Low Carbon Pulse Edition 35

22 February 2022

The November and December Report on Reports has been included in the Second Compendium of Low Carbon Pulse, which contains Editions 29 to 34 of Low Carbon Pulse (covering October 6, 2021 to February 6, 2022).

Please click here for the First Compendium of Low Carbon Pulse (containing Editions 1 to 28, covering October 6, 2020 to October 5, 2021). Click here and here for the sibling publications of Low Carbon Pulse, the Shift to Hydrogen (S2H2): Elemental Change series and here for the first feature in the Hydrogen for Industry (H24I) features.

As noted in recent editions of Low Carbon Pulse, the International Panel on Climate Change (IPCC) Working Group II (on Impacts, Adaption and Vulnerability) (WGII) is in the process of finalising its findings as part of the Sixth Assessment Report (AR6). For some time, the IPCC has signalled the release of the WGII report during February 2022. It is understood that the IPCC WGII report will be released on February 28, 2022. As the author finalises this Edition 35 of Low Carbon Pulse, the WGII is at the half-way point of two weeks' of meeting to finalise the Summary for Policymakers.

As the length of Low Carbon Pulse increased, it became apparent that a list of contents might assist the reader. Clicking on the contents list will take the reader to the section clicked:

| LIST OF CONTENTS: EDITION 35 OF LOW CARBON PULSE | |||

|---|---|---|---|

| Pages 2: | Timeline for 2022 | Pages 15 to 16: | Carbon Accounting, Carbon Capture, Carbon Capture and Use and CDR |

| Pages 3: | Legal and Regulatory highlights |

Page 16: | Carbon Credits, Hydrogen Markets and Trading |

| Pages 3 to 5: | Climate change reported and explained | Pages 16 to 19: | E-fuels / Future Fuels / Now Fuels |

| Pages 6: | GCC Countries | Page 19 to 20: | Cities, Clusters, and Hubs and Corridors and Valleys, and Giga-Factories |

| Pages 6 to 7: | Africa, India and Indonesia; Japan & ROK | Page 21 to 22: | Wind round-up, on-shore and off-shore |

| Page 8 to 9: | PRC and Russia | Pages 22 to 23: | Solar, Sustainability and NZE Waste; |

| Page 9 to 11: | Europe and UK; and Americas | Pages 23: | Land Mobility / Transport |

| Pages 11 to 13: | France and Germany; and Australia | Pages 24 to 25: | Ports Progress and Shipping Forecast |

| Pages 14: | Blue Green Carbon Initiatives & Biodiversity | Page 25 to 28: | Airports and Aviation |

| Pages 14: | Bioenergy and heat-recovery | Page 29 to 30: | Green Metals / Minerals, Mining and Difficult to Decarbonise Industries |

| Pages 14 to 15: | BESS and HESS (and other energy storage) | Page 31: | NZE Publications |

Timeline for 2022:

Editions 33 and 34 of Low Carbon Pulse identified events that may influence or impact progress to NZE (and the editions of Low Carbon Pulse that will cover each event).

IPCC: In September, the IPCC will publish the Synthesis Report. The Synthesis Report will synthesise and integrate materials contained in the Assessment Reports from each Working Group, and in three Special Reports (Global Warming of 1.5OC, Climate Change and Land and The Ocean and Cryosphere in a Changing Climate). The Synthesis Report will be in two parts, the Summary of Policymakers (SPM) and the Longer Report. Neither part of the Synthesis Report will be anywhere near the length of each Working Group Report and each Special Report.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse in respect of laws and regulation, and broader policy settings, in each case describing substance, progress and impact.

On February 18, 2022, as part of the Budget 2022, Singapore announced that the price on carbon would increase incrementally over time to between S$50 and S$ 80 per tonne of CO2-e by 2030. The increase in the price on carbon is part of an integrated plan to ensure that Singapore reaches NZE "by or around mid-century". This aligns with the achievement of the outcomes in the Glasgow Climate Pact. See the graphic on the carbon tax increase.

Mr Toh (Director at Energy Market Authority, Singapore), has provided a very helpful summary on Linked-In. A link to Mr Toh's summary is attached.

The format of Low Carbon Pulse does not allow detailed coverage of the various regulations relevant to progress to NZE across the EU.

In anticipation of the expiry of the four month scrutiny and objection period expiring without an effective objection to the Taxonomy Complementary Climate Delegated Act, the author of Low Carbon Pulse will provide a summary of the key regulations and their effect over coming months in a standalone article by the end of June 2022.

This section considers news items within the news cycle of this Edition 35 of Low Carbon Pulse relating to climate change and its impact. The intention is to monitor significant and material data points and information, and to explain them.

On February 8, 2022, nature.com reported on increasing levels of methane (CH4) in the climate system (under Scientists raise alarm over "dangerously fast" growth in atmospheric methane). CH4 concentration exceeded 1,900 parts per billion during 2021 – see the piece below on the NOAA 2022 Sea Level Rise Technical Report.

The article in nature is well-worth a read – it hones in on the fact that: "The causes of the methane trends have indeed proved rather enigmatic". Mr Alex Turner (an atmospheric chemist at the University of Washington, Seattle) goes on to observe that he is yet to see any conclusive answer emerge.

The nature article notes that the increase in CH4 is caused by both human activities and naturally: 62% of global CH4 emissions from 2007 to 2016 are estimated to have arisen from human activities – see the bar chart at the end of this section.

As is noted (again) in the nature article, tackling methane is probably the best opportunity to buy some time to allow decarbonisation to progress so as to avoid the worst effects of climate change by limiting the increase in average global temperatures to 1.5OC above pre-industrial times.

By way of reminder:

"Methane has contributed around 30% of the global rise in temperature to date … Emissions from fossil fuel operations present a major opportunity [to limit global warming in the near term] since the pathways to reduction are both clear and cost-effective".

Greater concentration is required to address greater concentration!

On February 23, 2022, the International Energy Agency (IEA) will present is Global Methane Tracker 2022. The January and February Report on Reports will provide detail from the Tracker. See graphics from a nature report on 'Where is methane coming from?' and 'A worrying trend'.

On February 16, 2022, the NOAA published its 2022 Sea Level Rise Technical Report (2022 SLRR).

The 2022 SLRR provides absorbing analysis (a little too absorbing for the already challenged sleep patterns of the author). Attached is the link to the conclusion section of the 2022 SLRR. See graphic on 'Physical factors directly contributing to coastal flood exposure' from the report.

On February 9, 2022, worldbank.org published How can developing countries get to net zero in a financeable and affordable way? The blog is excellent. By the use of one example from The Washington Post, the blog illustrates the existential and fundamental dynamics of the need for the more developed countries to work with developing countries to address the competing imperatives of economic development of developing countries and environmental preservation.

The Democratic Republic of Congo (DRC) has peatland covering an area the size of the US State of Iowa, and is estimated to retain as much as three years of GHG emissions as is emitted each year globally.

If the peatland in the DRC were to be drained, as developed countries have drained their peatland in the past, GHG emissions would be emitted to the climate system. As reported in recent editions of Low Carbon Pulse, the DRC is one of the Least Developed Countries and one of the most vulnerable countries to climate change (see Editions 33 and 34 of Low Carbon Pulse). The DRC is essential to the electric battery market, with around 70% of cobalt sourced the country, and year more than 73% of the Congolese people live below the poverty line.

These dynamics are repeated across Africa at COP27.

This is why the IUCN Africa Protected Areas Congress (APAC) scheduled to take place in Kigali, Rwanda from March 7 to 12, 2022. APAC (being the first continent-wide meeting of African leaders, interest groups and citizens, convened to focus on action required to establish and to preserve protected areas) is so important. Also, this explains why Egypt, as the host nation for COP-27, wants to focus on Africa.

The World Bank estimates (see Beyond the Cap – How Countries Can Afford the Infrastructure They Need while Protecting the Planet) that developing countries need to invest around 4.5% of GDP to develop infrastructure-related Sustainable Development Goals to avoid more than a 2OC increase in average global temperatures.

This analysis was published in 2019.

This analysis is from pre-COVID 19 and a pre-COP 26 era. A greater proportion of GDP is now required, with targets now tied to avoiding more than a 1.5OC increase in average global temperatures.

In this context, the World Bank blog states that it is essential to develop climate-smart and bankable project pipelines, and to mobilize private capital. This is not new. As regular readers of Low Carbon Pulse will know, these objectives were front and centre at COP-26 as one of the four pillars.

