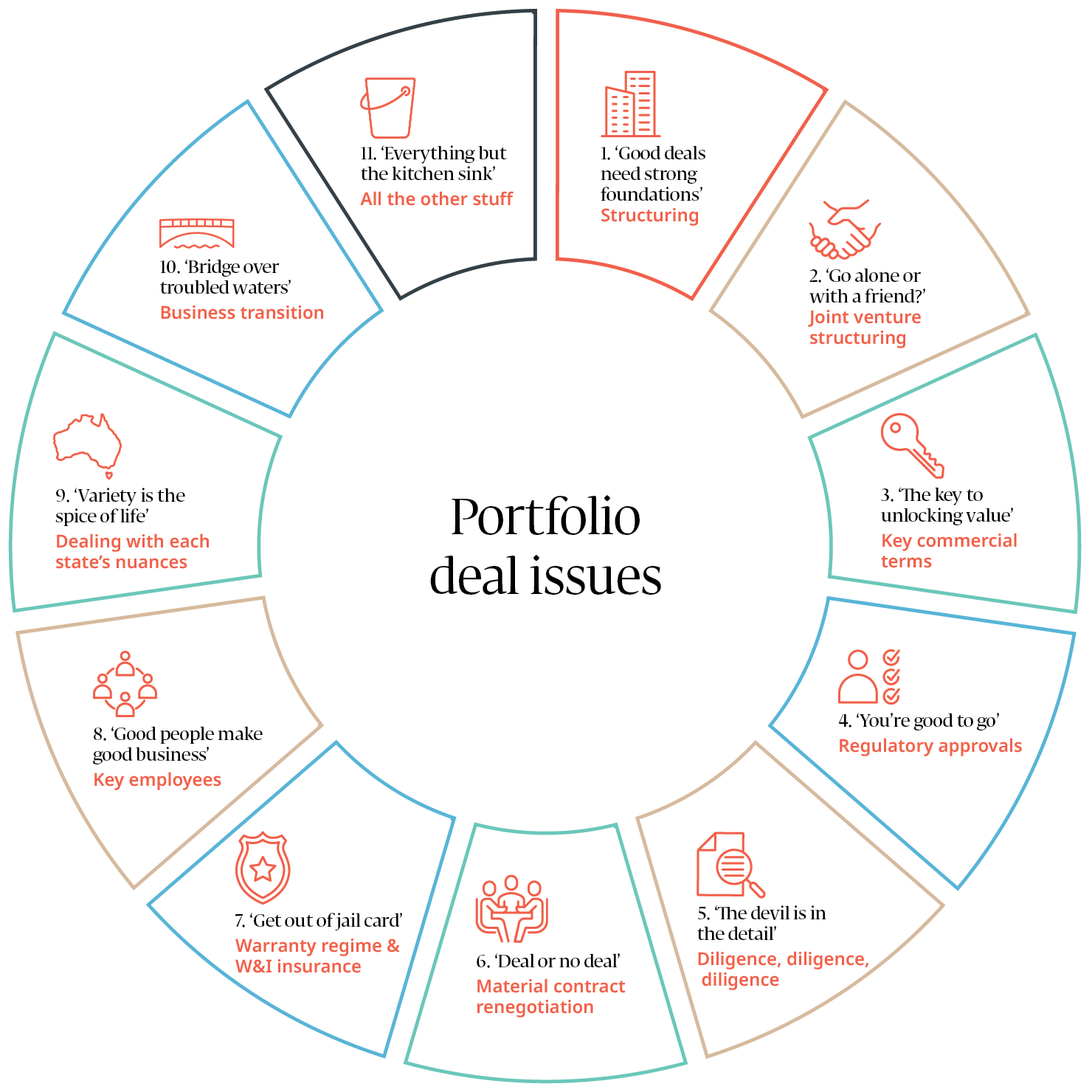

Portfolio hotel deals may be structured as either an asset acquisition (ie, buying the assets and the business) or a corporate acquisition (ie buying the entities that own and operate the business). The right structure for a portfolio acquisition will be driven by various considerations, including:

Getting the structure right at the outset is fundamental to overall success.

Due to the scale of some hotel portfolio deals, it is common for a portfolio to be acquired by a consortium, which may be comprised of two or many more parties. This will require the establishment of the joint venture and agreement on key joint venture terms - such as structure, funding, decision making, exit and liquidity, exclusivity and management arrangements, to name a few.

Joint venture partners may also have a view on the due diligence being undertaken and the terms of acquisition that will need to be addressed.

While the baseline commercial terms of price and timing for exchange and completion may not change, certain terms such as the deposit, conditions precedent, exclusivity and seller/buyer guarantees may be impacted by a portfolio deal.

This is closely followed by other fundamental terms – including warranty regimes, material adverse change provisions, financial adjustments, pre-completion restrictions, transitional arrangements and so forth.

If the buyer is ultimately foreign owned, foreign investment approval may be required. Allowing sufficient time in the process to lodge, progress and obtain foreign investment approval (if required) is critical for the timing of the deal.

Similarly, merger clearance notifications and/or approvals may be required. These should be identified up front so as to ensure these do not disrupt the transaction timetable.

A portfolio deal equals larger scale of due diligence. An appropriate level of materiality will need to be adopted. It remains fundamentally necessary to understand any key issues associated with the individual hotels within the portfolio, particularly issues which could impact value or give rise to material risk. A systematic approach to the due diligence scope and process – including legal, technical, planning and financial due diligence - is necessary.

Portfolio hotel deals have greater scale which can generate greater negotiating power. If hotels in the portfolio are managed by the same hotel operator, there may opportunities to renegotiate key management agreement terms, particularly if some of the assets have a vacant possession on sale provision.

Seller warranties are typically the product of significant focus and negotiation, and are ultimately tied to the outcomes of the due diligence process and the purchase price. Normally, the ability to make warranty claims is subject to disclosure, time limitations and monetary caps.

Where a seller has the potential for more exposure (on a dollar basis), it is common for parties to look to W&I insurance packages. In order to make use of this, it is necessary to confirm which party is required to effect and pay for any such policies.

A hotel is an operating business that relies upon its employees. Due diligence on employee terms and conditions, compliance with relevant awards and the potential for any employee claims is fundamental. Commercially, it is necessary to take steps to ensure that key persons such as general managers, financial controllers and those key to driving revenue, remain with the business after closing.

Where hotels in the portfolio are located across various states and territories in Australia, there is a need to deal with the different legislation that applies in each state. In particular, the following differ from state to state:

To manage timing and cost expectations, you need to understand these differences and ensure they are managed appropriately.

A smooth transition requires planning. A few key areas to consider include:

There are a myriad of other material issues to be worked through, for example FF&E accounts, asset management arrangements, financing, KYC and key/material contracts. The key is to understand these issues and where they fit so that they do not derail the overall transaction.

You will need a team of advisors who are familiar with the types of issues which arise in these sort of transactions and who can help you manage and strategically navigate the life of the deal and achieve a successful transactional outcome.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.

Sign-up to select your areas of interest

Sign-up