Energy Transition Investment Hydrogen

09 February 2022

It is clear that hydrogen – whether low-carbon (blue hydrogen) produced from natural gas but with the carbon dioxide captured; renewable (green) hydrogen produced using electrolysis powered by renewable electricity; and other colours of hydrogen - will play an important part in replacing fossil fuels for electricity generation, transportation and other industrial processes as countries seek to achieve their net zero targets. But what is the investment appetite, and how prepared are countries and organisations to develop, adopt and invest in hydrogen?

Following the recent launch of Ashurst’s Energy Transition Investment report, which surveyed close to 1,000 senior executives involved in energy investment decision making across the G20, this report takes a deeper dive into our findings in relation to hydrogen.

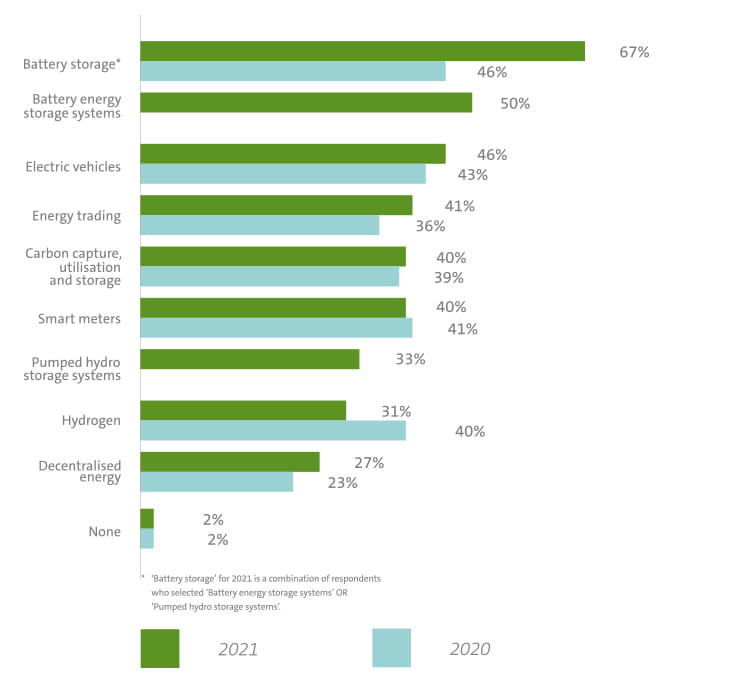

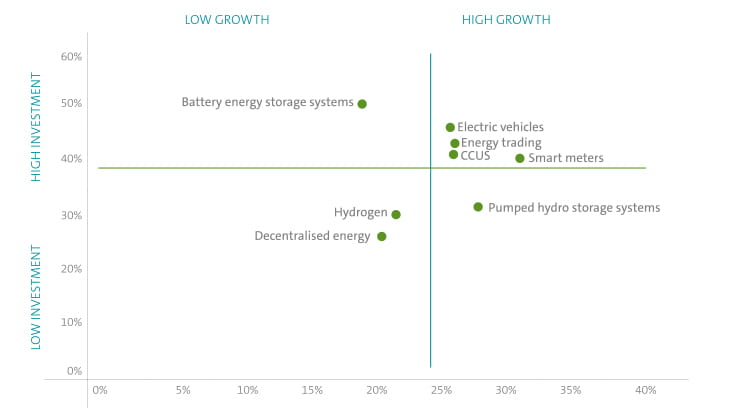

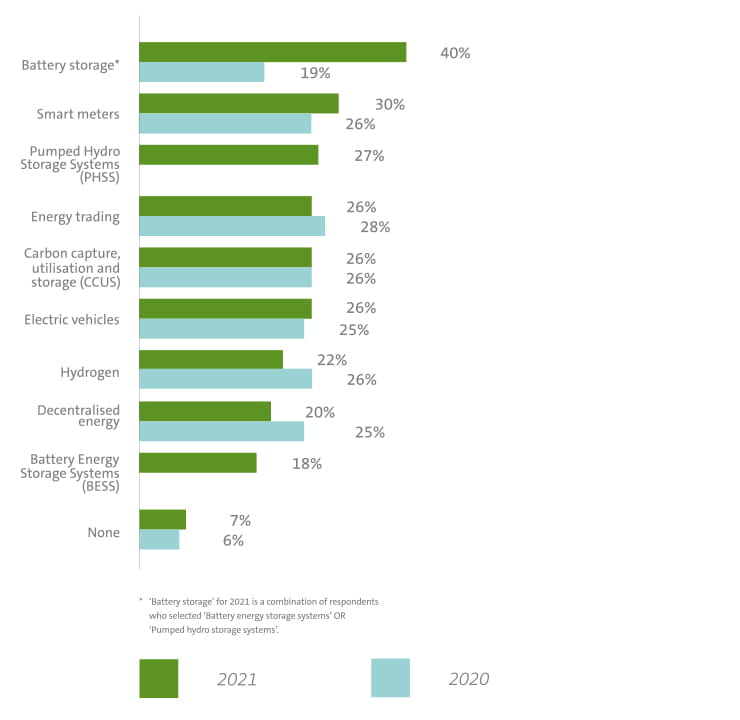

Across the G20, 31% of our respondents are currently investing in, or, importantly, have decided to invest in, hydrogen. Compared with other energy transition technologies polled, this ranked seventh, behind battery energy storage systems, pumped hydro storage systems, electric vehicles, energy trading, CCUS and smart meters, but ahead of decentralised energy.

While lower in the comparative rankings, the 31% current commitment level remains significant, and, on the transactions we are involved in, Ashurst is seeing larger amounts of capital being deployed into hydrogen-related businesses (from electrolysers manufacturers, to production facilities, to onshore transmission/distribution and fuelling infrastructure and through to export and import projects to create a global market).

Respondents’ sentiment that the technology will take longer to mature reflects the current cost estimates for hydrogen, which are not yet economically competitive. There is also a lack of clarity about how quickly domestic and international demand for hydrogen – whether as ammonia or liquified – will emerge, but that does not seem to be preventing people actively planning for investments.