As reported in Edition 30 of Low Carbon Pulse:

"Pillar 3 contemplated:

"To deliver on our first two goals, developed countries must make good on their promise to mobilise at least USD 100 billion in climate change funding a year by 2020.

International financial institutions must play their parts and we need to work towards unleashing the trillions in private and public sector finance to secure global net zero".

Progress was made in the sense of a clear acknowledgment (through an expression of "deep regret" - see paragraph 44 of the [Glasgow Climate Pact] that the goal of mobilising USD 100 billion a year by 2020 "had not yet been met". Developed countries are urged to mobilise "fully on the USD 100 billion a year commitment urgently through to 2025" (paragraph 46), and at least to double "their collective provision of climate finance for adaptation to developing countries from 2019 levels by 2025" (paragraph 18).

What needs to be done is known, the means of achieving what needs to be done is also known.

This section of Low Carbon Pulse considers news items within the news cycle of this Edition 35 of Low Carbon Pulse relating to the Gulf Cooperation Council (GCC) Countries, being countries that are leading the way in the development of Blue Hydrogen and Green Hydrogen capacity for own use and for export.

On February 6, 2022, khaleejtimes.com reported that Dubai is to reduce GHG emissions by 30% by 2030, providing a progress check on the road to achieving NZE by 2050. The Dubai Carbon Abatement Strategy 2030 (DCAS) was approved by The Supreme Council of Energy.

The DCAS is aligned with the UAE Net Zero Goal by 2050, as announced on October 21, 2021 (see Edition 29 of Low Carbon Pulse). The DCAS provides the basis for great granularity to develop initiatives and measures to reduce GHG emissions.

On February 15, 2022, h2-view.com reported that NEOM (see Editions 29, 31 and 32 of Low Carbon Pulse), is to undertake heavy-duty hydrogen fuel cell stack manufacturing, having contracted with Al Misehal Group for this purpose. Subject to finalisation of contractual arrangements, the heavy-duty hydrogen fuel cell stack manufacturing facility is to be located on NEOM's innovative floating industrial precinct, OXAGON. View the OXAGON in the report.

On February 16, 2022, Masdar (Abu Dhabi Future Energy Company) announced that Masdar and the Korean Agency for Infrastructure Technology Advancement (KAIA) had signed a memorandum of understanding (MOU) providing for them to explore the development of clean technology solutions, with a particular focus on hydrogen and smart cities. The MOU continues, and strengthens further, the long and strong partnership between the UAE and the ROK.

This section considers news items within the news cycle of this Edition 35 of Low Carbon Pulse relating to Africa. Africa remains the continent with most developing countries, the most Least Developed Countries and the most countries vulnerable to climate change, and the continent with some of the lowest levels of electrification.

On February 11, 2022, hydrogen.central.com reported (under South Africa Talks with Investors on Green Hydrogen Projects) that the Government of South Africa is in talks with potential investors to develop Green Hydrogen production projects. The current thinking of the Government of South Africa is to support the development of a pipeline of Green Hydrogen production projects requiring investment of USD 18 billion over the coming decade.

In the opening speech at the EU – African Union Summit (that commenced on February 17, 2022 and closed on February 18, 2022) President von der Leyen set the scene for the continued development of a Global Gateway:

"[The] Global Gateway is a strategy of investment in infrastructure and people … We want investments in quality infrastructure – connecting people and good and services … [the] Global Gateway will muster Europe's power to unlock unprecedented levels of investment … We can expect a package of at least EUR 150 billion for Africa in the next seven years. This is the first package under our Global Gateway Strategy … With this [first] package, we want to catalyse investments in three categories. The first, of course is infrastructure. And there, the top priority is energy. The pathway to renewable energy and, of course, the transition towards renewable energy. Because we all know first-hand that sustained economic development hinges on reliable access to energy. Africa has solar, wind and hydropower in abundance. So let us build on that. Let us invest in Global Gateway projects, for example to build together green hydrogen capacity …

The speech is worth reading in full, but putting energy front and centre is what was hoped for.

On February 17, 2022, hydrogen-central.com reported that Germany is to transfer hydrogen production technology to African countries.

The benefits of the transfer of technology will be reciprocal: to decarbonise Germany will need to import between 40% and 60% of its hydrogen demand, and it would be reasonable to expect that technology that is transferred will be used to produce Green Hydrogen for export to Germany. The commitment from Germany was made just before the commencement of the EU – African Union Summit, but very much aligned with the investment message conveyed by EU President von der Leyen.

This section considers news items within the news cycle of Edition 35 of Low Carbon Pulse relating to India and Indonesia, two countries with increasing populations and urbanisation, attendant increased levels of electrification, and being the countries with the third and seventh most GHG emissions.

On February 16 and 17, 2022 it was reported widely that India is to exempt Green Hydrogen (and Green Ammonia) producers from the cost of transmission. In addition, producers of Green Hydrogen (Green Ammonia) are to have flexibility to purchase renewable electrical energy (without incurring transmission charges) or develop their own renewable electrical sources, or exchange renewable energy.

The initiative also allows dispatch to a distributor of renewable electrical energy that is not needed to produce Green Hydrogen (or Green Ammonia), and to bank that dispatched renewable electrical energy, and then draw from that bank. The exemption and initiative are available to Green Hydrogen producers that establish Green Hydrogen production facilities before 2025.

The detail of the exemption and the initiative can be found in the attached link.

On February 19, 2022, solarquarter.com reported that PT Pertamina and Marubeni Corporation had signed a memorandum of understanding to work together to on CCS / CCUS and BECCS / BECCUS, including at the Marubeni paper mill in Indonesia, with the possible use of biomass, and the creation of carbon credits understood to be being contemplated.

Attached is the link to the January edition of India H2 Monitor – January 2022. As noted in previous editions of Low Carbon Pulse, we intend to include the link rather than repeat the context of the India H2 Monitor.

This section considers news items within the news cycle of this Edition 35 Low Carbon Pulse relating to Japan and ROK, being the countries with the fifth and tenth most GHG emissions, and the greatest dependence on imported energy carriers.

On February 7, 2022, it was reported widely that Doosan Fuel Cell had signed a letter of intent to cooperate with Shell (international energy corporation) and Korea Shipbuilding & Offshore Engineering (KSOE) (a leading corporation in shipbuilding and the offshore market, with Hyundai Heavy Industries as part of its group).

The three leading corporations are to develop, and to test the use of, marine fuel cell technology. It is understood that as the development and testing progresses, additional leading corporations (including ship builders and owners) will be involved, as will leading classification societies.

Doosan Fuel Cell is to develop and to test its low temperature solid oxide fuel cells (SOFCs) for the purposes of its work with Shell and KSOE, with the SOFCs to be certified by 2024. Shell will manage shipping and KSOE will install the marine fuel cells.

On February 7, 2022, it was reported widely that Lotte Chemical (see Editions 22, 23, and 34 of Low Carbon Pulse) is to invest up to USD 3.7 billion to develop hydrogen business across the ROK, This investment will support the development plans for Lotte Chemical for a hydrogen supply / value chain across the ROK. Future editions of Low Carbon Pulse will follow the developments.

On February 8, 2022, pulsenews.co.kr reported that ROK's battery majors, LG Energy Solution, SK On, and Samsung SDI has maintained a combined 30% share of the battery market globally. In GWh, this means that batteries from the Big Three were mounted on pure battery electric vehicles with a capacity of 90.1 GWh, and 296.8 GWh if plug-in-hybrid and hybrid vehicles are added to the 90.1 GWh for pure battery electric vehicles. The report contains a table providing details of the top 10 battery majors.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to the PRC and Russia, being countries that give rise to the most and the fourth most GHG emissions.

On February 11, 2022, channelnewsasia.com reported that the PRC is to focus on the development of photovoltaic solar and wind power development. This is news is entirely aligned with plans for PRC to enhance its HVDC network (see Edition 32 of Low Carbon Pulse for most recent coverage).

By way of reminder, and for those approaching the following statistic for the first time, hold on to your hat! Or take a seat! The PRC intends to have installed 1,200 GW of renewable electrical energy capacity by 2030.

In guidelines published by the National Energy Administration (NEA) on February 10, 2022, by 2030 all new energy demand is to be matched by dispatch from non-fossil fuel sources, and the development of renewable electrical energy capacity in the Gobi Desert is key to this. While the PRC remains on target to reach peak GHG emissions by 2030 (possibly a little sooner), the expectation is that coal-fired power station dispatch will increase until at least 2025, noting that a further 150 GW of coal-fired power generation capacity is expected to come on line within the 2021 to 2025 time frame.

