LIBOR transition and tough legacy Critical Benchmarks Act 2021 comes into force

23 December 2021

23 December 2021

On 15 December 2021, the Critical Benchmarks (References and Administrators' Liability) Bill received Royal Assent, becoming the Critical Benchmarks (References and Administrators' Liability) Act 2021 (the Act). The Act amends the UK Benchmarks Regulation1 (the UK BMR) to provide for the automatic transition of LIBOR-referencing contracts to synthetic LIBOR after the end of 2021 and to incorporate safe harbour provisions protecting users of synthetic LIBOR and LIBOR's administrator, ICE Benchmark Administration (IBA). No changes have been made to the original proposed text, which is discussed in detail in this briefing.

The changes introduced by the Act, along with implementation of the FCA's "tough legacy" regime (discussed at Is this different from "tough legacy"? below), mean that all English law contracts (except for cleared derivatives) that still reference one-month, three-month or six-month GBP or JPY LIBOR after 31 December 2021 will automatically transition to the relevant synthetic rate.

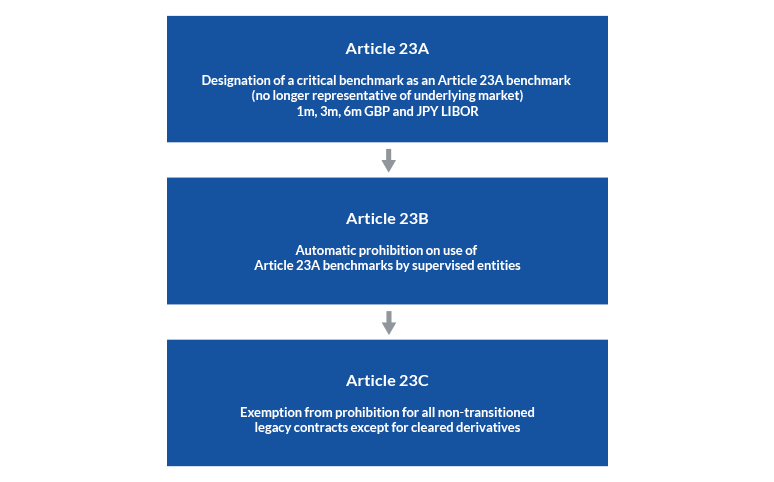

The Act amends the UK BMR by adding new Articles 23FA, 23FB and 23FC and making certain consequential amendments. The new Articles provide that:

The Act also clarifies that, where a contract contains fallback provisions that would be triggered by an announcement of cessation or future cessation of a particular benchmark, these provisions will not be triggered by an announcement of non-representativeness or future non-representativeness. This means that, where a contract contains fallback provisions but does not contain a "non-representative" (or "pre-cessation") trigger, as is the case for many pre-2020 floating rate notes and structured products, these fallback provisions have not been activated in respect of the Designated Rates. Therefore, where remediation of such products has not been completed by 1 January 2022, they will automatically transition to synthetic LIBOR.

However, the FCA has been very clear in its messaging that market participants are expected to continue their remediation efforts regardless, and that continued reliance on synthetic LIBOR is not acceptable, not least because synthetic LIBOR will not be maintained indefinitely.

Yes. The UK now has two distinct but related regimes as regards the use of synthetic LIBOR: the FCA "tough legacy" regime, which applies to entities that are "supervised entities" under the UK BMR, and the new, broader, regime established under the UK BMR by the Act, which applies to all English law contracts.

1. UK BMR "tough legacy" regime

Market participants that are "supervised entities" under the UK BMR are not permitted to use2 the Designated Rates after 31 December 2021, except where there is an express exemption for "tough legacy" contracts under the UK BMR. After establishing a very broad "tough legacy" scope, in November 2021, the FCA granted an exemption for all legacy contracts3 that are in scope of the UK BMR and have not transitioned from LIBOR to an alternative rate by 31 December 2021.

The exemption is available until at least the end of 2022. This means that UK BMR supervised entities can continue to use the Designated Rates, in synthetic form, at least until 31 December 2022. Thereafter, synthetic JPY LIBOR will be discontinued, and use of synthetic GBP LIBOR use may be restricted (for more detail, please see this briefing).

The cumulative effect of the relevant UK BMR provisions is summarised in the diagram below.

2. Critical Benchmarks (References and Administrators' Liability) Act 2021

The new rules introduced by the Act, the effect of which is explained in What are the new rules? above, have a broader scope than that of the FCA's tough legacy regime, and extend to any English law contract that still references one of the Designated Rates on 1 January 2022. As under the FCA tough legacy regime, there are no restrictions on use of the Designated Rates, but market participants should bear in mind (i) regulators' very strong guidance that transition away from LIBOR should be effected wherever possible, notwithstanding these new transitional measures, and (ii) synthetic JPY LIBOR will be discontinued at the end of 2022 and it is not yet clear for how long synthetic GBP LIBOR will continue.

The net effect of entry into force of the Act combined with finalisation of the FCA's tough legacy regime is that all English law contracts (except for cleared derivatives) that still reference one of the Designated Rates after 31 December 2021 will automatically transition to the relevant synthetic rate and will continue using that rate until the end of 2022.

After 31 December 2022, synthetic JPY LIBOR will no longer be available, so market participants will need to transition affected contracts over the next twelve months to avoid unintended consequences. The position is less clear for contracts that reference one of the GBP Designated Rates: under the UK BMR, synthetic GBP LIBOR may continue for up to ten years, but the FCA has said that it intends to compel synthetic GBP LIBOR publication for as short a time as possible.

While the introduction of the Act and finalisation of the FCA's tough legacy regime will buy "transition time" for market participants, the FCA has made it clear through sustained and unequivocal messaging that synthetic LIBOR is not a permanent solution and contracts and instruments must be transitioned wherever possible, meaning that remediation efforts will need to continue into 2022, and possibly beyond.

For more information on synthetic LIBOR, please see our LIBOR Q&A.

Authors: Amelia Howison, James Knight and Kirsty McAllister-Jones

1 EU Regulation 2016/1011 as it has effect under English law by virtue of the European Union (Withdrawal) Act 2018, as amended, and regulations made thereunder.

2 Within the UK BMR meaning of "use".

3 Other than cleared derivatives.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.