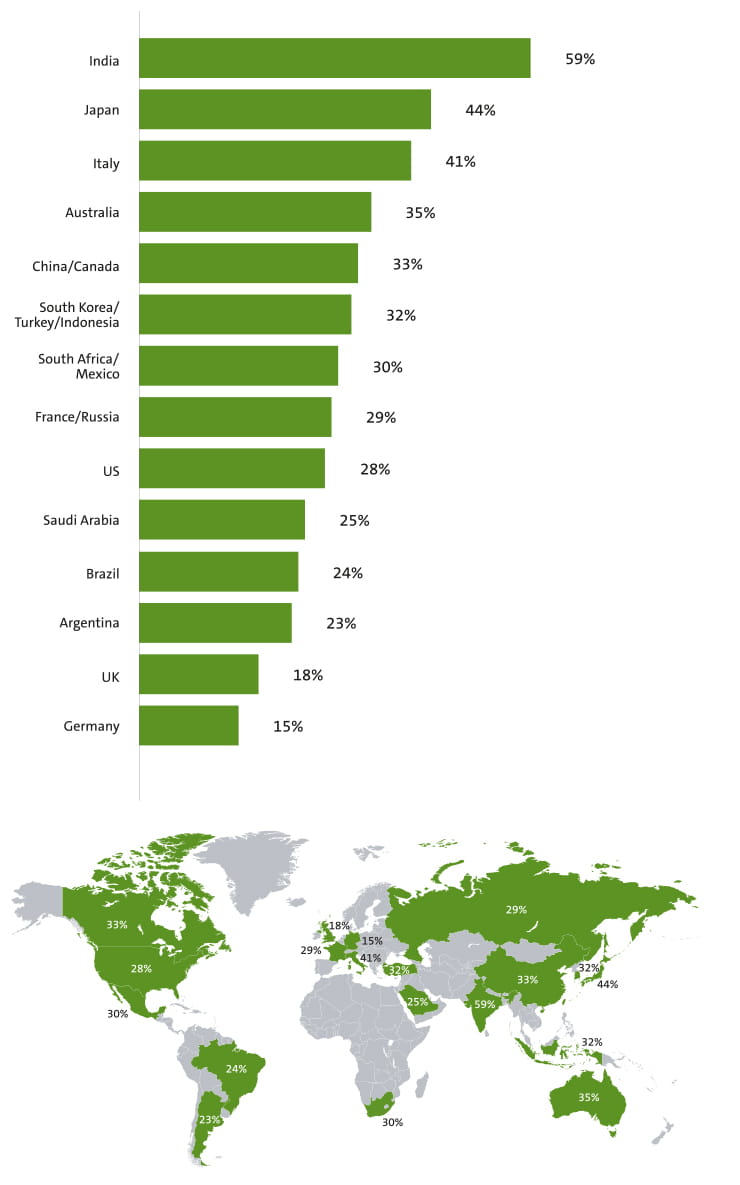

Collectively, our Asia Pacific respondents had the highest level of commitment to hydrogen, at 39%, reinforcing the higher levels of current consumption of hydrogen in the region.

In 2021 India announced (among other policy actions) upcoming auctions in relation to the production of green hydrogen, and plans to introduce a compulsory purchase obligation for the use of green hydrogen in the production of ammonia and refining.

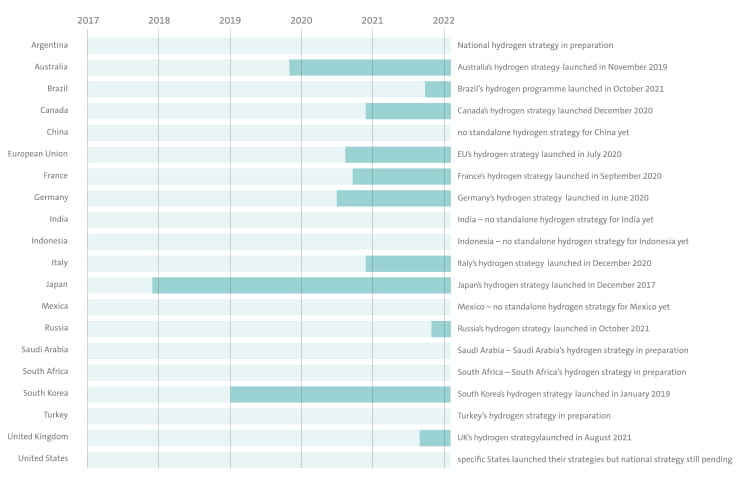

Japan, one of the earlier countries to formulate a strategy for the use of hydrogen, is focused on mainly importing the fuel, and exporting end-use technologies such as hydrogen fuel cell vehicles.

By contrast, Australia has more than 60 development projects in the hydrogen space (ranging from concept through to generation), and its government is investing A$1.2 billion in building the country’s hydrogen economy, with the aim to build a competitive export industry to position itself as a leading global player.

Across to Europe, Italy is looking to position itself as a European hub for hydrogen production. In its National Plan for Recovery and Resilience, €3.2 billion was allocated for the research, testing, production and use of hydrogen. Hydrogen currently accounts for 1% of energy consumption in Italy, however, it is mostly produced from fossil fuels. Current focus for the Government is to leverage Italy’s favourable geographic position and shift to green hydrogen production with the help of wind and solar energy.