By way of reminder:

Edition 34 of Low Carbon Pulse reported that in 2021 the PRC connected more off-shore wind than "every other in the world had managed to install in the last five years".

Data from the NEA indicate that a little under 17 GW (16.9 GW) of off-shore wind capacity was installed in 2021. Of the total global installed off-shore wind capacity of 54 GW, the PRC has 26 GW.

The World Forum Offshore Wind (WFO) report for 2021, Global Offshore Wind Report 2021 states that the PRC connected 12.7 GW (12.869 GW) of new off-shore wind field capacity during 2021. This is less than reported by the NEA. Nothing should be read into the difference, the WFO counts off-shore wind field capacity that is in operation with all turbines installed and first electrical energy produced.

The January and February Report on Reports will outline the WFO report. For the time being, the headlines are that, using the accounting methodology of the WFO, in 2021: 1. 15.7 GW of off-shore wind field capacity was installed; 2. The PRC added 12.7 GW of that capacity; 3. New and installed capacity now comprises 48.2 GW of installed capacity; and 4. There is 17 GW of off-shore wind field capacity currently under development and moving to deployment globally.

On February 17, 2022, Wood Mckenzie published an article placing the might of the PRC's renewable manufacturing capacity in context. As noted in previous editions of Low Carbon Pulse, the growth of the renewable manufacturing capacity of the PRC has assisted the PRC, and those trading with the PRC, to develop and deploy renewable capacity at a lower cost and at a faster rate than might otherwise have been the case.

Edition 33 of Low Carbon Pulse noted that the size of the PRC renewable manufacturing capacity in 2022 would likely exceed demand, with resulting over-supply capacity.

The Wood Mac article places these dynamics in context (including in a geopolitical context):

"This production [capacity] of epic proportions is enough to meet what China needs to accelerate decarbonisation while supporting the ambitions of much of the rest of the world".

"China's position as the world's dominant supplier of solar modules looks secure with nearly 70% of global manufacturing … wind turbines … account for 50% of global manufacturing, mainly of the [PRC] domestic market. The country also accounts for nearly 90% of global manufacturing capacity of lithium-ion batteries."

As ever, the Wood Mac article is well-worth a read. And the article is complemented by Wood Mac's February Horizons thought leadership, which identifies what has driven growth in the PRC's renewable sector, and Wood Mac's view of the sustainability of that growth. See graphic on 'China's renewables and battery manufacturing dominance' in the report.

On February 16, 2022 a number of sources reported on the first-bilateral study on the potential use of hydrogen across the Russian and German energy systems, and the role of hydrogen in the development of energy markets. The bilateral study is the work of Russian and German teams working in cooperation with each other.

The study is available through the AHK Russland website. The January and February Report on Reports will provide an outline of the findings from the study.

On February 17, 2022, the International Renewable Energy Agency (IRENA) and the State Grid Corporation of China held a virtual event, Facilitating the Transition Toward Smart Electrification with Renewables in China. The virtual event complemented the report prepared jointly by IRENA and State Grid Smart Electrification with Renewables: Driving the transformation of energy services.

The January and February Report on Reports will outline the findings from Smart Electrification with Renewables: Driving the transformation of energy services.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to countries within the European Union (EU) and the EU itself (as an economic bloc) and the UK given geographical proximity, and similar policy settings and progress towards NZE. In combination, countries comprising the EU give rise to the most GHG emissions after the Peoples Republic of China (PRC) and the US. The UK is a top-twenty GHG emitter, but has been a front-runner in progress towards NZE.

On February 3, 2022 the UK Government Department of Busines, Energy and Industrial Strategy (DBEIS) released its report Decarbonising heat in homes (DHIH report). The DHIH report will be covered in detail in the January and February Report on Reports, which will be included in the Second Compendium of Low Carbon Pulse during March, 2022.

Edition 34 of Low Carbon Pulse reported that: "the UK Government launched an open consultation process Contracts for Difference (CfD): proposals for changes to supply chain plans and CfD delivery. The consultation process ends at 11.45 pm on March 15, 2022." By way of reminder, Edition 17 of Low Carbon Pulse outlined changes to the form of CfD in 2021.

On February 9, 2022, DBEIS announced (under Government hits accelerator on low-cost renewable power) that contract for differences auctions will be held annually, rather any every other year as currently, to accelerate adoption of renewable electrical energy and enhance energy security. The next CfD round will open in March 2023.

Phase 2: Edition 33 of Low Carbon Pulse noted the passing of the deadlines for applications for funding to develop Phase 2 projects, Phase 2 projects being Power, Industrial Carbon Capture and Hydrogen production projects. In addition, Greenhouse Gas Removal (GGR) projects (GGR including BECCS and DACs) with an interest in requesting access to Track 1 Clusters (the Track 1 Clusters being East Coast and HyNet North West, with the Scottish Cluster in reserve) were invited to complete expressions of interest. It has been the intention to include an update on the applications in Edition 34 or this Edition 35 of Low Carbon Pulse, but to manage the length of each Edition the author has deferred this idea, rather a future edition of Low Carbon Pulse to cover the successful applicants.

It was reported from a number of sources that the levelized cost of energy (LCOE) from photovoltaic solar sources is lower in the UK than was the case a decade ago. See the graph here.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to the US, Brazil, Canada, and Mexico, being countries that give rise to the second, sixth, ninth and eleventh most GHG emissions.

On February 7, 2022, h2-view.com (under Canada Hydrogen Alliance unveils project to accelerate hydrogen innovation) reported that the Hydrogen Transition Hub is to begin a new project to support acceleration of resolution of challenges associated with the development of the global hydrogen economy – the FUSION-MAP project.

On February 9, 2022, rechargenews.com reported (under California scopes $30bn grid plan in face of "unprecedented" green power demand) that the Californian state grid operator, Caiso, has estimated that up to USD 30 billion may be required to enhance the high-voltage transmission network across the state to ensure the integrity and stability of the grid at it moves to 100% renewable electrical energy and up to 121 GW of BESS across the grid.

The final version of the 20 Year Transmission Outlook will be published in March 2022, and will be covered in the March and April Report on Reports.

Various editions of Low Carbon Pulse reported have reported on the Infrastructure Investment and Jobs Act (IIAJA) also known as the Bipartisan Infrastructure Law (BIL), its progress and its passing. The initiatives in the IIAJA are now being rolled out.

On February 9, 2022, the US Department of Energy (DOE), through the Office of Fossil Energy and Carbon Management (FCEM), announced formally the roll-out of the USD 24 million in federal funding for research and development and front-end engineering and design that will advance the adoption of clean hydrogen as a carbon free fuel for electrical energy generation, industrial use and transportation. This is the first step in provision of funding for RDD.

On February 10, 2022, the Biden Administration rolled out its plan to allocate USD 5 billion to fund the development and deployment of electric vehicle chargers over the coming five years. This initiative is part of, which earmarked USD 7.5 billion to roll-out a nationwide electric vehicle charging network of 500,000 electric vehicle chargers. The initiative includes the designation of alternative fuel corridors.

On February 15, 2022, the US DOE announced that it requires information on the development of hydrogen hubs across the US, with at least four hydrogen hubs contemplated.

By way of reminder:

The largest hydrogen program in the IIAJA provides the US (DOE) with USD 8 billion to provide support for at least four hydrogen hubs that are able to demonstrate that their development and deployment will contribute to production of clean hydrogen (being hydrogen than gives rise to less than 2 kg of CO2 for each 1 kg of hydrogen produced) and to multiple uses of that clean hydrogen. The IIAJA prescribes that at least one hydrogen hub will use fossil fuel feedstock to produce hydrogen, one will use renewables and one will use nuclear.

Also there is funding to support lowering the cost of production of Green Hydrogen with the goal of achieving a cost of USD 2 per kg by 2026 and for research, development and demonstration (RDD) to develop and deliver clean hydrogen production, delivery, storage and use technologies. Finally, the IIAJA contemplates the development of a national hydrogen strategy and roadmap to facilitate large-scale, and wide-spread, production, delivery, storage and use of clean hydrogen.

This section considers news items within the news cycle of this Edition 35 of Low Carbon Pulse relating to France and Germany.

