Australia's Capacity Investment Scheme – Consultation opens on the design for Western Australia

18 April 2024

18 April 2024

DCCEEW published a consultation paper outlining the design of the CIS in WA on 12 April 2024 (WA Consultation Paper). It is available at: Capacity Investment Scheme - Western Australia Design Paper - Climate (dcceew.gov.au).

The WA Consultation Paper follows:

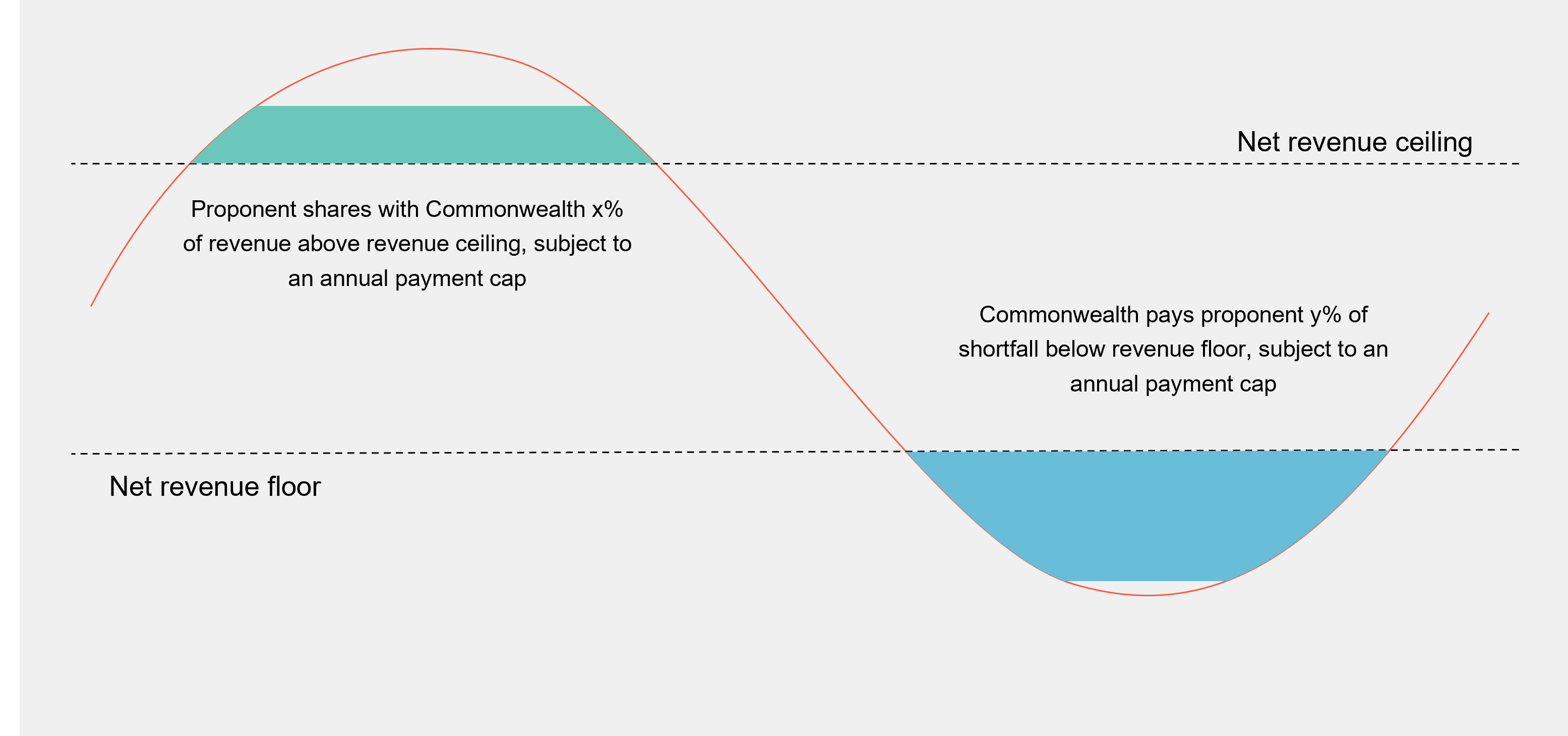

The CIS involves the Commonwealth Government seeking competitive tenders for renewable and clean dispatchable capacity, with successful projects offered long-term CISAs for an agreed revenue floor and ceiling.

If the annual net revenue earned by the project exceeds the net revenue ceiling, the project owner pays the Government an agreed percentage of revenue above the ceiling. If the project's annual net revenue is below the net revenue floor, the Government pays the project owner an agreed percentage of the shortfall below the revenue floor.

Source: Capacity Investment Scheme – Western Australia Design Paper (April 2024), Australian Government Department of Climate Change, Energy, the Environment and Water.

A Wholesale Electricity Market exists in relation to the South-West Interconnected System in WA, WA's largest electricity network. Importantly, the WEM is not part of the NEM and has certain distinct features. This includes a Reserve Capacity Mechanism under which electricity generators, storage and other eligible providers can apply to be certified to receive Capacity Credits for capacity made available to the WEM. These Capacity Credits can be sold to other market participants such as large consumers (who have individual reserve capacity requirements that they must meet) or the market operator, AEMO, separately from any energy actually generated by the provider in a particular trading interval. Contracting in the WEM is also predominately by way of bilateral transactions between market participants, with market settlement taking account of those bilateral transactions.

In its earlier design papers for the NEM, DCCEEW noted a different CIS design would be required for the WEM as a result of these distinct features.

The WA Consultation Paper outlines a different CIS design to the NEM, whilst also noting that the design for implementation of the CIS in WA is intended to closely mirror the processes in the NEM that have already been announced and implemented.

Important features of the CIS design for the WEM include:

It appears that, in WA, the CIS will only apply to the WEM. The WA Consultation Paper does not indicate that it will be available to projects that will connect to networks outside of the WEM in WA, such as the North-West Interconnected System in the Pilbara region of WA.

The WA CIS is expected to target an indicative 6.5 TWh of variable renewable energy and 1.1 of GW of four-hour equivalent (4.4 GWh) dispatchable capacity in the WEM over the period to 2030. This is subject to a final Renewable Energy Transformation Agreement being agreed between the Commonwealth and WA Governments.

The first tender is anticipated to commence in June 2024, with an indicative target of 500 MW of four-hour equivalent (2 GWh) clean dispatchable capacity. It will be open to projects that are:

Subsequent tenders will be run annually, approximately one year ahead of the commencement of the separate process under the RCM.

The implementation of the CIS in WA comes at a time of significant reform in the WEM, including 'New WEM Commencement' in October 2023.

Whilst we expect there to be significant interest in the CIS in WA, its introduction does introduce further complexity to participation in the market at a time of significant change. It will be important for market participants to understand the details of the implementation of the framework in the WEM when they become available, including:

Author: Caroline Lindsey, Partner; and Thea Walton, Lawyer.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.