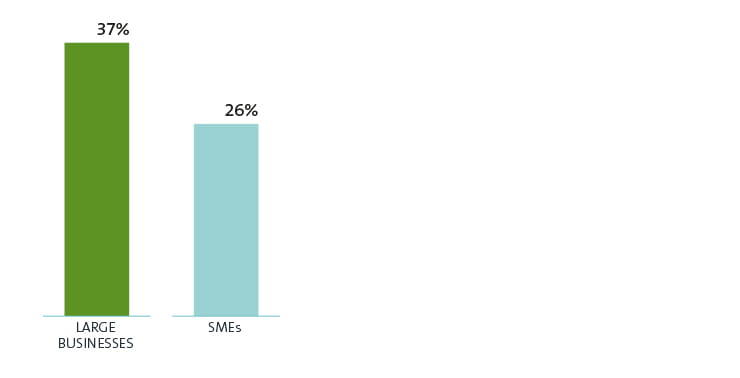

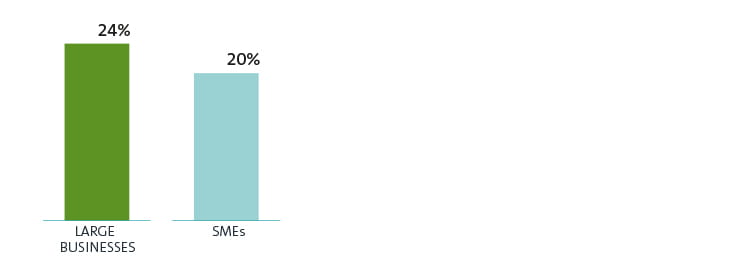

When looking at the size of businesses investing in hydrogen, we saw that large businesses had a higher level of commitment at 37%, with SMEs at 26% bringing down the global average. This difference is quite notable in that, comparing to other technologies, our findings did not highlight such a vast gap.

This is representative of the fact that the driving force of the deployment and future plans for this relatively nascent technology are being led by governments or larger organisations who have the greatest drivers to decarbonise and/or the risk capital to deploy to invest at the earlier stage of development.

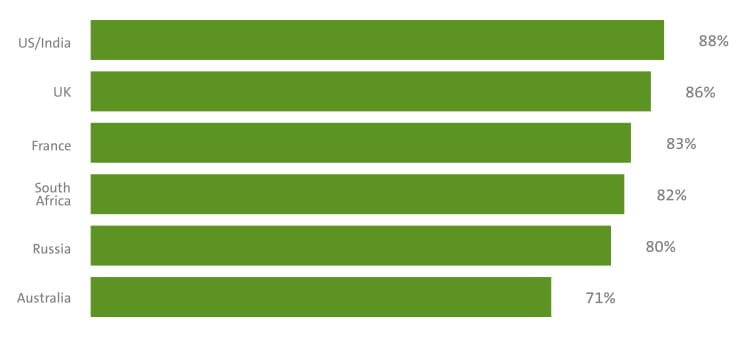

Which of the following non-power generation technologies are you CURRENTLY OR HAVE DECIDED to utilise or invest in? (Please select all that apply)