On February 9, 2022, the three day One Ocean Summit opened in the sea port of Brest, France, on the Brittany Coast. The One Ocean Summit was convened by the President of France, Mr Emmanuel Macron, and may be regarded as the centre piece of the six month EU presidency of France.

In the lead-up to the One Ocean Summit there was considerable coverage of the agenda and the basis for engagement, with identified role of blue diplomacy "in a host of area, from privacy to pollution to overfishing and carbon storage [Blue Carbon]".

In addition to countries attending the One Ocean Summit (in person and virtually), the One Ocean Summit was attended by leading shipping companies, AP Moller Maersk, CGM and Hapag-Lloyd (each in the vanguard of the decarbonisation of shipping). The One Ocean Summit is to be followed by the UN Intergovernmental Conference on Marine Biodiversity of Areas Beyond National Jurisdiction to be held in New York in March 7 to 18, 2022.

[Note: At the time of publication of this Edition 35 of Low Carbon Pulse, the UN Intergovernmental Conference of Marine Biodiversity of Areas Beyond National Jurisdiction is under maintenance.]

The key points to take away from the One Ocean Summit are:

EU Member States and 16 other countries agreed to pursue a global agreement by the end of 2022 to regulate the use of sea-waters lying outside the jurisdiction of each country (the High Seas). The hope is that agreement can be reached in New York in March 2022.

More than 30 countries committed to the 30x30 Coalition, the purpose of which is to protect 30% of the world's land and sea by 2030.

French, German, Italian and Spanish development banks, and the European Bank for Reconstruction and Development and European Investment Bank are aligned around the clean oceans initiative to reduce the mass of plastic at large in oceans by 9 million metric tonnes each year, with financing of €4 billion pledged by 2025.

Columbia and France announced the establishment of a Blue Carbon Coalition to provide financial support for the restoration of coastal ecosystems, including mangrove swamps, salt marshes and sea-grass beds.

For all agreements and initiatives click on the following link.

On February 11, 2022, President Macron announced that France would join the High Level Panel for a Sustainable Ocean Economy (Ocean Panel). France joins 15 other countries on the Ocean Panel (Australia, Canada, Chile, Fiji, Ghana, Indonesia, Jamaica, Japan, Kenya, Mexico, Namibia, Norway, Palau, Portugal, and the US). With France joining, the 16 countries (represented on the Ocean Panel) represent globally nearly 46% of exclusive economic zones (comprising areas of sea within the jurisdiction of countries, as opposed to the High Seas – see below), 25% of fisheries and 20% of the shipping fleet.

In a busy few days for Norwegian Prime Minister, Mr Jonas Gahr Støre (see below under Wind round-up, on-shore and off-shore: Norwegian off-shore winding up), as the co-chair of the Ocean Panel, Prime Minister Støre welcomed the announcement:

"I am delighted to see President Macron and France commit to the ambitious agenda of the Ocean Panel. With a sustainably managed ocean, we will all stand better equipped to meet many of our challenges, such as climate change, plastic pollution and biodiversity loss."

| THE AIMS OF THE OCEAN PANEL |

|---|

| By enhancing humanity's relationship with the ocean, bridging ocean health and wealth, working with diverse stakeholders and harnessing the latest knowledge, the Ocean Panel aims to facilitate a better, more resilient future for people and the planet. |

In a busy week for President Macron, on February 10, 2022, President Macron announced that the nuclear industry in France was to undergo a rebirth. The announcement by President Macron has been signalled for a while (see Editions 29 and 31 of Low Carbon Pulse), and aligns with the EU Green Taxonomy.

President Macron announced that six new nuclear reactors would be developed (with options to develop a further eight to make 14) so at to remove the reliance of France on fossil fuels, and to allow France to achieve carbon neutrality by 2050. As noted in previous Ashurst publications, around 70% of the electrical energy generated in France is derived from use of nuclear reactors.

In context, it is important to understand that the rebirth is a matter of renewal – a firm proportion of France's existing nuclear reactor power stations will come to the end of their life-cycle by 2035. It is understood that the six new nuclear reactors will be 1,650 MW EPR2 – being third generation pressurized water reactors.

At the same time as the development of new nuclear reactors was announced, President Macron announced that the development and deployment of photovoltaic solar and off-shore wind field capacity would be accelerated. In this context, President Macron announced that France will have developed 40 GW of off-shore wind field capacity by 2050, on a rough and ready basis, equating to 50 off-shore wind field projects. Currently France has 2 GW of off-shore wind field capacity, and it has plans to procure a further 8.75 GW of off-shore wind field capacity by 2028 (see Editions 16 and 32 of Low Carbon Pulse).

In addition, President Macron said that €1 billion in funding support would be provided to allow the development and deployment of emerging and new technologies, including the development and deployment of floating off-shore wind field capacity.

This section considers news items that have arisen within the news cycle of this Edition 35 Low Carbon Pulse relating to Australia, a top-twenty GHG emitting country, and a developed country with the highest GHG emissions per capita.

Australia is however progressing to NZE at a faster rate than many other developed countries, and, along with the GCC Countries, is one of four countries rich in solar resources (and wind resources) that appear likely to lead in the development of the hydrogen economy over the next five years (and beyond): Australia, Chile, the PRC and Spain.

On February 8, 2022, WAtoday (under Billions to transform the Pilbara: WA's hydrogen hubs plan revealed) report that the Government of Western Australia intends to develop hydrogen hubs along the coast of Western Australia, making use of 500 km of Pilbara coastline to develop the necessary photovoltaic solar capacity to power electrolysers to produce Green Hydrogen and Green Ammonia. See the map of 'Pilbara interconnected hydrogen hubs' here.

The development of the hydrogen hubs and solar strip would further monetise the renewable resources of the Pilbara region – principally its solar resource. The Pilbara region would become a "global centre for hydrogen production, use and export at scale". The development of the Green Hydrogen and Green Ammonia production capacity in the Pilbara, would allow the greening of the iron ore industry.

As outlined, there will be five hydrogen hubs producing Green Hydrogen, from Onslow to Port Hedland. Critically, a Green Hydrogen pipeline is planned. The plans have the support of leading international energy corporations and leading iron ore producers, Fortescue Metals Group (and its subsidiary, Fortescue Future Industries), and Rio Tinto.

On February 8, 2022, Rystad Energy reported on the quantity of renewable electrical energy dispatched to match load across Australia during January 2022 – 3,628 GWh, an historical high. This was a result of many factors, but some standouts were that each of the six wind farms in Western Australia, Badgingarra, Emu Downs, Mumbida, Walkaway, Warradarge and Yandin, delivered capacity factors of greater than 50% during January. The two best performing photovoltaic solar farms during January were also in Western Australia – Merredin and Greenough River (the first utility scale solar project in Australia).

On February 9, 2022, Dr Andrew Forrest, AO (founder of Fortescue Metals Group) announced plans to develop a 5.4 GW, AU$ 10 billion, photovoltaic solar and wind project to power its iron ore operations in the Pilbara, Western Australia (the Uaroo Hub). The Uaroo Hub project involves the deployment of around 25 km2 of photovoltaic solar panels and 340 wind turbines. Coming up for 12 months on since the commitment of FMG to achieve carbon neutrality in its mining operations (in mid-March 2021), the basis of the realisation of that commitment is now becoming apparent.

While renewable electrical energy is being developed at good rate in Australia, the carbon intensity of electrical energy generation is still high – please click to the graphic to get a sense of this (Carbon Intensity Link).

Within the news cycle of this Edition 35 of Low Carbon Pulse, AGL Energy and Origin Energy (two of the big three integrated energy corporations in Australia, the third being EnergyAustralia) announced plans to shutter the two largest coal-fired power stations in New South Wales, and the largest remaining coal-fired power station in Victoria:

On February 10, 2022, the Australia and New Zealand Bank (ANZ) released its Hydrogen Handbook. The Hydrogen Handbook is a very useful addition to the commonwealth of knowledge available for those active in the Australian market.

The January and February Report on Reports will be outline the key elements covered by the Hydrogen Handbook.

On February 15, 2022, pv-australia.com reported that Australia has installed 25 GW of photovoltaic solar capacity – almost 1 kW for each person resident of the Lucky Country. As has been noted in previous editions of Low Carbon Pulse, this progress has been achieved primarily by the forward thinking States and Territories of Australia.

While this places Australia at the forefront of installed photovoltaic solar capacity per capita, as is apparent from the Carbon Intensity Link, Australia still has a ways to go to lead the world in the lowest GHG emissions per capita. See the map outlining capacity distribution.

