AUSTRAC's superannuation sector money laundering and terrorism financing threat update

08 November 2022

08 November 2022

Are you keeping abreast of threats relevant to the superannuation industry?

The Australian Transaction Reports and Analysis Centre (AUSTRAC) has released a superannuation sector threat update (the AUSTRAC threat update).

The aim of the AUSTRAC threat update is to provide superannuation funds with the latest insights regarding money laundering and terrorism financing (ML/TF) risks. Specifically, the AUSTRAC threat update highlights the threats and vulnerabilities that are new to the superannuation industry, or have changed since the 2016 superannuation sector risk assessment (the 2016 assessment) published by AUSTRAC.

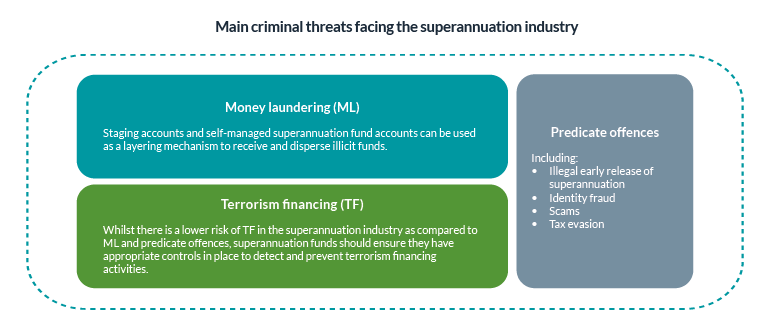

Consistent with the 2016 assessment, AUSTRAC have assessed the risk of criminal threats (which comprise the nature and extent of ML/TF and other predicate offences) facing the superannuation industry to be medium. The AUSTRAC threat update emphasises that whilst the threats and vulnerabilities facing the industry remain similar to those outlined in the 2016 assessment, the sophistication of activities associated with some offences has increased in recent years.

The diagram below outlines the main criminal threats currently faced by the superannuation industry.

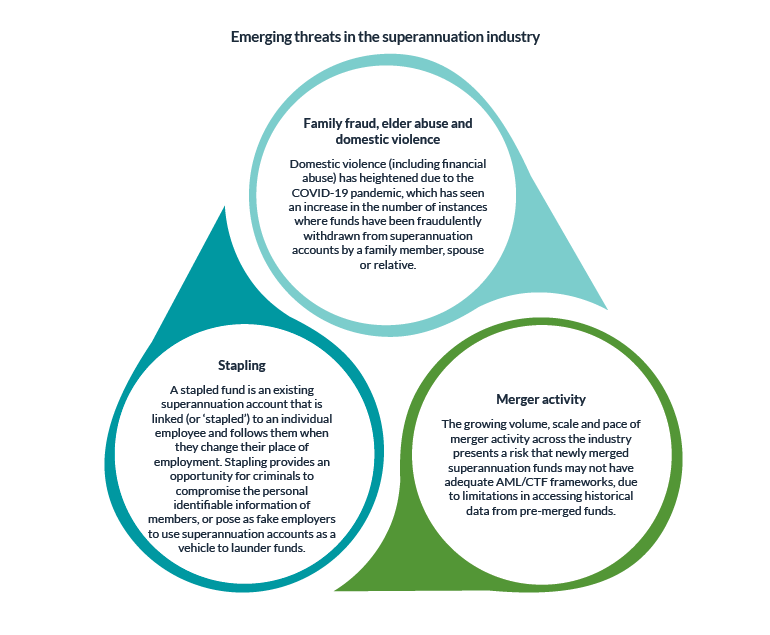

In addition to the current criminal threats facing the industry, superannuation funds should be aware of emerging threats, so that they can implement appropriate controls to mitigate associated risks. Emerging threats facing the superannuation industry are outlined in the diagram below.

The AUSTRAC threat update highlights cybercrime as a common threat enabler in the superannuation industry. Specifically, bad actors can use cybercrime to engage in criminal activity involving the illegal early release of funds, identity fraud, scams and the use of staging accounts1 as a layering mechanism to launder money (by obscuring the true source and ownership of funds).

Cybercrime is particularly attractive to criminals due to the speed with which criminal activities can be performed and the relatively low level of operating costs required to perform such activities.

The superannuation industry has become an attractive target for cybercriminals, especially due to the digitisation of many superannuation services, which allows fund members to perform a range of activities without face-to-face contact, including:

1. Staging accounts are accounts established for the purpose of consolidating or moving funds, with the end goal being to either transfer the funds to a different account, or to withdraw them from the superannuation system.

Superannuation funds should consider adopting the following actions in order to protect themselves against the increasingly complex type of threats facing the industry.

Superannuation funds should remain cognisant of the evolving threats faced by the industry, given an absence of appropriate controls could result in substantial repercussions. Examples of repercussions that superannuation funds could face in response to control deficiencies or gaps are listed below.

The repercussions listed above can lead to long-lasting reputational and financial damage for superannuation funds. Superannuation funds should therefore be proactive in implementing appropriate controls to mitigate financial crime risks, in order to protect the best interests of its members, and ultimately the fund.

For more information see AUSTRAC's 2022 superannuation sector - money laundering and terrorism financing threat update

For more information see AUSTRAC's 2016 superannuation sector - money laundering and terrorism financing risk assessment

Authors: Philip Hardy, Partner, Risk Advisory; Kieran Francis, Director, Risk Advisory; and Justine Tan, Executive, Risk Advisory

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.

Sign-up to select your areas of interest

Sign-up