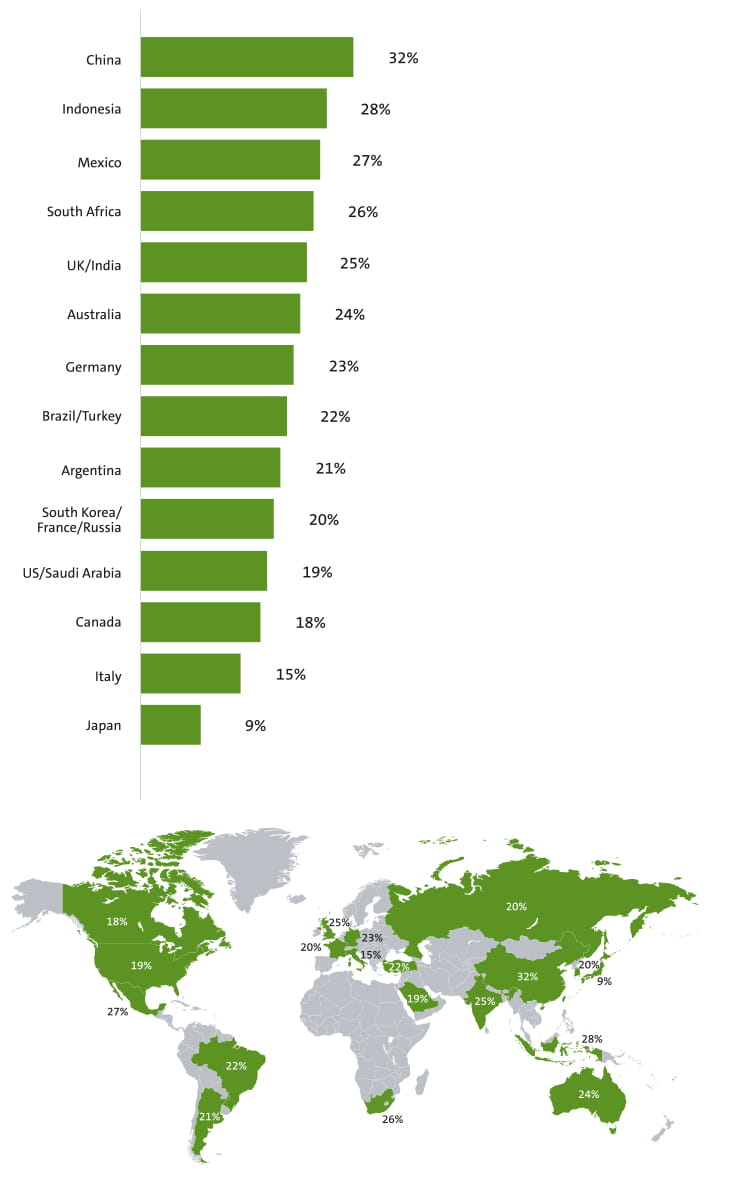

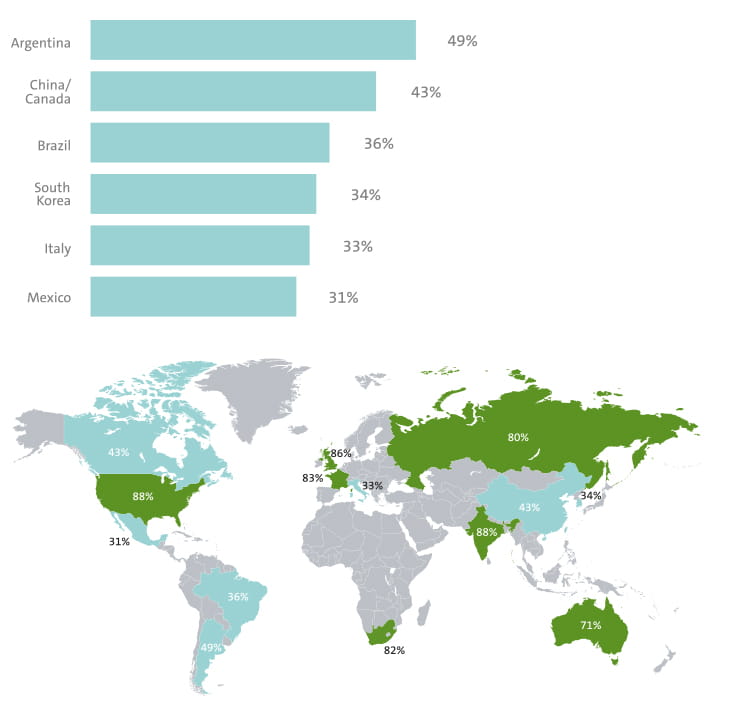

Looking forward over the next five years at which organisations are considering to utilise or invest in hydrogen, we see some interesting changes in the potential investor mix. In particular, Chinese organisations come on top, while organisations based in the UK jump up the rankings. We also see a, perhaps unsurprising, correlation between countries where the top investor organisations are headquartered, and those countries where targets are likely supporting positive investor sentiment.

As examples:

Overall, in terms of most likely technology to invest in, hydrogen was chosen by 22% of respondents across the