This section considers news items that have arisen within the news cycle of this Edition 35 Low Carbon Pulse relating to the Blue Carbon and Green Carbon initiatives and Biodiversity.

To manage the length of this Edition 35 of Low Carbon Pulse, and noting the detailed coverage in Editions 32, 33 and 34, Edition 36 of Low Carbon Pulse will include features on Blue and Green Carbon, and Bio-diversity.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to bioenergy, being energy, whether in gaseous, liquid or solid form, derived or produced from biomass. Bioenergy includes any energy derived or produced from biomass (organic matter arising from the life-cycle of any living thing, flora or fauna, including from organic waste streams), whether in gaseous, liquid or solid form.

In addition, recovered heat and waste heat (derive from any source, including waste water) has been added to this section.

From recent activity and reporting, it appears likely that the avoidance of waste heat energy, and the recovery of waste heat energy will become a priority under the first pillar as a part of Energy Efficiency (IEA) and Energy conservation and efficiency (IRENA). By some estimates, up to 67% of energy arising is wasted. The increased awareness of sourcing heat reflects increased awareness of the energy used to heat buildings, and its source: heating buildings results in around 25% of total final energy demand, with around 75% of the feedstock used to satisfy that energy demand derived from fossil fuels.

To manage the length of this Edition 35 of Low Carbon Pulse, and noting the detailed coverage in Editions 32, 33 and 34, Edition 36 of Low Carbon Pulse will include features on bioenergy and heat-recovery.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to battery electric storage systems (BESSs) and hydrogen energy storage systems (HESSs). In addition to BESSs and HESSs, other forms of energy storage systems are covered, including use of compressed air energy storage (CAES) and pumped storage. In this context, long duration energy storage (LDES) is considered, being energy technology that is able to allow the off-take electrical energy out of storage for a duration of more than four hours. In the brave new world described in Edition 13 of Low Carbon Pulse: "BESS storage of 10/12/24 hours is being contemplated for business users, and up to 72 hours for telecommunications companies, including to guard against the consequences of land-borne weather events". The November and December Report on Report provides a summary of the LDES Council and McKinsey report from November 2021.

On February 8, 2022, pv-magazine-australia reported that Rystad Energy (see Edition 27 of Low Carbon Pulse) expected that the BESS capacity of Australia would double during 2022. See graphic on 'Overview of utility batteries in Australia'.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to carbon accounting and carbon dioxide removal (CDR), including to bioenergy carbon capture (BECCs), bioenergy carbon capture use and storage (BECCUS), carbon capture and storage (CCS), carbon capture use and storage (CCUS) and direct air capture (DACS). Effective accounting for carbon arising and CDR go hand-in-hand.

By way of background CDR is recognised in the 2021 Report as including: afforestation, soil carbon sequestration, bioenergy with carbon capture and storage (BECCS), wet land restoration, ocean fertilisation, ocean alkalinisation, enhanced terrestrial weathering and direct air capture and storage (DACS) are all means of CO2 removal.

The IEA pathway to NZE estimates that in order to achieve NZE it will be necessary to capture and to remove up to 7.6 giga-tonnes of CO2 each year through CCS, CCUS and CDR. CCS and CCUS (and BECCS and BECCUS) involve the capture at source of CO2, preventing release to the climate system. The following provides a helpful overview of carbon capture as things currently stand.

On February 9, 2022, eni.com announced that Eni UK had signed 19 memorandums of understanding with corporations interested in the provision of carbon transportation and storage services by Eni UK, so as to store permanently CO2 in Eni UK's depleted hydrocarbon reservoirs in Liverpool Bay, as part of the HyNet North West Project.

On February 12, 2022 (and after), it was reported widely that INPEX is to invest around USD 850 million to develop the world's largest CCS facilities in Australia. The CCS project will capture CO2 arising from the Ichthys Project.

On February 14, 2022, upstreamonline.com reported (under Decarbonising industry: Nippon Steel looks to DeepC Store's Australian floating CCS hub) that Nippon Steel Corporation (the largest steel producer in Japan) is exploring the export of CO2 to what has been described at the first off-shore floating CCS hub in the Asia Pacific – off-shore of Australia.

For these purposes, it is reported that DeepC Store had signed a study agreement with Nippon Steel, under which jointly, DeepC Store and Nippon Steel will assess the storage of between 1 to 5 million metric tonnes per annum of liquified CO2 captured by Nippon Steel and transported for storage to the Cstorel project (DeepC Store's flagship multi-user off-shore floating CCS hub).

On February 16, 2022, energy voice.com reported that Storegga and Talos are to work together on a new CCS project in Louisiana, US (River Bend CCS). Talos has announced that it is to lease around 26,000 acres. The area under lease is in Iberville, St James, Assumption and Lafourche parishes, with capacity to store up to 500 million metric tonnes of CO2. As reported, the location of the River Bend CCS is ideal with up to 80 million metric tonnes of CO2 arising annually within the region.

On February 17, 2022, Aker Carbon Capture announced progress on carbon capture on the Northern Lights Project, with Aker Carbon Capture and the Northern Light Joint Venture signing a memorandum of understanding to realise carbon capture and storage projects together in Norway, and across Europe. The Northern Lights Project involves the collection of CO2 captured by emitters which is to be transported by CO2 carriers to a receiving terminal in Norway, and then transported by pipeline into storage in a geological sub-surface structure 2,600 metres under the sea-bed of the North Sea.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to the creation of carbon credits, the role of carbon credits, and the trading of them.

Also this section covers the development of hydrogen markets and trading (bilateral and likely wholesale).

On February 8, 2022, Wood Mackenzie published an article entitled Voluntary carbon markets: here to stay? The article is stated to be the first in a series of articles. Among other things, the article frames the use of voluntary carbon markets by corporations, outlines the genesis of the market, and notes the varying quality of carbon credits / offsets that may be acquired from the voluntary carbon market.

In this context, the authors provide a helpful graphic – What makes a high-quality carbon offset?

As ever, the Wood Mac article is well-worth a read, especially for those wishing to orientate their thinking clearly.

In the context of work on a standalone article on Carbon Credits, Article 6 and the Paris Rulebook, the author re-read the excellent article published in climatetechv.sustack.com - Wrangling the wild west of the voluntary carbon offset market.

As noted in Edition 35 of Low Carbon Pulse, the article may be considered mandatory market reading for this interested in the Voluntary Carbon Market / Voluntary Carbon Credit Market:

"The world of climate tech overflows with mind-bending technologies. But perhaps the most mind bending of all? The voluntary carbon markets".

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to the development of production capacity to derive and to produce E-fuels (energy carriers derived or produced using renewable energy) and Future Fuels (energy carriers derive and produced that are characterised as clean carbon or low carbon fuels). E-fuels include Green Hydrogen and Green Ammonia, and Future Fuels include Blue Hydrogen and Blue Ammonia.

Editions 33 and 34 of Low Carbon Pulse included the TotalEnergies' Aerobic Digestion Ecosystem infographic. TotalEnergies has produced a Hydrogen Production Ecosystem infographic.

On February 9, 2022, it was reported widely that Cactus Energia Verde (CEV) plans to invest €5 billion in the development of a Green Hydrogen Project in Ceara, Brazil, to produce 126,000 metric tonnes of hydrogen and 63,000 metric tonnes of oxygen annually.

For these purposes, it is reported that CEV had signed a memorandum of understanding (MOU) with the Government of Ceara (GOC) to develop a Green Hydrogen production facility at the Pecém Port Complex. The renewable electrical energy to power the electrolysers will be sourced from a photovoltaic solar project (the 2.4 GW Uruque Photovoltaic Park) and wind project (a 1.2 GW offshore wind field currently under construction).

The MOU with CEV is the 15th MOU signed by the Government of Ceara with prospective proponents (see Editions 10 and 21 of Low Carbon Pulse): AES, Differential, EDP, Enegix, Eneva, Engie, FFI, Green Energy Cactus, H2Helium, Hytron, Neoenergy, Qair, Total Eren, Transhydrogen Alliance, and White Martins / Linde have all signed MOUs with GOC.

On February 9, 2022, Essar Oil UK announced plans to develop the first refinery-based hydrogen (powered) furnace at its Stanlow refinery. On the installation of the hydrogen furnace, existing furnaces will be decommissioned.

On February 11, 2022, Total Eren announced plans to develop a 10 GW Green Hydrogen production facility in the Western Sahara. The investment is estimated to be US$10.6 billion and will be located in Morocco's southern region of Guelmim-Oued Nour.

On February 15, 2022, it was reported widely that Neptune Energy (leading independent UK oil and gas company) and RWE (German energy giant) are to develop the H2opZee project to demonstrate production of Green Hydrogen off-shore. The H2OpZee is to develop and to deploy 300 to 500 MW of electrolyser capacity in the Dutch Sector of the North Sea to produce Green Hydrogen, using off-shore wind field capacity to power the electrolysers.

The Green Hydrogen produced by H2opZee will be transported to the Netherlands using an existing pipeline, repurposed for this use. It is understood that Neptune Energy and RWE intend H2opZee to be operational before 2030. Ahead of a final investment decision, Neptune Energy will undertake a feasibility study, commencing 2022.

The H2opZee project is supported by the Dutch Government under the auspices of TKI Wind op Zee, an initiative to bring tougher financing, knowledge and people to support the development of off-shore energy transition projects. See a graphic summary of the project.

On February 16, 2022, it was reported widely that Mitsubishi Heavy Industries (MHI) is to establish the Takasago Hydrogen Park to produce hydrogen that MHI will use to allow it to develop and to commercialise its hydrogen gas turbine technology. Takasago Hydrogen Park will use electrolyser technology to produce Green Hydrogen, and it will produce hydrogen from the thermal treatment of methane (Grey without CCS / CCUS, Blue Hydrogen, without CCS / CCUS).

On February 16, 2022, it was reported widely that Fortescue Future Industries and Woodside Energy had been shortlisted as partners to Contact Energy and Meridian Energy for the Southern Green Hydrogen project. Other shortlisted potential partners are said to include a consortium comprising ENEOS, Mitsui and BOC Gases.

As understood, the current intention is to develop 600 MW of Green Hydrogen production capacity. The Green Hydrogen produced by the Southern Green Hydrogen project would be used domestically within New Zealand and exported.

By way of reminder:

On February 17, 2022, h2-view.com reported (under US-based Gold Hydrogen Programme to extract natural hydrogen from underground) and Edition 34 of Low Carbon Pulse reported on the extraction of Gold Hydrogen in Australia, with a particular focus on South Australia.

The Gold Hydrogen Programme comprises key players, including Cemvita Factory, Chart Industries, EXP and Center for Houston's Future.

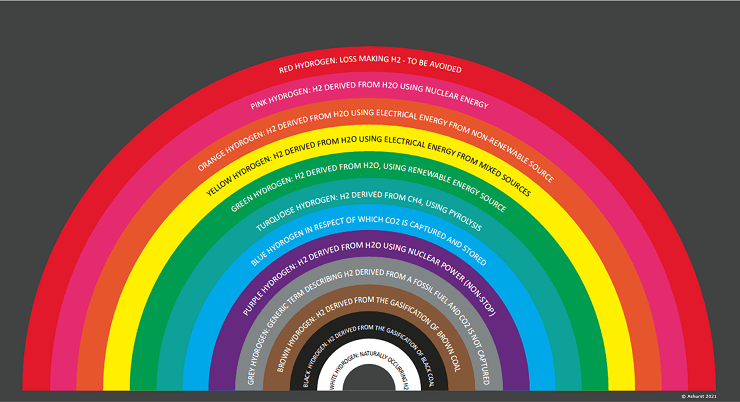

Note: Some authors / commentators use Purple Hydrogen to refer to the production of hydrogen using coal or petcoke gasification using CCS to capture the CO2 arising.

In South Australia, White Hydrogen is being referred to as Gold Hydrogen, reflecting the rush to acquire exploration licenses.

On February 18, 2022, reuters.com reported that Southern California Gas Co (the largest gas utility in the US, and division of Sempra Energy) intended to deliver Green Hydrogen to Los Angeles (the Angeles Link) to assist in the decarbonisation of the electrical energy, industrial and manufacturing and transportation sectors. SoCalGas announced that the Angeles Link could displace up to 3 million gallons of diesel fuel a day and may be used to convert up to four natural gas fired power stations to hydrogen.

The reported scale of the SoCalGas' plans is epic: up to 20 GW of electrolyser capacity sourcing renewable electrical energy from up to 35 GW of installed photovoltaic solar and wind capacity, 2 GW of BESS, and a 200 to 700 mile pipeline to haul Green Hydrogen to the point of use.

On February 17, 2022, it was reported widely that a 100 MW Green Hydrogen production facility is to be developed at the Port of Zeebrugge, Belgium. The facility is to be developed by BESIX and John Cockerill, working with Fluxys and Virya Energy.

The Flemish Minister for Economy and Innovation, Ms Hilde Crevits stated: "Hyoffwind is one of the projects that Flanders has submitted in connection with the European call for IPCEIs".

The derivation and production of hydrogen from waste appears to be gathering momentum. In the first of the Hydrogen for Industry publications (entitled Feature 1: Hydrogen from Waste), the derivation / production of hydrogen from waste was considered. In a number of recent news items, it is clear that hydrogen from waste, organics and plastics is coming close to breaking through as a viable source of hydrogen. In the standalone article referred to above (under E-Fuels / Future Fuels), Michael Harrison and Richard Guit will provide an update.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to the development of:

Also the section considers developments in cities to decarbonise (including using waste heat), and to cool, cities. The development of infrastructure at ports and installation and support vessels for off-shore wind developments are considered in the Ports Progress and Shipping Forecast section of each edition.

On February 8, 2022 it was reported widely that the Basque Hydrogen Corridor Association (BH2CA) has identified investment decisions of over USD 200 million to be made in 2022. (By way of reminder, Edition 11 of Low Carbon Pulse outlined the establishment of the BH2CA.) The BH2CA held a conference on February 7, 2022. Low Carbon Pulse will follow the development of the Basque Hydrogen Corridor as it widens and lengthens.

On February 9, 2022, SGN H100 Fife provided an outline of A world-first green hydrogen gas network in the heat of Fife. The H100 Fife is described as "a first-of-a-kind demonstration project that's leading the way in decarbonising home heating … [bringing] 100% green hydrogen gas to customers for the first time". As is the case in a number of northern European countries heating accounts of a material proportion of GHG emission, according to SGN in the UK 37% of "all UK carbon emissions".

On February 11, 2022, cleantech corporation Enapter announced plans to develop a giga-factory to manufacture up to 2.1 GW of electrolysers in Saerbeck, a town in North-Rhine-Westphalia, Germany.

In February 2022 a hydrogen corridor for the Pyrenees Region was announced. Future editions of Low Carbon Pulse will cover its development.

On February 12, 2022 it was reported widely that ArcelorMittal, Enagas, Grupo Fertiberia and DH2 Energy intend to develop "the world's largest renewable and competitive hydrogen hub" (HyDeal España) that will result in an additional installed electrolyser capacity of 7.4 GW by 2030, with power to be sourced from 9.5 GW of renewable electrical energy, with the production and supply of Green Hydrogen to increase incrementally, starting in 2025.

The Green Hydrogen produced by HyDeal España will be supplied to industrial users located in Asturias, Spain. It has been reported that those industrial users will commit to offtake for 20 years, thereby matching supply with sufficient demand to allow the HyDeal España to proceed.

The headline grabbing fact that has emerged from the news items around HyDeal España is that:

"HyDeal Spain is the first concrete implementation of the green hydrogen model with a cost of €1.5 / kg [of hydrogen] announced .."

The installation of the 7.4 GW of Green Hydrogen production capacity contemplated HyDeal España, the 2 GW of Green Hydrogen production capacity contemplated by Project Catalina, and 2 GW of Green Hydrogen production capacity contemplated by SHYNE, means that these projects will match the Spanish Government's target and will then exceed (by nearly 8 GW) 4 GW of installed capacity by 2030. With other projects announced and planned, Spain appears well set to lead Europe in Green Hydrogen production.

By way of reminder, since the start of 2022, Editions 33 and 34 have reported as follows:

By way of summary:

To reflect the momentum around hydrogen production development in Spain, the following infographic is helpful. In summary, all targets in the road to 2030 are going to be in the rear-view mirror:

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to the development of wind power generation capacity, on-shore and off-shore (fixed bottom and floating).