G20, ranking sixth, this time only edging out decentralised energy and battery energy storage systems. This is likely to be because hydrogen is more nascent when compared to other more established low carbon technologies like solar and wind.

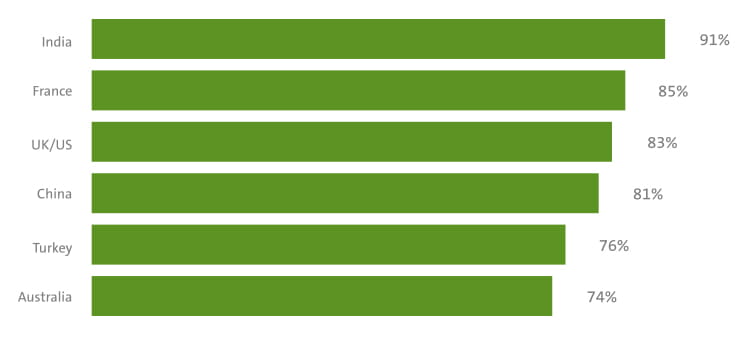

Which NEW non-power generation technologies is your organisation considering to utilise or invest in over the next 5 years? (Please select all that apply)

Again comparing the size of businesses driving this investment interest, we see the difference between large businesses and SMEs shorten, at 24% and 20% respectively, perhaps reflecting that, as this technology matures it will gain interest from the wider market.