On February 7, 2022, www.the-eic.com (under Adger Energi, GIG to bid for floating wind project in Norway) reported that Norwegian power utility, Adger Energi had partnered with Macquarie-owned Green Investment Group (GIG) to bid for floating off-shore wind field site within the Utsira Nord zone (covering 1,010 km2 and having an average depth of 267 metres).

The 1.5 GW Utsira Nord (North Utsira) zone is one of the two zones for which the Norwegian Government is seeking licensing applications, the other zone being Sørlige Nordsjø II (South Utsira). GIG regards Utsira Nord as suitable for the development of floating off-shore wind field capacity because of its deep waters strong wind conditions/ resources, and relatively close proximity to industrial off-takers of renewable electrical energy.

The Norwegian Government intends to auction the 3 GW Sørlige Nordsjø II in two phases. The auction model is under-development, with legislation required to support the off-shore wind development. It was reported widely that the Norwegian Offshore Wind Cluster, met to debate the off-shore auction model with the Norwegian Prime Minister, Mr Jonas Gahr Støre.

On February 10, 2022, Prime Minister Støre outlined first phase (comprising 1.5 GW) of the Sørlige Nordsjø II off-shore wind field development: the first phase was to be completed in the second half of the current decade, providing up to 7 TWh per annum of renewable electrical energy.

Prime Minister Støre did not rule out the provision of government funding support (through subsidies of the electrical energy price). In respect of the second phase of the development of Sørlige Nordsjø II project the Prime Minister contemplated that 1.5 GW of renewable electrical energy from this off-shore wind field development may find a market in northern Europe, rather than Norway.

Regular readers of Low Carbon Pulse will recall earlier coverage of both Utsira Nord and Sørlige Nordsjø II. For ease of reference, that earlier coverage is included below.

On February 8, 2022, offshoreWIND.biz (under Race for New Mega Offshore Wind Acreage Starts in Poland) reported that PKN Orlen (a Polish based oil refiner and petroleum retailer, see Editions 20 and 34 of Low Carbon Pulse) and Polska Grupa Energetyczna (PGE) has submitted multiple applications for permits to develop off-shore wind field capacity in areas recently designated for development in the Polish sector of the Baltic Sea.

It is reported that there are 11 areas for which applications may be submitted to build and to operate off-shore wind fields and energy islands. PKN Orlen has submitted applications for seven areas, covering around 3 GW of installed capacity. PGE has submitted applications for six areas, with two applications submitted jointly with Enea and one jointly with Tauron.

| WHY IS THE BALTIC SEA IS HIGHLY PROSPECTIVE? |

|

|---|---|

| WindEurope estimates that the Baltic Sea will allow the development of up to 80 GW of off-shore wind capacity |

Strong and stable winds, particularly the case across the Polish sector |

| The Polish sector of the Baltic Sea has relatively shallow waters suitable for fixed bottom off-shore wind fields |

The Polish sector of the Baltic Sea will allow the development of up to 28 GW of off-shore wind capacity |

On February 11, 2022, it was reported widely that the Vattenfall (Swedish state owned energy corporation) 1.8 GW Norfolk Vanguard off-shore wind field project had been approved by the UK Secretary of State for Business, Energy and Industrial Strategy, Mr Kwais Kwarteng.

The Norfolk Vanguard off-shore wind field development is within the Norfolk Offshore Wind Zone, covering an area of 1,3067 km2, located 47 km of the coast of Norfolk, England. The Norfolk Vanguard is in addition to the 1.8 GW Norfolk Boreas, in respect of which approval has already been given.

On February 15, 2022, offshoreWIND.biz reported that the Swedish Government is to identify suitable areas to develop off-shore wind fields for the purposes of generating 120 TWh annually from sources of renewable electrical energy (noting that the electrical energy consumption of Sweden is 140 TWh annually).

It is understood that the Swedish Energy Agency (SEA) has identified, and reported on, three areas – located in the Baltic Sea, the Gulf of Bothnia and the North Sea having wind resources of between 20 to 30 TWh annually. The SEA will work with the Swedish Maritime Administration (SMA) to identify areas from which 90 TWh annually can be generated. The SEA is to report on progress by no later than March 2023, the SMA no later than December 2024.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to the development of solar power generation capacity, on-shore (photovoltaic and concentrated) and floating.

Also this section covers relating to the development of facilities and technologies to process and to recycle NZE Waste. Also this section considers the treatment of residual NZE Waste.

On February 8, 2022, energy-utilities.com (under Egypt reviews offers of green hydrogen projects in Suez ahead of COP 27) reported that the Government of Egypt and the Suez Canal Economic Zoen (SCZone) had met to discuss offers received for the development of Green Hydrogen projects in the SCZone. Future editions of Low Carbon Pulse will report on developments.

On February 7, 2022, jtc.gov.sg announced that JTC Corporation (a Singapore government agency championing sustainable industrial development in Singapore) intends to mandate the installation of roof-top photovoltaic solar panels on new land and land-based allocation, lease renewals, and land launches. This initiative extends the mandate that already existed in respect of some, but not all, property. JTC Corporation anticipates that this initiative will result in the installation of 82 MW at peak (82 MWp). In context, by 2030, Singapore anticipates that it will have installed 2 GWp, sufficient for around 350,000 households a year, and comprising around 3% of electrical energy load of Singapore in 2030.

On February 8, 2022, it was reported widely that Spanish renewable energy giant, Iberdrola is developing a MW hydro-electric power complex in northern Portugal, using water from three reservoirs: Alto Tâmega, Daivões and Gouvães.

The hydro-electric power complex will deploy a 880 MW reversible storage facility (pumped-storage), which is able to store water from the Daivões reservoir delivered into the Gouvães reservoir. There is a 650 metre differential between the two reservoirs, use of the differential will generate renewable electrical energy, with the water in the Gouvães reservoir pumped into the Alto Tâmaga reservoir. The pumped storage is being described as the "Alto Tâmega giga battery": on operation the energy storage of Portugal will increase by 30%.

On February 11, 2022, in was reported widely that the State of California, US, is to cover canals with photovoltaic solar "canopies", with the expectation being that the use of photovoltaic solar "canopies" will realise multiple GW of renewable electrical energy.

On February 15, 2022, h2-view.com reported that "the worlds' second largest hydroelectric facility" in Paraguay (having peak capacity of 14 GW) is considering the development of a pilot project to produce Green Hydrogen using 50% of the capacity of the hydroelectric facility. It is reported that NeoGreen Hydrogen (comprising an experienced team of developers and financers) will undertake a feasibility and scoping study for these purposes.

On February 15, 2022, pv-magazine.com reported that new research indicated that choice of location and financing conditions are key in reducing the levelized cost of energy (LCOE), allowing the development of utility-scale photovoltaic solar facilities in Sweden without the need for financial support from Government. The researchers found that the lowest LCOE was €0.02737 kWh. See the graph in the report.

On February 16, 2022, IEA published its Electricity Market Report – January 2022. The January and February Report on Reports will outline the finding from the Electricity Market Report – January 2022.

On February 18, 2022 it was reported widely that the UK Octopus Group intends to partner with First Nation communities to develop renewable electrical energy projects in Australia's Northern Territory. It was reported that Octopus Group has teamed up with the Northern Territory Indigenous Business Network (NTIBN) to establish Desert Springs Octopus (DCO). Low Carbon Pulse will follow the development of this initiative.

On February 9, 2022, daimlertruck.com announced that it had completed the first trial of its 10 metre electric eCitaro articulated bus on the in schedule service route at Seiser Alm in South Tyrol.

To manage the length of this Edition 35 of Low Carbon Pulse, news items have been included on trains only. Edition 36 of Low Carbon Pulse will "catch-up" on other Land mobility news items.

On February 2, 2022, railjournal.com reported that the German States of Berlin and Brandenburg, and train operator and infrastructure manager Niederbarnimer Railway (NEB) had reached agreement to procure and to deploy hydrogen fuel cell technology on trains in the German Capital region, and the development of infrastructure.

The deployment will commence on the Berlin-Wilhelmsruh-Basdorf line. The initial procurement is reported to be for seven hydrogen fuel cell technology powered and propelled units. The procurement and deployment is proceeding with the benefit of €25 million of grant support from the German Federal Ministry of Finance.

On February 9, 2022, railway-news.com (under CAF and Iberdrola Partner on Hydrogen-Powered Train Project) reported that CAF (Spanish rail vehicle and equipment manufacturer) and Iberdrola (Spanish integrated energy giant) had signed a framework agreement to promote the use of Green Hydrogen in the rail and passenger.