Looking into our respondents’ opinion as to whether their country was prepared to develop and adopt hydrogen, it is clear that regulatory change is needed to support the advancement of hydrogen deployment. If governments are serious about creating a local hydrogen economy and/or being part of a new global hydrogen trading ecosystem, it is clear that they will need to create the incentive to invest, whether by stick or carrot or both.

With some governments already having increased available incentives, we expect private sector investment to continue to grow, particularly as government regulation and support become clearer.

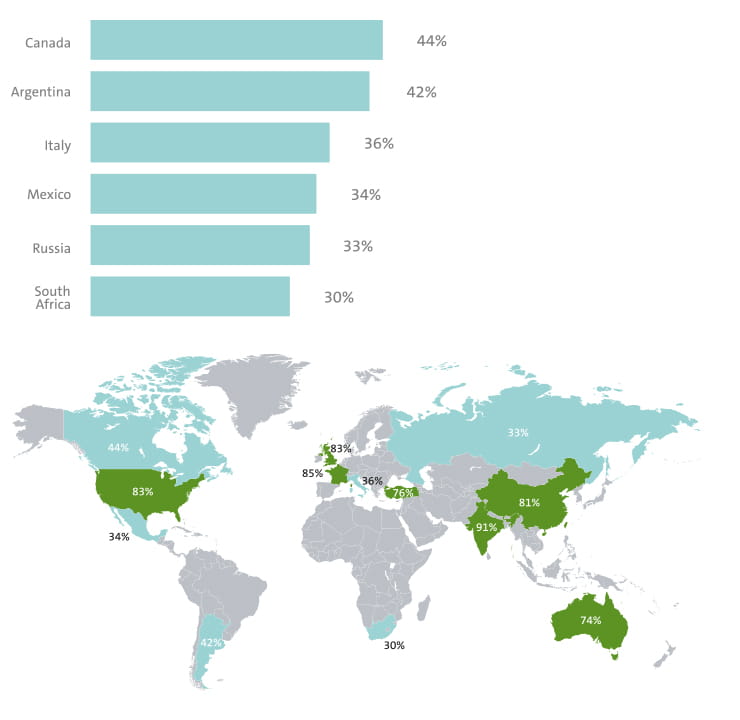

When looking at individual organisations’ own preparedess to develop, adopt or invest in hydrogen, 70% of respondents felt their organisation was prepared to do so, but that was actually one of the lower results across differing low carbon technologies.

This also highlights some interesting dichotomies when we look at the perception of each countries’ preparedness, versus the organisations’ own preparedness within their home regions. For example, Chinese organisations rank their own preparedness high at 81%, whereas they rank their overall country as one of the least prepared.

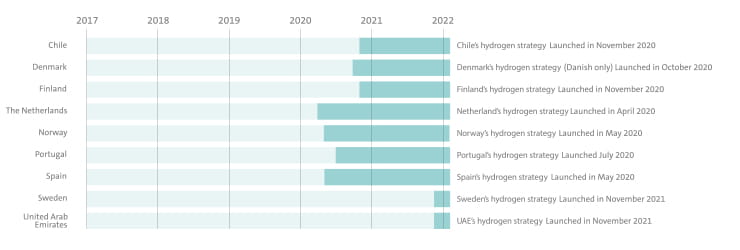

Despite the seemingly slow progress in hydrogen adoption, our report shows the confidence in hydrogen as an investment asset is consistently growing. There is more to be done at the government-level with incentives and regulatory frameworks posing as major drivers for hydrogen market to truly develop. With many of the G20 and other developed nations leading the charge on drafting hydrogen strategies, roadmaps and business models, we expect investment activity to continue to increase.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.

Sign-up to select your areas of interest

Sign-up