The signing of the framework agreement comes ahead of the testing of the hybrid electric battery and hydrogen-powered and propelled train developed by CAF at its Zaragoza plant as part of the FCH2RAIL project (see Edition 26 of Low Carbon Pulse). The tests are to commence in April 2022, and hydrogen supplied by Iberdrola will be used.

Both Porterbook (the UK's largest rolling stock owner) and Rolls Royce have announced that they were working together to pioneer the advancement of rail decarbonisation.

To date, Porterbrook and Rolls Royce have worked together on the HybridFLEX (combining power and propulsion using diesel and battery) for Chiltern Railways (dear to the heart of the author). The HybridFLEX has been developed further so that it can use hydrogen too - making it the world's "first tri-mode" train.

Moving forward, Porterbrook and Rolls Royce intend to work together to develop the use of sustainable / synthetic fuel and net-zero fuels, including hydrogen using both fuel cell technology and internal combustion engine technology.

On February 19, 2022, asia.nikkei.com reported that East Japan Railway (JR East) had unveiled Japan's first hydrogen-powered hybrid train (Hybari) on February 18, 2022, using technologies developed by Hitachi Corporation and Toyota Motor Corporation – hydrogen fuel cells and electric battery technologies. JR East is to commence testing of the Hybari in March 2022.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to the development and deployment of production and storage capacity, and infrastructure, at ports for E-Fuels / Future Fuels (including Hydrogen Hubs) and to capture and to store or to use of carbon, or both (including Carbon Clusters), and the connection of port infrastructure to the hinterland.

Also this section considers news items that relate to the development of infrastructure at ports, including to allow the development of off-shore wind fields.

Within the news cycle covered by this Edition 35 of Low Carbon Pulse, no news items have come to light on Ferries that may be regarded as significant for the purposes of Low Carbon Pulse.

For some time, the Energy Observer 2 has received considerable news coverage across many industry and main stream and network news outlines.

The reason for this are that the Energy Observer is powered and propelled by liquid hydrogen using fuel cell technology and by Oceanwings®, and is a multipurpose cargo ship that would result in zero emission sea borne transportation of cargo. The Energy Observer 2 was presented at the One Ocean Summit in Brest, France (see France and Germany: One Ocean Summit above).

The Energy Observer 2 has been developed by Energy Observer (and its industrial subsidiary, EODev), and its technology and operational partners, Air Liquide, Ayro (the developer of Oceanwings®) CMA CGM Group (global leader in maritime transport and logistics), LMG Marin (naval architecture corporation, and developer of the world's first liquid hydrogen powered and propelled ferry, the MV Hydra – see Editions 23 and 34 of Low Carbon Pulse). Bureau Veritas has been providing ongoing input as the design of the Energy Observer has developed. View the Energy Observer 2 here.

As noted above (under Teaming with ideas), Shell is working with Doosan and KSOE to develop fuel cell technology to power and to propel vessels using liquid hydrogen (LH2O). On February 8, 2022 it was reported widely that Shell International Trading and Shipping is working with GTT to accelerate technology development to allow the carriage of LH2O as an energy carrier: GTT is a proven technology developer and provider of cryogenic technologies. GTT and Shell are going to work together to design containment systems to allow the storage and transportation of LH2O. As readers of Low Carbon Pulse and sibling publications will know, the development of containment systems and scaling up the capacity of LH2O is key to the development of the world trade in hydrogen.

On February 11, 2022, h2-view.com reported that Aker Clean Hydrogen (a corporation within the Aker ASA Group) and Kuehne+Nagel (leading logistics solutions corporation) are combining to continue progress in decarbonising the shipping industry in Norway. Aker Clean Hydrogen is to supply green fuels to Kuehne+Nagel (including Green Hydrogen, Green Ammonia and Green Methanol) for the purposes of its maritime logistics business so at to power and to propel vessels with engines converted to use or the green fuels, including dual fuel engines.

On February 10, 2022, gcaptain.com reported that the WSC has identified six pathways (economic and regulatory) that it regards as key for nations within the UN International Maritime Organisation (IMO) to address to achieve a successful transition to zero carbon shipping. The WSC made a formal submission to the IMO dated February 9, 2022.

For those that have been following the WSC, the pathways will not be a surprise: 1. Applied R&D for ship-board to shoreside systems, to allow use of zero-carbon fuels; 2. Global application of a carbon price (GHG Price) (see Edition 27 of Low Carbon Pulse); 3. Life-cycle fuel accounting with appropriate regulatory mechanisms for first movers, critically, transparent well-to-wake life-cycle analysis of fuels, distinguishing well-to-tank and tank-to-wake emissions, coupled with incentives to encourage use of zero carbon fuels; 4. Integrated development of global production and supply of zero carbon fuels; 5. The Green Corridors as an enabler of the fuel / technology transition (see below for Green Shipping Corridors in practice); 6. New build standards that support energy transition by requiring energy transition to zero carbon.

As has been the case before, the author looks for the Maersk McKinney Moller Center for Carbon Shipping perspective, which is fully supportive of the approach of the WSC. The perspective of the Maersk McKinney Moller Center for each pathway is worth a read.

Edition 30 of Low Carbon pulse reported on Green Shipping Corridors as follows:

"Clydebank Declaration: On November 10, 2021, the Clydebank Declaration was agreed at COP-26. The Clydebank Declaration emphasises the importance of limiting "the increase in global average temperature to 1.5OC above pre-industrial levels", expressed great concern that if "no further action is taken, international shipping emissions are expected to represent 90% to 130% of 2008 emissions levels by 2050", and recognised that "a rapid transition in the coming decade to clean maritime fuels, zero-emission vessels, alternative propulsion systems, and the global availability of landside infrastructure to support these, is imperative for the transition to clean shipping".

In addition the signatories to the Clydebank Declaration commit to facilitate the development of Green Shipping Corridors, with at least six Green Shipping Corridors by "the middle of this decade … [and] many more corridors … by 2030". A Green Shipping Corridor is a route between two or more ports that are "zero-emission maritime routes".

The signatories to the Clydebank Declaration are: Australia, Belgium, Canada, Chile, Denmark, Fiji, Finland, France, Germany, Republic of Ireland, Italy, Japan, Republic of the Marshall Islands, Morocco, the Netherlands, Norway, Spain, Sweden the UK, and the US.

On February 13, 2022, it was reported widely that two Green Freeports are to be established in Scotland. Each Green Freeport will offer incentives to investors (including tax incentives). Low Carbon Pulse will cover the process and outcome of the tendering and bidding process as it develops.

As has been noted consistently in Low Carbon Pulse, while the development of hydrogen, ammonia, methanol and carbon dioxide production and capture technologies is key to progress to NZE, as important is the development and deployment of sea-going carriers that can transport these energy carriers and CO2 from the point of production to the market in which they are to be used or stored.

As noted in Edition 34 of Low Carbon Pulse, progress is being made in respect of the MV Suiso Frontier, but the technology used for the MV Suiso Frontier is being scaled up by KHI, with containment tanks of 40,000 m3 having already being certified, and plans for four tanks per vessel. Once the technologies are established and tested, sea-going carriers need to be built at a rate consistent with the in tandem growth of the supply and demand for the energy carriers of the future.

Edition 34 of Low Carbon Pulse reported that Mitsubishi Heavy Industries (MHI) Group unit, Mitsubishi Shipbuilding, entered into a contract with Sanyu Kisen, based in Kobe, Japan, to build a demonstration test vessel to carry liquified carbon dioxide (LCO2). The LCO2 carrier is to be built at the MHI Enoura Plant, at MHI's Shimonoseki Shipyard Machinery Works.

This section considers news items that have arisen within the news cycle of this Edition 35 of Low Carbon Pulse relating to the development and deployment of technology at airports and in the aviation sector to decarbonise the airports and the aviation industry.

On February 7, 2022, it was reported widely that Airbus Industries may manufacture engines powered by hydrogen. Edition 32 of Low Carbon Pulse reported that Airbus Industries intends to develop a zero-emission hydrogen powered and propelled commercial aircraft by 2035.

Editions 30 and 33 of Low Carbon Pulse reported on the testing of engines using sustainable / synthetic aviation fuel (SAF). ATR (joint partnership between major European players Airbus and Leonardo), Braethens Regional Airlines and Neste (World’s largest producer of renewable diesel and sustainable aviation fuel refined from waste and residues) are to test the use of 100% SAF for one engine to achieve 100% SAF certification.